Link to academic journal article: Bolotova, Y. 2021. “Market Power in the Fluid Milk Industry in the Eastern United States (Case Study).” Applied Economics Teaching Resources 3(2): 39-67.https://ageconsearch.umn.edu/record/312081?ln=en

In 2007 and 2009, dairy farmers in the U.S. Southeast and Northeast regions filed class action antitrust lawsuits in which they alleged that Dean Foods (Dean) and Dairy Farmers of America (DFA), the largest fluid milk processor and the largest dairy cooperative in the country, respectively, engaged in anticompetitive conduct that restricted competition in fluid milk markets in these regions. The lawsuits alleged a conspiracy among the defendants to restrain trade and suppress milk prices paid to dairy farmers for raw milk used in fluid milk manufacturing as well as a conspiracy to monopolize and monopsonize fluid milk markets in the Southeast and Northeast regions, which violated Sections 1 and 2 of the Sherman Antitrust Act of 1890. The lawsuits were settled after several years of litigations, and neither Dean nor DFA admitted to any wrongdoing.

This article sheds light on competition (business conduct) issues in the fluid milk industry revealed during these antitrust litigations, which increase in importance in light of current restructuring. Dean filed for bankruptcy in the fall of 2019. DFA purchased a substantial portion of Dean’s assets in the spring of 2020. Following this acquisition, DFA will become the largest supplier of raw milk used in fluid milk product manufacturing and the largest processor and marketer of fluid milk products in the country.

By the early 2000s, the fluid milk industry was highly concentrated. In 1999, the average market share of the four largest dairy cooperatives reported for 11 U.S. markets was 76.5%, and the average market share of the four largest fluid milk processors reported for 14 U.S. markets was 75.6% (U.S. General Accounting Office, 2001). In 2003, the average market share of the four largest food retailers reported for 15 U.S. markets was 73.9% (U.S. Government Accountability Office, 2004). These market shares are the four-firm concentration ratios (CR4). The industries with CR4 exceeding 75% are likely to facilitate anticompetitive conduct of firms with market power (Hovenkamp, 2005).

Dairy cooperatives have historically been involved in raw milk marketing and processing raw milk into a variety of manufactured dairy products, including fluid (beverage) milk, cheese, and butter (Shields, 2010). The business objective of farmer-owned cooperatives is to increase returns to their farmer-members. Dairy cooperatives are obligated to accept and sell all milk of their farmer-members and to obtain the highest possible milk prices, which dairy farmers are not able to negotiate individually. Many dairy cooperatives perform bargaining functions by representing farmer-members in contract negotiation processes with dairy processors. The Capper-Volstead Act (1922), a limited antitrust immunity to the Sherman Act, makes it possible for dairy farmers to engage in collective marketing activities, including price negotiations with dairy processors, through dairy cooperatives.

Dairy Farmers of America (DFA) is the largest dairy cooperative in the country. It was formed in 1998 as a result of the merger of four large regional dairy cooperatives (U.S. General Accounting Office, 2001). DFA is a vertically integrated cooperative that owns and operates fluid milk processing plants. Suiza Foods Corporation and Dean Foods Company were the two largest fluid milk processors in the United States prior to 2001, when Suiza acquired Dean, creating a new company, Dean Foods.

To protect competition for fluid milk sold through schools and retail outlets, the U.S. Department of Justice (DOJ) conditioned approval of this merger on Suiza and Dean selling 11 fluid milk processing plants (U.S. Department of Justice, 2001). These plants, which were located in Alabama, Florida, Indiana, Kentucky, Ohio, South Carolina, Virginia, and Utah, were divested to National Dairy Holdings (NDH), a newly formed company that was 50% owned by DFA. The new Dean (a publicly traded company) became the largest fluid milk processor in the country.

Dairy farmers in the Southeast and Northeast regions filed class action antitrust lawsuits in 2007 and 2009, respectively, in which they alleged that Dean and DFA engaged in anticompetitive conduct that restricted competition in fluid milk markets in these regions as early as January 2001 in the Southeast and January 2002 in the Northeast (Sweetwater Valley Farm, Inc., et al. v. Dean Foods Company et al.; Allen et al. v. Dairy Farmers of America, Inc. et al.). The lawsuits included allegations of illegal exercise of buyer market power by DFA and Dean in the market for purchase of raw milk used in fluid milk manufacturing, in violation of Sections 1 and 2 of the Sherman Act.

Dairy farmers claimed that DFA and Dean (among other defendants: fluid milk processors and milk marketing agencies) agreed to not compete for Grade A milk used in fluid milk manufacturing (Class I milk within the system of Federal Milk Marketing Orders (FMMOs)) and that they limited dairy farmers’ access to fluid milk processing (bottling) plants. Taken together, these actions substantially restricted marketing options for dairy farmers and decreased milk prices paid to dairy farmers, particularly the amount of over-order premiums.

The geographic markets affected by the allegedly anticompetitive conduct of DFA and Dean included FMMO 5 (Appalachian) and FMMO 7 (Southeast), collectively referred to as the Southeast, and FMMO 1 (Northeast) (Figure 1). The milk price received by dairy farmers has two components: a government-set component determined within FMMOs and a privately negotiated over-order premium. Over-order premiums are paid for milk quality characteristics, volume, and milk assembling services provided by dairy cooperatives. Over-order premiums are typically paid on Class I milk, so they also reflect supply and demand conditions in the local fluid milk markets.

In their complaints filed in the court, dairy farmers claimed that the following conduct of DFA, Dean, other fluid milk processors, and milk marketing agencies restricted competition in fluid milk markets in the Southeast and Northeast regions:

| FMMO | Total Milk Quantity (million lb) | Class I Milk Quantity (million lb) | Class I Milk Utilization Rate (percent) |

Class I Milk Price ($/cwt) | Uniform Price ($/cwt) |

| Northeast | 25,420 | 9,508 | 37 | 22.09 | 20.23 |

| Appalachian | 5,729 | 3,845 | 67 | 22.24 | 21.34 |

| Florida | 2,833 | 2,424 | 86 | 24.24 | 23.53 |

| Southeast | 6,129 | 4,163 | 68 | 22.64 | 21.74 |

| Upper Midwest | 34,315 | 3,686 | 11 | 20.64 | 18.29 |

| Central | 15,199 | 4,867 | 32 | 20.85 | 18.82 |

| Mideast | 16,719 | 6,448 | 39 | 20.85 | 19.17 |

| Pacific Northwest | 8,239 | 2,120 | 26 | 20.74 | 18.83 |

| Southwest | 12,901 | 4,324 | 33 | 21.85 | 19.59 |

| Arizona | 4,615 | 1,357 | 29 | 21.19 | 19.41 |

| Market average or total | 132,100 | 42,742 | 32 | 21.70 | 19.44 |

Source: USDA AMS Dairy Program, 2014.

As stated in the complaints, the economic incentives for DFA and Dean to use the above-described business practices in the fluid milk industry in the Southeast and Northeast regions were to decrease milk costs to increase the profit of fluid milk manufacturing. As compared with the FMMOs averages, FMMOs 1, 5, and 7 have the highest Class I milk utilization rates (the share of raw milk used in fluid milk manufacturing, as compared to other dairy products), the highest Class I milk prices (prices processors pay for raw milk used in fluid milk manufacturing), and the highest uniform prices (FMMO minimum prices received by dairy farmers), leading to higher costs incurred by fluid milk processors in these regions (Table 1). In addition, dairy farmers claimed that DFA, instead of pursuing its main business objective of increasing returns to dairy farmer-members, acted in the manner of a profit-maximizing fluid milk processor.

In 2007, food retailers in the Southeast region filed a separate antitrust lawsuit that included allegations of illegal exercise of seller market power by Dean and DFA (Hurley, 2017). These food retailers alleged that anticompetitive conduct of Dean and DFA, which stemmed from the 2001 merger between Suiza and Dean, lessened competition in the market for sales of fluid milk products in the Southeast, in violation of Sections 1 and 2 of the Sherman Act.

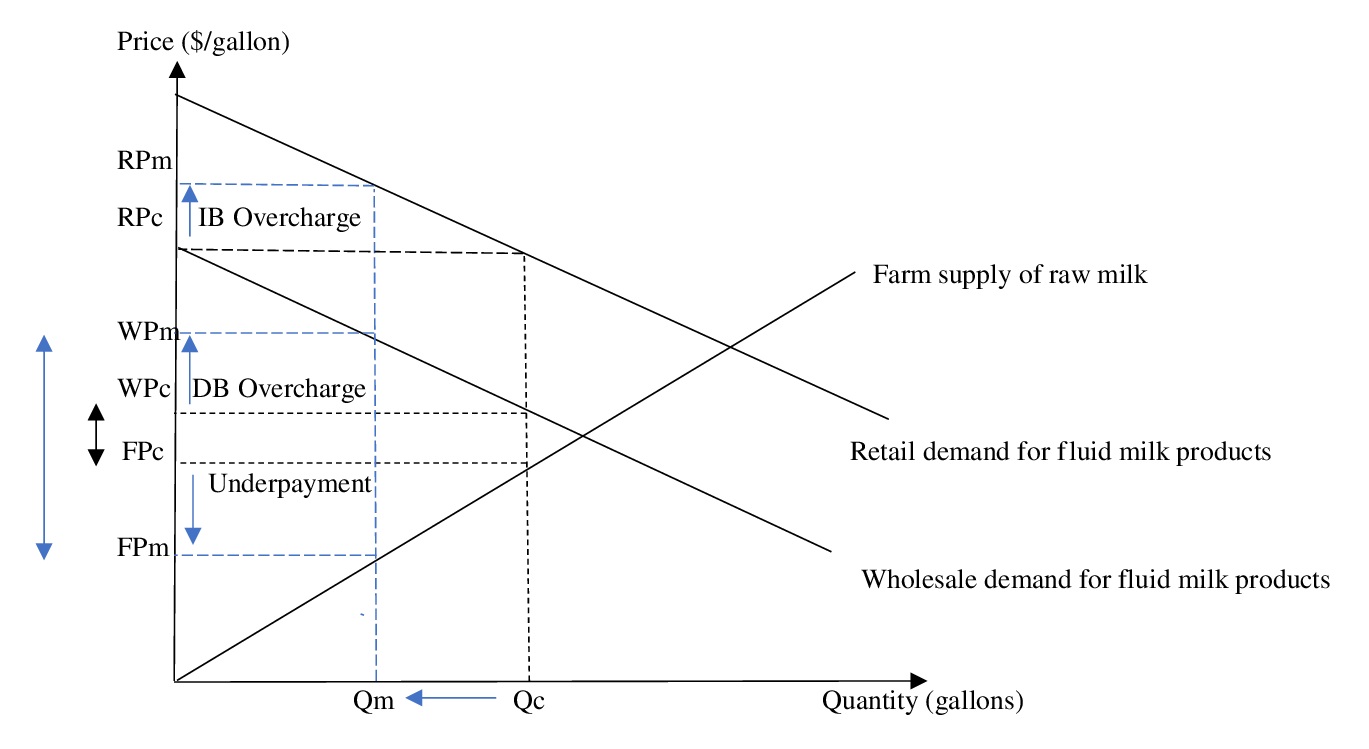

Figure 2 demonstrates the effects of market power of the fluid milk processing industry on milk quantity, prices, and margins in the fluid milk supply chain. Given a high level of industry concentration, the fluid milk processing industry is oligopsony in the input market (raw milk purchasing) and oligopoly in the output market (fluid milk marketing). Compared with a competitive industry, to maximize their profit, fluid milk processors exercising market power would decrease the quantity of raw milk purchased and the quantity of fluid milk products produced from Qc to Qm. This would cause the raw milk price (“farm price”), which is the cost for fluid milk processors, to decrease from FPc to FPm (buyer market power affecting inverse supply of raw milk) and the wholesale and retail prices of fluid milk products to increase from WPc to WPm and from RPc to RPm, respectively (seller market power affecting inverse demand for fluid milk products). Consequently, the farm-to-wholesale margin increases from (WPc-FPc) to (WPm-FPm). The farm-to-wholesale margin includes fluid milk processing costs and fluid milk processors’ profit. This margin, measured in dollars per gallon, is indicated with double-sided arrows in Figure 2.

The buyer market power decreases costs and increases profit of fluid milk processors by the amount of underpayment to dairy farmers (“Underpayment” rectangle in Figure 2). Dairy farmers sell a smaller quantity of milk and receive lower milk prices. The seller market power increases revenue and profit of fluid milk processors by the amount of overcharge attributed to direct buyers of fluid milk products, such as food retailers (“DB Overcharge” rectangle in Figure 2). Final consumers purchasing fluid milk products at the retail level are also overcharged (“IB Overcharge” rectangle in Figure 2). Buyers of fluid milk products purchase a smaller quantity of these products and pay higher prices. The underpayment and overcharge are the basis for damages that dairy farmers and food retailers aimed to recover during antitrust litigations. Dairy farmers and food retailers were entitled to recover treble damages under the Clayton Act of 1914.

In their complaints, dairy farmers and food retailers claimed that the allegedly anticompetitive conduct of DFA and Dean violated Sections 1 and 2 of the Sherman Act. Section 1 declares illegal contracts, combinations, and conspiracies in restraint of trade in interstate commerce. Section 2 declares illegal a single firm conduct and a conspiracy of a group of firms aiming to illegally attempt to monopolize or to monopolize the market. Both Sections 1 and 2 equally apply to seller market power cases, such as a lawsuit filed by food retailers, and buyer market power cases, such as lawsuits filed by dairy farmers.

After several years of litigations, the lawsuits were settled. Neither Dean nor DFA admitted to any wrongdoing. Dean and DFA settled the lawsuit with food retailers in 2017; the settlement’s terms were not publicly disclosed. Dean settled the lawsuit with dairy farmers in the Northeast in 2011 for $30 million and the one in the Southeast in 2012 for $140 million (Kick, 2013; Natzke, 2018). DFA settled the lawsuit with dairy farmers in the Southeast in 2013 for $158.6 million and the one in the Northeast in 2014–2016 for $50 million (Kick, 2013; Natzke, 2018). The DFA settlement agreements included some restrictions on DFA entering new full supply agreements and renewing existing full supply agreements during the settlement terms.

A group of dairy farmers in the Northeast opted out of the original settlement reached with DFA in this region and filed in 2016 a new lawsuit, Sitts v. Dairy Farmers of America and Dairy Marketing Services. During this antitrust litigation, a critical issue of the role of the Capper-Volstead Act as a limited antitrust immunity to the Sherman Act was raised. Section 1 of the Capper-Volstead Act declares

Persons engaged in the production of agricultural products as farmers, planters, ranchmen, dairymen, nut or fruit growers may act together in associations, corporate or otherwise, with or without capital stock, in collectively processing, preparing for market, handling, and marketing in interstate and foreign commerce, such products of persons so engaged. Such associations may have marketing agencies in common; and such associations and their members may make the necessary contracts and agreements to effect such purposes: Provided, however, That such associations are operated for the mutual benefit of the members thereof…

The DOJ filed in the court a Statement of Interest as an aid, clarifying its interpretation of the Capper-Volstead Act, as applied to Sitts v. Dairy Farmers of America and Dairy Marketing Services (U.S. Department of Justice, 2020a). In this statement, the DOJ evaluated the allegedly monopsonistic conduct of DFA against the Capper-Volstead Act exemption for agricultural cooperatives. The DOJ stated that the Capper-Volstead Act antitrust exemption should be interpreted narrowly and that the conduct falling outside of this exemption should be interpreted broadly. The DOJ analysis is summarized below:

The judge dismissed the lawsuit permanently one day before the trial (Natzke, 2020). The lawsuit was settled, but the settlement terms were not publicly disclosed.

The analysis of competition problems in the fluid milk industry reveals the following issues and questions:

The competition issues revealed during the milk antitrust litigations gain more importance in light of current restructuring. Dean filed for bankruptcy in the fall of 2019. DFA purchased a substantial portion of Dean’s assets in the spring of 2020 (U.S. Department of Justice, 2020b). DFA is to become the largest supplier of raw milk used in fluid milk product manufacturing and the largest processor and marketer of fluid milk products in the country. This significant change in the market structure, particularly in the Eastern United States, from two dominant fluid milk processors to one dominant fluid milk processor will affect milk supply agreements between dairy cooperatives and fluid milk processors, and fluid milk contracts between fluid milk processors and buyers of fluid milk products (retailers, wholesalers, and institutional buyers).

The available empirical research has already evaluated potential retail price effects of DFA-Dean merger using data for 2008–2018 (Badruddoza, McCluskey, and Carlson, 2022). Their empirical evidence suggests that this merger is likely to increase DFA’s seller market power and might lead to average increases of 29% in retail prices for fluid milk products (1.27 cents per ounce of milk) in the long run. Future empirical research should evaluate the actual effects of this merger on milk quantities, prices, and margins to inform future policy directions affecting marketing, pricing, and competition process in the fluid milk supply chain.

Allen et al. v. Dairy Farmers of America, Inc. et al. 2011. D. Vt. 5:09-cv-00230-cr. “Revised Consolidated Amended Class Action Complaint and Jury Demand.” Available online: https://www.courtlistener.com/recap/gov.uscourts.vtd.18481.286.0.pdf.

Badruddoza, S., J.J. McCluskey, and A.C. Carlson. 2022. “Foaming Up a Milk Empire? Projected Effects of a Dairy Merger.” Applied Economic Perspectives and Policy 44(3): 1327-1339.

Bolotova, Y. 2021. “Market Power in the Fluid Milk Industry in the Eastern United States.” Applied Economics Teaching Resources 3(2): 39-67.

Hovenkamp, H. 2005. Federal Antitrust Policy: The Law of Competition and Its Practice, 3rd ed. Thomson West.

Hurley, L. 2017, November 17. “U.S. Supreme Court Declines Dean Foods Antitrust Appeal.” Reuters. Available online: https://www.reuters.com/article/us-usa-court-milk-idUSKCN0J11NT20141117.

Kick, C. 2013, January 29. “DFA to Pay $158.6 Million in Antitrust Settlement.” Farm and Dairy. Available online: https://www.farmanddairy.com/news/dfa-to-pay-158-6-million-in-antitrust-settlement/47061.html.

Natzke, D. 2018, August 31. “Northeast Lawsuit Payments Finally Hit Dairy Farmer Mailboxes.” Progressive Dairy. Available online: https://www.progressivedairy.com/news/industry-news/northeast-lawsuit-payments-finally-hit-dairy-farmer-mailboxes\.

Natzke, D. 2020, September 30. “Settlement Agreement Reached in DFA Northeast Lawsuit.” Progressive Dairy. Available online: https://www.progressivedairy.com/news/industry-news/settlement-agreement-reached-in-dfa-northeast-lawsuit.

Phillips, S.K. 2019. “The Future of Dairy Cooperatives in the Modern Marketplace: Redeveloping the Capper-Volstead Act.” Dickinson Law Review 124(1): 175-202.

Shields, D.A. 2010. Consolidation and Concentration in the U.S. Dairy Industry. Washington, DC: Congressional Research Service, R41224.

Sitts et al v. Dairy Farmers of America, Inc. and Dairy Marketing Services, LLC. 2016. D. Vt. 2:16-cv-00287-cr. “Complaint and Jury Demand.” Available online: https://storage.courtlistener.com/recap/gov.uscourts.vtd.27234/gov.uscourts.vtd.27234.1.0.pdf.

Sweetwater Valley Farm, Inc., et al v. Dean Foods Company et al. 2008. E.D. Tenn. “Corrected Consolidated Amended Complaint.” Available online: http://www.southeastdairyclass.com/PDFs/CorrectedConsolidatedAmendedComplaint.pdf

U.S. Department of Agriculture. 2014. Federal Milk Order Marketing and Utilization Summary, Annual 2013. Washington, DC: U.S. Department of Agriculture, Agricultural Marketing Service.

U.S. Department of Agriculture. 2022. Map of Federal Milk Marketing Orders. Washington, DC: U.S. Department of Agriculture, Agricultural Marketing Service. Available online: https://www.ams.usda.gov/sites/default/files/media/Federal Milk Marketing Orders Map.pdf.

U.S. Department of Justice. 2001, December 18. Justice Department Requires Suiza Foods and Dean Foods to Divest 11 Dairy Processing Plants. Antitrust Press Release. Available online: https://www.justice.gov/archive/opa/pr/2001/December/01_at_652.htm.

U.S. Department of Justice. 2020a. Statement of Interest on Behalf of the United States of America Interest of the United States: Sitts v. Dairy Farmers of America and Dairy Marketing Services. Available online: https://www.justice.gov/atr/case/garret-sitts-et-al-v-dairy-farmers-america-inc-and-dairy-marketing-services-llc.

U.S. Department of Justice. 2020b, May 1. Justice Department Requires Divestitures as Dean Foods Sells Fluid Milk Processing Plants to DFA Out of Bankruptcy. Antitrust Press Release 20-420. Available online: https://www.justice.gov/opa/pr/justice-department-requires-divestitures-dean-foods-sells-fluid-milk-processing-plants-dfa.

U.S. General Accounting Office. 2001. Dairy Industry: Information on Milk Prices and Changing Market Structure. GAO-01-561 Report.

U.S. Government Accountability Office. 2004. Dairy Industry: Information on Milk Prices, Factors Affecting Prices, and Dairy Policy Options. GAO-05-50 Report.

U.S. Government Accountability Office. 2019. Dairy Cooperatives: Potential Implications of Consolidation and Investments in Dairy Processing for Farmers. GAO-19-695R Report.