Efforts to reduce livestock manure methane (CH4) emissions in the United States will likely intensify in the coming decade. California, the biggest milk-producing state in the United States, has committed to reducing its livestock CH4 emissions by 40% in 2030 relative to 2013. Further, the Inflation Reduction Act of 2022 allocated funding to the U.S. Department of Agriculture (USDA) to promote “climate-smart” farming practices and renewable energy projects. Some of this newfunding will subsidize manure CH4 reductions through pre-existing USDA programs, such as the Rural Energy for America Program.

Promoting anaerobic digesters is a prominent strategy for reducing manure CH4 emissions from livestock farms. Anaerobic digesters capture biogas with high CH4 concentration from manure lagoons and transport this biogas to where it can be flared, combusted for electricity or heat, or injected into a pipeline for use as compressed natural gas (CNG). At least 416 manure-based U.S. anaerobic digesters are projected to be operational in 2023, a 63% increase relative to 2018 (Figure 1).

Credit sales in environmental markets can provide an important revenue stream that influences the decision to install and operate a digester and thus reduce CH4 emissions. However, environmental market credits are subject to price fluctuations, regulatory uncertainty, and high transaction costs (Pierce and Strong, 2023, Smith, 2023). The U.S. Congress passed the Growing Climate Solutions Act in 2022 to reduce barriers farmers confront in accessing environmental market credit opportunities.

The participation of anaerobic digesters in environmental markets is strategically important to examine, sinceanaerobic digesters are the only on-farm conservation practice that has received offsets in a U.S. governmental cap-and-trade program to date (Pierce and Strong,2023). While research has studied forest carbon offset protocols, few studies have investigated which U.S. anaerobic digesters have received credits in offset and biofuel programs (Pierce and Strong, 2023). This lack of research impedes efforts to reduce livestock manure CH4 emissions, as this information would inform policymakers about which digesters are most susceptible to fluctuations in environmental market conditions.

We link a database of digesters and their characteristics with information about which digesters have received offset credits or have approved pathways in two environmental market programs administered by California’s Air Resources Board (CARB). One program is CARB’s Cap-and-Trade Program, which issues offset credits to digester projects for avoided CH4 emissions. The second program is CARB’s Low Carbon Fuel Standard (LCFS), which provides credits to CNG-producing digesters that reduce the carbon intensity of transportation fuels. Our results demonstrate which types of digesters have benefited from these credit opportunities and would be impacted by program changes. Specifically, our results allow us to examine how participation in environmental markets by digesters varies by animal type, region of the country, digester characteristics, and end-use of biogas.

CARB’s two programs have national implications because digesters across the United States can be eligible for credits in them. In some states, digesters that sell electricity onto the grid are eligible for renewable energy certificates (RECs) for displacing fossil fuel-generated electricity. However, unlike CARB’s offset and biofuels programs, REC markets have localized impacts since biogas projects are typically only eligible for RECs within their state or nearby states.

Cap-and-trade programs allow regulated emitters to purchase “offsets,” which are credits issued to eligible projects from non-regulated sources, as a low-cost compliance option. Cap-and-trade programs were conceptualized, particularly in the mid-to-late 2000s, as the principal market mechanism of providing financial incentives for greenhouse gas mitigation to non-point sources, like farms. However, while CARB’s offset protocol for digesters has existed for over 10 years, few studies have examined which digesters have participated in it.

CARB administers the only government-administered U.S. cap-and-trade program that has issued offsets to digesters. CARB’s cap-and-trade program is important to digesters because offset prices in the voluntary market or in the northeast’s cap-and-trade program (the Regional Greenhouse Gas Initiative, or “RGGI”) are lower. Due to low prices, RGGI has never issued offsets to a digester project (RGGI, 2023).

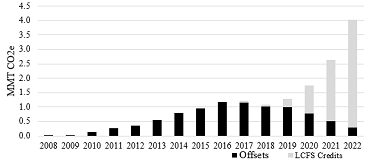

CARB issued approximately 1 million metric tons (MMT) of carbon dioxide equivalent (CO2e) per year in offsets to U.S. digesters under this protocol during 2015–2019 (Figure 2). Subsequently, CARB placed restrictions on offset use to strengthen point source pollution reductions within California, particularly those near low-income and minority communities. While CARB allowed regulated entities to use offsets for up to 8% of their annual compliance obligation through 2020, CARB reduced this percentage to 4% for the 2021–2025 compliance period. This rule change contributed to a decline in digester offsets in CARB’s program in recent years (Figure 2).

Also, as of 2021, CARB stipulated that at least half of offsets must provide direct environmental benefit to California. For livestock offset projects, demonstrating environmental benefit to California implies that the project must occur within the state. While digesters throughout the U.S. are eligible under CARB’s protocol, prior to 2020 there were no limits on out-of-state projects vis-à-vis California projects. Between 2013 and 2022,CARB issued over 8.8 MMT of CO2e in offsets under its livestock protocol, with 13% of those credits attributed to California dairies. During the same period, livestock operations in Wisconsin (19%) and Idaho (16%) received more offset credits than those in California.

CARB’s LCFS is the main state-level program issuing biofuel credits to digesters. Two other states, Oregon and Washington, have analogous programs. However, Oregon has issued few credits for biomethane to date (ODEQ, 2023), and Washington’s program only began in 2023. Digesters can also earn credits in the nationally administered Renewable Fuel Standard (RFS) as a cellulosic biofuel. While the Environmental Protection Agency (EPA) does not maintain a public list of which digesters have received credits, there is likely a highdegree of overlap among digesters receiving LCFS and RFS credits since receiving credit in one program does not preclude receiving credits in the other program.

CARB’s LCFS mandates an average carbon intensity(CI) for gasoline and diesel sold in California. The LCFS provides producers of fuels with low CIs, such as biogas, with credits that can be sold to refiners and importers of fuels with high CIs. CARB stipulates a 20% reduction inthe CI of transportation fuels by 2030. Any U.S. anaerobic digester that connects to a common carrier pipeline can receive LCFS credits. This is because CARB administers the LCFS using a “book and claim” approach (i.e., credits are issued based on the quantity of fuel supplied and not where it is consumed).

CARB’s LCFS credit formula provides digesters with credits for avoided CH4 emissions. For this reason, digesters cannot receive both offsets and LCFS creditsfrom CARB for the same period. LCFS credits issued to anaerobic digesters increased from 0 in 2016 to 3.8 MMT CO2e in 2022 (Figure 2). For comparison, in 2022 CARB only issued 0.3 MMT CO2e in offsets to U.S. digesters.

In addition to CARB’s offset restrictions, a second reason for the shift from offsets to the LCFS is due to high LCFS prices. In nominal (i.e., unadjusted for inflation) terms, LCFS prices doubled over a 2-year period, from less than $100/MT CO2e at the end of 2017 to over $200/MT CO2e by the beginning of 2020. In 2018, 79% of digesters used biogas to produce electricity or heat/power. Due to high LCFS prices, 94% of digesters established during the next 5 years used biogas to produce CNG.

LCFS prices fell throughout 2022 as the supply of renewable diesel credits increased concurrently. This downturn in prices has implied that revenue from digesters declined from approximately double the levelof digester costs to about the same as digester costs (Smith, 2023).

We identify the characteristics of digesters that received environmental credits by merging three datasets:

• the AgSTAR Livestock Anaerobic Digester Database, which contains a list and associated details of manure-based anaerobic digesters for U.S. livestock farms (EPA, 2022);

• CARB’s list of Cap-and-Trade Program offset recipients (CARB, 2022a);

• CARB’s public database of approved LCFS pathways (CARB, 2022b).

We merged these three databases based on the digester name and on other supporting information (e.g., location, start date, and biogas end-use type). Merging these data allows us to link the characteristics of digesters with information about their participation in offset and biofuel programs. We eliminated a select number of digesters from the database that were not eligible for offset credits.

Of the 381 digesters in our database, we classify them according to their age (using whether they were less than 5 years as a threshold) and whether they received either offsets/LCFS credits or not. We found these typologies helpful in discerning patterns in environmental market participation.

We examine whether there is variation in the participation of digesters in environmental markets among the following four categories:

• region of the country,

• livestock type,

• fuel type, and

• digester type.

Regional variation in environmental market participation is informative since CARB began restricting out-of-state offset projects in 2021. So, these data will inform whichregions will be affected by increases or reductions in environmental credit opportunities. We examine the other three categories—livestock type, fuel type, and digester type—because the costs of installing digesters varies among these types of systems. So, revenue streams that support digester installation and maintenance may also vary accordingly.

Table 1 shows the percentage of digesters among the four age/credit classifications by these five categories.For instance, the table indicates that among digesters that are at least 5 years old and have received environmental credits, 26%, 38%, 13%, and 23% are in the Northeast, Midwest, California, and other regions, respectively.

Table 1 indicates that 62% of U.S. digesters are 5 or more years old. Also, the percentage of digesters that have received offsets or LCFS credits is similar between older and newer digesters (39% and 38%, respectively). Thus, 61% of U.S. digesters have never received environmental credits from CARB. One reason digesters may not participate in environmental markets is a lack of awareness of them, particularly if their main motivations in installing a digester are to improve environmental stewardship or to generate byproducts, like bedding(Pierce and Strong, 2023). A second reason is that high transaction costs reduce the net revenue farms receive from environmental credit sales, and thus their incentive to participate in those markets (Pierce and Strong, 2023).

Older digesters are concentrated in the Northeast and Midwest. A higher percentage of older digesters that do not receive environmental market credits are from the Northeast than the Midwest, and vice versa for older digesters that received environmental market credits. A similar pattern between Northeast and Midwest digesters also occurs among newer digesters. One reason may be that Midwest digesters have been more active participants in the LCFS than Northeast digesters, since CARB applies a per-mile discount on credits as the distance from California increases.

There were few digesters in California historically. Despite having the most dairy cows of any state, fewer than five dairies in California operated anaerobic manure digesters before 2002 (CalEPA, 2023). Throughout the 2000s, construction of manure digesters in California remained low, due in part to regulatory requirements related to air emissions and waste discharge permits. However, the increase in digesters within the past 5 years has been concentrated in California due to funding available from the California Department of Food and Agriculture (CDFA, 2022). Table 1 shows that 64% of the newer digesters that are receiving credits are in California, relative to 60% for new digesters that are not receiving credits.

Digesters primarily collect dairy manure, since they are more economically feasible on dairy farms than on swine farms (Cowley and Brorsen, 2018a). Among older digesters, 89% of digesters with credits and 79% of digesters without credits collected dairy manure. This may because swine farms are more likely to receive government grants for digesters than dairy farms (Cowley and Brorsen, 2018b) and thus may have been less dependent on environmental market revenue.

For newer digesters, however, these proportions were 85% and 97%, respectively. The CARB database indicates that some of the swine farms participating in the LCFS are aggregating manure from multiple farms. So, having one digester aggregate manure from multiple farms may allow swine farms to absorb the transaction costs (e.g., maintaining equipment, undergoing verification) of participating in the LCFS.

Older CNG digesters have predominantly received environmental credits, presumably because they were in existence during, and able to take advantage of, the spike in LCFS credit prices. Newer CNG digesters account for 80% and 88% of those that have or have not, respectively, received environmental credits. Newer CNG digesters may account for a high proportion of digesters that have not received credits since they may be less incentivized to after the recent fall in prices. Digesters that flare or have an unspecified end use are proportionately more likely to receive environmental credits. This may be because digesters that flare have no revenue from electricity or biogas sales and thus may have a relatively high need for other revenue streams.

“Covered lagoons” are, as the name implies, passive digesters that require low maintenance; this type of digester makes up 38% of U.S. digesters. Digesters that heat and mix the manure, such as plug flow and complete mix digesters, are more expensive than covered lagoons but also produce more methane. Within the past 5 years, covered lagoon digesters have become more prevalent (Table 1). Among both older and newer digesters, covered lagoon digesters comprise a greater proportion of digesters that receive environmental credits than those that do not.

Offset credits were conceptualized as a critical revenue stream for digesters in the mid-to-late 2000s when the deployment of digesters was in nascent stages (Leuer, Hyde, and Richard, 2008). However, it appears that offset protocols provided a limited incentive on digester installation nationally throughout the 2010s (Figure 1). Offset issuance to digesters in CARB’s Cap-and-Trade Program likely peaked in 2016 and 2017 due to subsequent regulatory changes, and RGGI has never issued offsets to digesters.

Instead, in 2022, CARB issued 13 times as many LCFS credits as offset credits (Figure 2). The development of the LCFS market, along with subsidies within California (CDFA, 2022), have led to a sharp increase in digesters in California that produce CNG (Figure 1, Table 1). While LCFS prices fell during 2022, LCFS credit issuance nonetheless increased 77% between 2021 and 2022. With a new program in Washington and other states exploring whether to implement similar programs, it is possible that crediting opportunities in state-level clean transportation fuel programs proliferate throughout the 2020s.

Another provision that may spur manure CH4 mitigation on U.S. livestock farms is the potential expansion of the RFS to electric vehicles. In December 2022, the EPA proposed a rule so that electric vehicle manufacturers could obtain RFS credits—electronic renewable identification numbers (eRINs)—when their vehicle charging stations source renewable biogas. EPA did not finalize this eRIN provision when they released the Set Rule in June 2023, and whether the EPA ultimately adopts an eRIN protocol and how it would work are unclear. Still, in concept, such a rule could induce greater digester installation. Whereas farms need pipeline access to supply CNG and receive credits under the LCFS, eRINs could incentivize CH4 mitigation for farms without pipeline access via electric power generation.

California Air Resources Board (CARB). 2022a. Compliance Offset Program. Available online: https://ww2.arb.ca.gov/our-work/programs/compliance-offset-program [Accessed 25 April 2023].

———. 2022b. LCFS Pathway Certified Carbon Intensities. Available online:https://ww2.arb.ca.gov/resources/documents/lcfs-pathway-certified-carbon-intensities [Accessed 25 April 2023].

California Department of Food and Agriculture (CDFA). 2022. Dairy Digester Research and Development Program Report of Funded Projects (2015-2022): 2022 Report to the Joint Legislative Budget Committee. Available online: https://www.cdfa.ca.gov/oefi/ddrdp/docs/2022_DDRDP_Legislative_Report.pdf [Accessed 15 June 2023].

California Environmental Protection Agency (CalEPA). 2023. History: Anaerobic Digesters at Dairies in California. Available online: https://calepa.ca.gov/history/ [Accessed 9 May 2023].

Cowley, C., and B.W. Brorsen. 2018a. “Anaerobic Digester Production and Cost Functions.” Ecological Economics 152:347–357.

———. 2018b. “The Hurdles to Greater Adoption of Anaerobic Digesters.” Agricultural and Resource Economics Review 47(1):132–157.

Environmental Protection Agency (EPA). 2022. AgSTAR Livestock Anaerobic Digester Database. Available online: https://www.epa.gov/agstar/livestock-anaerobic-digester-database [Accessed 24 April 2023].

Leuer, E.R., J. Hyde, and T.L. Richard. 2008. “Investing in Methane Digesters on Pennsylvania Dairy Farms: Implications and Scale Economies and Environmental Programs.” Agricultural and Resource Economics Review 37(2):188– 203.

Oregon Department of Environmental Quality (ODEQ). 2023. Clean Fuels Program First Quarter 2022 Data. Available online: https://www.oregon.gov/deq/ghgp/cfp/Pages/Quarterly-Data-Summaries.aspx [Accessed 24 April 2023].

Pierce, M.H., and A.L. Strong. 2023. “An Evaluation of New York State Livestock Carbon Offset Projects under California’s Cap and Trade Program.” Carbon Management 14(1):2211946.

Regional Greenhouse Gas Initiative (RGGI). 2023. Public: Offset Projects. Available online: https://rggi-coats.org/eats/rggi/index.cfm?fuseaction=search.project_offset&clearfuseattribs=true [Accessed 24 April 2023].

Smith, A. 2023. “The Value of Methane from Cow Manure.” Available online: https://asmith.ucdavis.edu/news/digester-update [Accessed 17 April 2023].