Meat markets, like many other essential markets for food and household goods, have gone through massive adjustments during the COVID-19 pandemic. Lusk, Tonsor, and Schulz (2021) studied the meat supply shock generated by packers operating at lower capacities compared to last year and the effect on packer marketing margins and price spreads. For most of April and May 2020, federally inspected cattle slaughter averaged 22% lower and hog slaughter was 13% lower relative to the same period in 2019 (Lusk, Tonsor, and Schulz, 2021). By the end of June 2020, cattle and hog slaughter had recovered to 2019 levels (Lusk, Tonsor, and Schulz, 2021). Headlines in national newspapers illustrated the intense scrutiny the meat sector experienced between April and May 2020 (Reiley, 2020; Corkery and Yaffe-Bellany, 2020; Brandt, 2020). The trade-off between plant employees’ health and well-being and national availability of meat products was thrust into the national media spotlight (Brandt, 2020; Corkery and Yaffe-Bellany, 2020). On April 28, 2020, the president signed an executive order that compelled slaughterhouses to remain open, saying that “such closures threaten the continued functioning of the national meat and poultry supply chain” (Jacobs and Mulvany, 2020).

In addition to these impacts on supply, the COVID-19 pandemic also had swift and tangible impacts on meat demand. Restaurant closures and a general aversion to indoor dining even when available (Peter, 2020) continues to impact individual meat items in distinct and unique ways from other cuts or products. Figure 1 shows the unprecedented decrease in spending in food away from home (FAFH). Gibson (2020) suggests that “the Coronavirus flipped what, and how, Americans eat.” Arguably, sit-down and high-end tablecloth restaurant establishments may have been more affected than carry-out, fast food establishments (Gaulke and Elrod, 2020). The questions remains: How are restaurant closures, along with the shift in what and how American’s eat, affecting preferences and demand for various cuts (of beef) and resulting beef prices?

Changes in the relative value of different cuts within a beef carcass impact the profitability of that carcass for beef packers, processors, distributors, retailers, and food service. Meat, unlike milk or grain, is produced in discrete units, such as one head of cattle. Each unit (head) is made up of individual cuts, such as ribs, tenderloins, and chuck (U.S Department of Agriculture, 2021). As long as cattle is being slaughtered, there is the potential for commercial availability of various cuts. At the same time there are economic forces on packers who have to decide how to process a carcass into the various cuts, using a variety of factors from relative pricing to yield estimates to demand estimates. The pandemic-induced shift in spending toward food at home has had major implications for the demand for beef cuts typically oriented toward food service. These cut-specific impacts on demand have implications along the beef supply chain. Changes in price relationships of beef cuts may alter the profit structure for packers, where the prices of lower demanded items may have to be subsidized by other cuts. Further, labor issues induced by the pandemic—in addition to various supply and demand impacts—may have altered how packers break down the primal into different cuts.

We study the change in the relative prices of traditionally food service beef cuts compared to other cuts more commonly offered in supermarkets for at-home preparation and consumption. Our hypothesis is that restaurant closures due to COVID-19 in mid-March of 2020 may have changed the wholesale price relationship between beef cuts that are traditionally oriented toward foodservice outlets and other beef cuts traditionally oriented toward at-home dining. A change in the relative pricing of beef cuts, especially the rapid deterioration of value in typically high-value and high-profit cuts, could significantly alter the value proposition in the beef supply chain. Additionally, we explore how the pandemic-induced shock on beef markets may have been different than other prominent market shocks in meat markets in recent history.

The traditional discussions around spreads in meat focus on differences in price at separate steps in the supply chain, namely farm, wholesale, and retail (U.S. Department of Agriculture, 2020c). However, little attention has been given to the relative differences in prices of specific cuts of beef. Within the traditional context, the intertemporal relationships among live, wholesale, and retail beef prices are important factors in the efficiency and equity of the meat marketing system, and the understanding of such relationships has long been useful for private as well as public policy decision making (Pouliot and Schulz, 2016). But did COVID-19 induce a change in the price relationship among traditional foodservice beef cuts relative to other cuts? And is this change relevant to decision makers? While it may be too early to know if some of these changes will be temporary or if they will have lasting implications, we can look at both questions with an inquisitive eye. It remains unknown whether or when pre pandemic dining habits will resume. Current information indicates that a sizable portion of the U.S. population has expressed hesitation about returning to dine-in restaurants even after a vaccine (Tonsor and Lusk, 2020). Therefore, it is possible that the effect of pandemic-induced restaurant closures may extend beyond the present. We explore both questions using the wholesale stage of the supply chain as a reference. However, this information may be relevant at the end consumer level, where consumers use differences in relative prices of beef cuts to make their buying decisions.

Source: U.S. Department of Agriculture (2020a).

U.S. Department of Agriculture (2020a).

In 2018, the U.S. food service sector represented 8.028 billion pounds of beef (Pawlak and Napier, 2019), which is approximately 26.2% of the total beef reported by USDA (U.S. Department of Agriculture, 2020e). In this study we choose tenderloins, which is the cut used for filet mignon, as the flagship food service item. In 2018, filets were the largest dollar generator in the beef category of the food service sector (Pawlak and Napier, 2019). Other sources have categorized filet mignon as the most frequently menued steak by full-service restaurants (Daley, 2018). Filet mignon is traditionally purchased at restaurants (Gibson, 2020), which makes tenderloin ideal for this analysis as it serves as comparison to other beef cuts that may not rely on food service sales.

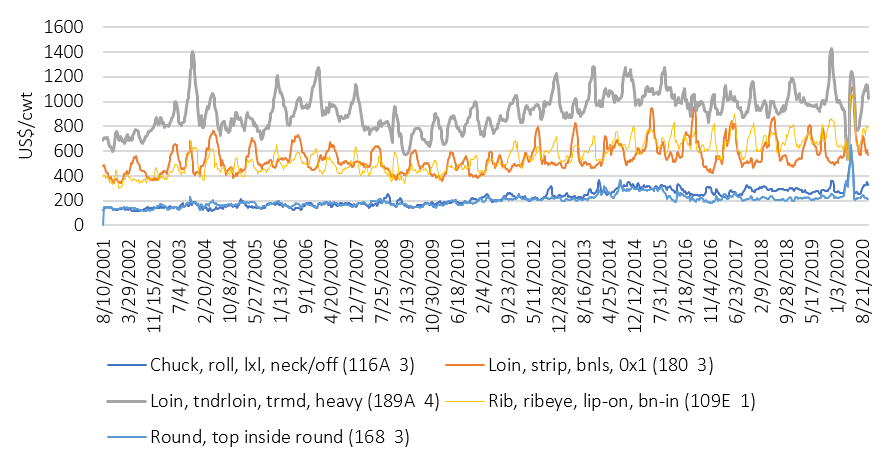

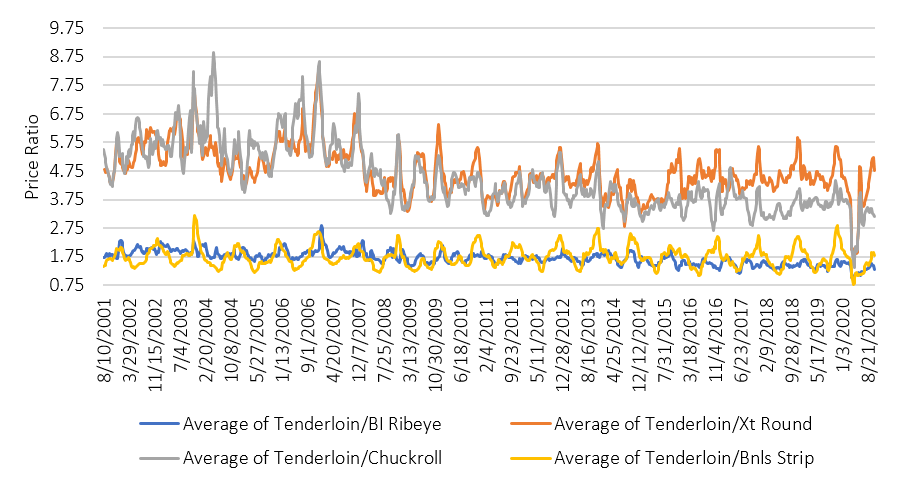

Data from the USDA National Weekly Boxed Beef Cutout and Boxed Beef Cuts-Negotiated Sales report (LM_459) from April 2001 to October 2020 show that wholesale choice tenderloin prices were the cheapest on April 10, 2020, in nominal terms. We selected bone-in ribeye, bone-in strips, chuck rolls, and top rounds as the retail items to be compared with tenderloins. Data from the U.S. Department of Agriculture (2020a) show that from November 2018 through November 2020, ribeyes were featured in the highest number of stores for the rib complex, strips for the loin complex (where tenderloin belongs as well), chuck arm roast and chuck arm steak for the chuck complex, and top round was the fourth most featured in the round complex. The chosen retail items each reached their highest price in April 2020 (Figure 2). Although tenderloin prices rose sharply from their April 10, 2020, lows, the relative relationship of tenderloin price compared to the retail cuts reached their lowest levels during the period evaluated in April 2020 (Figure 3). Other shocks in the beef markets, like the 2008 financial crisis, may have affected consumer’s financial ability to dine out, but the implications of the pandemic-associated closures and market disruptions are much more universal. The scale of impacts on beef purchasing through all marketing channels simultaneously has altered the relative pricing of cuts (e.g., tenderloins) in ways not seen previously.

The COVID-19 pandemic included a supply shock component due to reduced slaughter and a demand shock stemming from restaurant closures and aversion toward in-person dining even when available. The latter can be visually apprehended by looking at Figure 1, which displays a change in food spending, induced by the pandemic, like no other market shock has induced in recent history. In this section we provide some perspective of how the pandemic-induced restaurant closures and aversion toward in-person dining demand shock may be different than other recent shocks in the beef markets. Recent shocks in the meat markets can be classified as demand shocks, like bovine spongiform encephalopathy (BSE) events, beef recalls, and financial crises and supply shocks like droughts, which can induce U.S. herd contraction. The BSE events of 2003 and widespread droughts of 2010–2013 would have had an impact across the beef carcass and not have disproportional effects on certain cuts. Other shocks like the financial crisis of 2008 may have had a more negative effect on more expensive cuts.

Food-safety-related shocks, include outbreaks of contamination of listeria, Escherichia coli (E. coli) and salmonella in meat and BSE in cattle. Such shocks have impacts on demand for beef (Piggott and Marsh, 2004), shareholders earnings (Thomsen and McKenzie, 2001), beef prices (McKenzie and Thomsen, 2001), and cattle futures prices (Lusk and Schroeder, 2002). In their application, Piggott and Marsh (2004) found that meat recalls, due to pathogens, induced reallocation of expenditures within meat groups. Regarding BSE, highly publicized information regarding an infected cow in December 2003 had a large and significant negative effect on beef sales (Schlenker and Villas-Boas, 2009). The relevance of recall shocks seems evident from this review of literature, but what is its direct impact on retail, wholesale, and farm beef prices? McKenzie and Thomsen (2001) found that retail prices of boneless beef were negatively affected by ground beef realls related to E. coli, but such price effects where insignificant at the wholesale and farm level. This suggests a localized effect on beef cuts that could be used for ground beef (boneless beef).

Weather-related shocks can have a significant impact on food prices in the United States as demonstrated by the 1988 and 2012 droughts. The 2012 drought, the worst one after the 1988 drought, was widespread, covering 80% of U.S. agricultural land (Bureau of Labor Statistics, 2012). One effect of the 2012 drought was the increase of corn prices over 20% and an increase in the Producers Price Index (PPI) 1–2-month percentage change for beef and veal of 19% in June 2012 (Bureau of Labor Statistics, 2020). As a point of comparison, the PPI’s 1–2-month percentage change for beef and veal increased by 76.9% (Bureau of Labor Statistics, 2020) in May 2020, showing a more severe effect from the pandemic than from the severe droughts.

The global financial crisis of 2008 was partially credited with a negative impact on the food industry through the impact of financial speculation (Ghosh, 2010) and is another prominent recent shock in the meat markets. Demand imbalances driven by increase in demand for meat combined with demand of grains for biofuel production were also part of the equation (Ghosh, 2010), which ultimately led to significant spikes in world market prices of agricultural commodities. A relevant aspect of the financial crisis is a decrease in expenditures in food away from home (FAFH) in the United States, which decreased by 7% from 2007 to 2009, and in food at home (FAH) expenditures, which decreased by 4% (U.S. Department of Agriculture, 2020b). As a point of comparison, FAFH nominal sales decreased by 48% from February to April of 2020, while FAH increased by 10% (U.S. Department of Agriculture, 2020b). This lends validity to the idea that the pandemic has been a different type of shock into beef markets than other recent shocks and that particular attention and awareness should be warranted by the industry.

Our analysis suggests that the aftermath of the pandemic for the beef industry may be different than the aftermath of other types of market shocks, say a financial crisis or a foodborne illness scare. Further, there is more reason to believe that the pandemic impacts will extend into at least the near future as we slowly work our way out of the pandemic regime. An extended period of cooking at home may shift consumer preferences to less food away from home or alter preferences in other unforeseen ways. If this is the case, beef packers may wish to again revisit how carcasses are processed and/or how various cuts are marketed.

Livestock markets have shown resilience throughout the COVID-19 pandemic and the food supply chain has suffered adjustment pains. However, the food supply chain has proven its resilience in the midst of this extreme and prolonged shock. The food production and processing sector may be more resilient to new outbreaks than what it was in March 2020, as many changes were implemented on the processing facilities and production lines to ensure social distancing. However, fears of food shortages have not subsided (Dorning, 2020; Lederer, 2020; Moffat, Gonzales, and McGregor, 2020), since the food processing sector is still operating in close and sometimes crowded spaces. Even if the supply chain exhibits stability under pressure, the demand side of the equation requires attention.

Food away from home spending has increased later in the summer of 2020, with many restaurants offering outdoor dining options, where consumers may feel safer eating. However, with the end of the warm weather in the northern part of the United States and the possibility of restaurant closures, it seems as though the story for common food service products, such as beef tenderloins, experienced in March 2020 has the potential to repeat. For years, the Thanksgiving and Christmas holidays have been “prime” time for specialty beef cuts like tenderloins, ribeyes and strip loins. It will be interesting to see how demand, combined with smaller gatherings to celebrate the holidays, will continue to playout in meat markets this year. Regardless of holiday 2020 demand, the March 2020 through November 2020 period, which is typically “grilling season” flanked by the restaurant-heavy Valentine’s Day and the winter holidays, has been anything but typical.

The deployment of the COVID-19 vaccine in Spring 2021 will be an interesting development to consider. A monthly online survey by Tonsor and Lusk (2020) revealed that a COVID-19 vaccine would prompt U.S. consumers to immediately have more dine-in meals (20%), slowly begin to have more dine-in meals (45%) and do not expect to change their dine-in activity (35%). This suggests that a segment of the U.S. population may still choose to not go to restaurants after a vaccine is available, which may suggest that the beef price relationship may not go back to the pre-COVID19 levels or structure, at least in the short term.

While the industry has long watched traditional spreads, the change in spending patterns on food at home and food away from home due to prolonged time out of restaurants has pushed a new type of “spread” into livestock marketers’ field of vision—relative prices between beef cuts, especially the highest end cuts traditionally bound for food service outlets and those cuts more commonly featured at your retail grocer’s meat case. Such relative prices among beef cuts may be relevant for packers’ profit structures, including how they break down beef carcass into different cuts. Further, changes in price relationships at the wholesale level may lead retailers to alter what is featured to shoppers on the basis of relative cost and availability of different beef cuts and potentially also in conjunction with availability of meats and proteins more broadly than just beef. Consumers face retail prices of different beef items and the relative spread among those prices may influence their beef buying decisions. Last, consumers purchasing decisions may be influenced by price differences between beef cuts and across different proteins. In 2020, those cuts resided side-by-side at the meat counter, and that juxtaposition may be changing how consumers select beef now and into the future.

Brandt, J. 2020, April 18. “Meat Plant Workers and Your Dinner at Risk in Coronavirus Pandemic.” NBC Philadelphia. Available online: https://www.nbcphiladelphia.com/news/coronavirus/meat-plant-workers-and-your-dinner-at-risk-in-coronavirus-pandemic/2378482/.

Bureau of Labor Statistics. 2012. “Will the 2012 Drought Have a Bigger Impact on Grocery Prices Than the 1988 Drought?” Beyond the Numbers 1(18). Available online: https://www.bls.gov/opub/btn/volume-1/will-the-2012-drought-have-a-bigger-impact-on-grocery-prices-than-the-1988-drought.htm.

Bureau of Labor Statistics. 2020. “PPI Commodity Data.” Databases, Tables & Calculators by Subject. Available online: https://data.bls.gov/timeseries/wpu022101&output_view=pct_12mths [Accessed November 18, 2020]

Centers for Disease Control and Prevention. 2018. “Bovine Spongiform Encephalopathy (BSE), or Mad Cow Disease.” Available online: https://www.cdc.gov/prions/bse/bse-north-america.html.

Corkery, M., and D. Yaffe-Bellany. 2020, April 18. “The Food Chain’s Weakest Link: Slaughterhouses.” New York Times. Available online: https://www.nytimes.com/2020/04/18/business/coronavirus-meat-slaughterhouses.html.

Daley, B. 2020, June 14. “In Praise of Filet Mignon: Maligned by Chefs Yet Still Beloved.” Chicago Tribune. Available online: https://www.chicagotribune.com/dining/craving/ct-food-filet-mignon-defended-0620-story.html.

Dorning, M. 2020, November 23. “Meatpacking Link Found in Up to 8% of Early U.S. Covid Cases.” Bloomberg. Available online: https://www.bloomberg.com/news/articles/2020-11-23/study-ties-6-to-8-of-u-s-covid-cases-to-meatpacking-plants.

Gaulke, C., and N. Elrod. 2020, June 3. “What Restaurants Will Survive Coronavirus?” CBS New York. Available online: https://newyork.cbslocal.com/2020/06/03/restaurants-sit-down-delivery-takeout-coronavirus/.

Ghosh, J. 2010. “The Unnatural Coupling: Food and Global Finance.” Journal of Agrarian Change 10(1): 72–86.

Gibson, K. 2020, April 8. “Filet Mignon Is Cheapest in Decade as Coronavirus Upends Meat Supplies.” CBS News. Available online: https://www.cbsnews.com/news/coronavirus-supply-filet-mignon-lowest-cost-decade/.

Jacobs, J., and L. Mulvany. 2020, April 24. “Trump Orders Meat Plants to Stay Open in Move Unions Slam.” Bloomberg. Available online: https://www.bloomberg.com/news/articles/2020-04-28/trump-says-he-s-issuing-order-for-tyson-s-unique-liability.

Lederer, E. 2020, November 14. “Nobel UN Food Agency Warns 2021 Will Be Worse Than 2020.” Associated Press. Available online: https://apnews.com/article/famine-david-beasley-nobel-prizes-coronavirus-pandemic-united-nations-f2c0e3b3d85b457a97b81c2c5fed08bd.

Lusk, J.L., and T.C. Schroeder. 2002. “Effects of Meat Recalls on Futures Market Prices.” Agricultural and Resource Economics Review 31: 47–58.

Lusk, J.L., G. Tonsor, and L.L. Schulz. 2021. “Beef and Pork Marketing Margins and Price Spreads during COVID-19.” Applied Economic Perspectives and Policy 43(1): 4–23.

McKenzie, A.M., and M.R. Thomsen. 2001. “The Effect of E. coli O157:H7 on Beef Prices.” Journal of Agriculture and Resource Economics 26(2): 431–444.

Moffat, A.R., C. Gonzales, and S. McGregor. 2020, November 23. “Panic Buying’s Back with COVID-19 Surge, but Food Companies, TP Makers Are Ramping Up Supply.” Chicago Tribune. Available online: https://www.chicagotribune.com/business/ct-biz-covid-19-grocery-toilet-paper-shortage-20201123-4gqxyakj7nfmjarow2ptrm3dfu-story.html.

Pawlak, J., and M. Napier. 2019. Usage and Volumetrics Assessment of Beef in Foodservice Study, 2018 ed. Technomic, prepared for the Beef Checkoff. Available online: https://www.beefitswhatsfordinner.com/Media/BIWFD/Docs/4_26_19-2018-volumetric-summary-for-beef-research.pdf.

Peter, M. L. 2020, August 20. “K-State’s Tonsor Spoke at Virtual K-State Risk and Profit Conference.” K-State Research and Extension News. Available online: https://www.ksre.k-state.edu/news/stories/2020/08/economist-reviews-shocks-to-beef-industry.html.

Piggott, N., and T. Marsh. 2004. “Does Food Safety Information Impact U.S. Meat Demand?” American Journal of Agricultural Economics 86(1): 154–174.

Pouliot, S., and L. Schulz. 2016. “Measuring Price Spreads in Red Meat.” Agricultural Policy Review. Available online: https://www.card.iastate.edu/ag_policy_review/pdf/winter-2016.pdf.

Reiley, L. 2020, April 28. “In One Month, the Meat Industry’s Supply Chain Broke. Here’s What You Need to Know.” Washington Post. Available online: https://www.washingtonpost.com/business/2020/04/28/meat-industry-supply-chain-faq/.

Richardson, Z. 2020, November 23. “How Will COVID-19 Affect Thanksgiving?” MSU Today. Available online: https://msutoday.msu.edu/news/2020/how-will-covid-19-affect-thanksgiving.

Schlenker, W., and S. Villas-Boas. 2009. “Consumer and Market Responses to Mad Cow Disease.” American Journal of Agricultural Economics 91(4): 1140–1152.

Thomsen, M.R., and A.M. McKenzie. 2001. “Market Incentives for Safe Foods: An Examination of Shareholder Losses from Meat and Poultry Recalls.” American Journal of Agricultural Economics 82: 526–538.

Tonsor, G., and J. Lusk. 2020. Impact of Coronavirus (COVID19) Vaccine on Food Service. [Special report]. Manhattan, KS: Kansas State University. Available online: https://www.agmanager.info/livestock-meat/meat-demand/monthly-meat-demand-monitor-survey-data/impact-coronavirus-covid19.

U.S. Department of Agriculture. 2020a. Datamart. Washington, DC: U.S. Department of Agriculture, Agricultural Marketing Service. Available Online: https://mpr.datamart.ams.usda.gov/menu.do?path=Products\Beef\Weekly Boxed Beef\(LM_XB459) National Weekly Boxed Beef Cutout and Boxed Beef Cuts - Negotiated Sales.

U.S. Department of Agriculture. 2020b. Food Expenditures Series. Washington, DC: U.S. Department of Agriculture, Economic Research Service. Available online https://www.ers.usda.gov/data-products/food-expenditure-series/.

U.S. Department of Agriculture. 2020c. Meat Price Spreads. Washington, DC: U.S. Department of Agriculture, Economic Research Service. Available online: https://www.ers.usda.gov/data-products/meat-price-spreads/.

U.S. Department of Agriculture. 2020d. Weekly Advertised Retail Prices. Available online: https://www.marketnews.usda.gov/mnp/ls-report-retail?runReport=true&portal=ls&startIndex=1&category=Retail&repType=item&species=BEEF®ion=0&grade=0&cut=LOIN&product=BONE-.

U.S. Department of Agriculture. 2020e. World Agricultural Outlook Board, "World Agricultural Supply and Demand Estimates" and supporting materials and ERS Estimates of per capita Disappearance. Accessed on 12/27/2020.

U.S. Department of Agriculture. 2021. USDA Daily Boxed Beef Report. Washington, DC: U.S. Department of Agriculture, Agricultural Marketing Service. Available online: https://www.ams.usda.gov/sites/default/files/media/USDADailyBoxedBeefReport.pdf.

Wakamatsu, H., and K. Aruga. 2013. “The Impact of the Gas Shale Revolution on the U.S. and Japanese Natural Gas Markets.” Energy Policy 62: 1002–1009.

Walansky, A. 2020, October 19. “An Intimate Thanksgiving Dinner Can Still Be Big on Flavor.” Forbes. Available online: https://www.forbes.com/sites/alywalansky/2020/10/19/an-intimate-thanksgiving-dinner-can-still-be-big-on-flavor/.