Recently, foreign ownership of U.S. agricultural land has been a hot topic for U.S. politicians and the news media. The public, seeing ever-increasing farmland prices, wonders whether foreign entities entering the land market might be a driving force. Following events of the recent pandemic, concerns about food security and disturbances in food supply chains due to non-U.S. ownership of agricultural assets have surfaced. Deteriorating U.S.–China relations have also fueled national security concerns surrounding Chinese holdings of U.S. farmland. In light of these concerns, it seems warranted to better understand who holds U.S. agricultural land and what recent investment trends might reveal about the future of foreign land acquisition in the United States.

No federal law prohibits the ownership of private agricultural land by foreign persons or entities. The Agricultural Foreign Investment Disclosure Act of 1978 (AFIDA) grants the USDA the authority to monitor land acquisitions and record transaction information, including the name of the foreign person or entity, country of residence, parcel acreage, land use (such as cropland, pasture, forest, or other agricultural land), purchase price, and the date of transfer. AFIDA requires all foreign entities acquiring an interest in agricultural land with at least 10 acres or producing $1,000 or more in agricultural products to report the transaction within 90 days of the date of acquisition. Failure to comply results in a civil penalty of up to 25% of the fair market value of the interest held in the land (USDA, 2021). USDA publishes an annual report of foreign ownership or leasing of U.S. agricultural land by country or origin and U.S. state where the acquisition occurred.

It is worth noting that AFIDA requires reporting of ownership and partial ownership in U.S. agricultural land by a foreign investor as well as leaseholds of 10 years or more. In other words, foreign investments in U.S. land covered by AFIDA includes both foreign ownership and leasing. Current AFIDA regulations exempt foreign investors from the reporting requirement if their lease of agricultural land is for less than 10 years, but pending congressional legislation seeks to reduce that threshold to 5 years (Brown, 2022). In this article, we distinguish between foreign interest ownership versus long-term leases (10 years or greater) and argue that foreign investment in U.S. agricultural land via leasing is an increasingly important phenomenon but not well understood. As of 2020, over half of transactions by foreign buyers holding U.S. agricultural land are via long-term leases, covering more than 30% of acres held by foreign entities and reported under AFIDA. For the past decade, from 2011 to 2020, long-term leases have been even more important, as they account for 60% of all foreign interests in U.S. farmland in terms of acres and more than 70% of all transactions reported under AFIDA.

The USDA does not have the authority to intervene in private land deals, but individual states have passed legislation that affects who can buy agricultural land and how much they can own. In the past 2 years, many states have proposed legislation limiting foreign ownership. Those bills vary in detail—affecting the scope of limitations—and differentiate between individuals and corporations. Similarly, at the federal level, several legislators have proposed measures seeking to control, prohibit, restrict, or increase oversight on foreign investments in the U.S. agricultural sector.

The University of Arkansas National Agricultural Law Center (2023) splits the proposed measures of the 117th Congress (2021–2022) into four categories, some of which fall into multiple categories. The proposed bills either

Adding the Secretary of Agriculture to CFIUS includes designating agricultural supply chains as “critical infrastructure” and explicitly addresses farmland acquisitions near military installations.

Twenty-four states have some restrictions on foreign ownership of land; however, each state’s restrictions vary based on the definition of agriculture or farming, restrict certain kinds of foreign owners, or allow foreign owners to only acquire up to a certain amount of agricultural land. Several states, such as Iowa, also already have restrictions on corporate land ownership that affect both foreign and U.S. companies (National Agricultural Law Center, 2023b). In 2021 and 2022, 12 states proposed legislation restricting or prohibiting foreign ownership of agricultural land (Alabama, Arizona, Arkansas, California, Indiana, Iowa, Mississippi, Missouri, Oklahoma, South Carolina, Tennessee, and Texas). However, of those states, only Indiana passed legislation restricting certain foreign ownership or long-term lease of agricultural land in 2022 (National Agricultural Law Center, 2023a). Based on the recent flurry of activity, it is reasonable to expect the federal and state governments to propose and enact more measures in the near future.

Foreign ownership or leasing of U.S. agricultural land increased by 2.4 million acres in 2020 (USDA, 2021). However, that acreage represents a relatively small proportion of the overall base of U.S. farmland and timberland. The total amount of U.S. cropland, pasture, and forestland with foreign ownership or leasing interest in 2020 was 37.6 million acres, which represents about 2.9% of all privately held U.S. agricultural land.

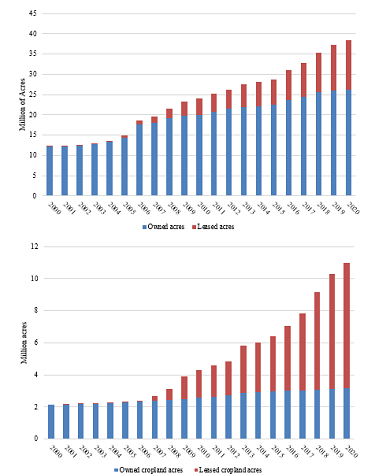

While a small proportion of the farmland base, foreign acquisition of U.S. agricultural land has been trending upward in recent years (Figure 1). From 2009 to 2015, foreign ownership or leasing of U.S. agricultural land increased at a moderate pace, averaging an additional 2.2 million acres per year. Since then, the increases have been more pronounced, especially for cropland and forestland. The increase in cropland acquisitions since 2018 is interesting given the increases in farmland values that have occurred since then. While cropland is getting more expensive, foreign investors are becoming more active in the market. However, this market activity appears to be in the form of long-term leases (Figure 1b).

Although foreign-owned and leased acres of farmland make up only 2.9% of all U.S. agricultural land, there is foreign-held land in all 50 states and its magnitude varies significantly. The concentration of foreign land owned and leased across the United States depends on the land use, as shown in Figure 2a, which shows state-level percentages of foreign-held agricultural land relative to all privately held farmland for all U.S. states. Texas has the most foreign-owned land with over 4.7 million acres, followed by Maine (just over 3.5 million acres) and Alabama (1.8 million acres). Maine leads U.S. states for foreign ownership as a percentage of privately held agricultural land with 19.5%, followed by Hawaii (9.2%), Washington (7.1%), Alabama (6.2%), Florida (5.8%), Louisiana (5.8%), and Michigan (5.7%) (USDA, 2021). Figure 2b further shows that foreign entities own or lease less than 4% of all cropland in most of the Corn Belt and Great Plains states.

Another trend in foreign land investments is the nature of land acquisition. The AFIDA reporting form allows respondents to list and self-report one of six ownership structures for the land they have obtained:

In other words, the first five categories are broadly foreign “ownership,” while category 6 is largely leaseholds.

In 2020, 62% of foreign land investments in acres reported under AFIDA fell into the first category (whole ownership), while 32% fell into the sixth category (long-term leases). The amount of land wholly owned by foreign entities declined over time, while the percentage of leased acres increased. This growth in leasing relative to ownership manifests in the cropland category more than in the pasture, forest, or other agricultural land classifications. Figure 1 shows that foreign-owned cropland represents only 12% of all foreign-owned U.S. agricultural land; however, foreign-leased cropland accounts for nearly two-thirds of all foreign leaseholds of U.S. agricultural land. As shown in Figure 1b, the percentage of cropland owned accounted for the vast majority of foreign interest in U.S. cropland but fell below the percentage of cropland leased in 2013. By 2020, ownership accounted for 26% of foreign land holdings of U.S. cropland, while 71% fell under long-term leases. In other words, most additional foreign acquisition of U.S. cropland in recent years has been through long-term leases, which more than tripled from 2010 to 2020. Foreign-held forestland does not follow this pattern—ownership accounts for 89% and long-term leases account for 4%.

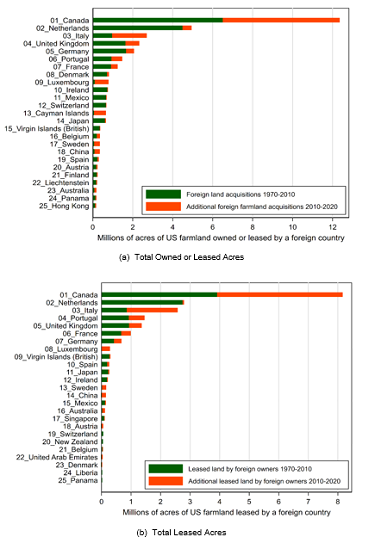

Figure 3 shows that Canada is the largest foreign holder of U.S. agricultural land, accounting for 32%, or 12.4 million acres, of the total land base held by foreign entities. Following Canada, the Netherlands (13%), Italy (7%), the United Kingdom (6%), and Germany (5%) are the next four largest holders, collectively holding 31%, or 12 million acres.

China is relatively new to the U.S. agricultural land market—most of China’s acquisitions occurred in the past 10 years. Through more investments globally, especially as part of the Belt and Road Initiative (AEI, 2023), China has consistently reduced its reliance on U.S. agricultural products (Zhang, 2021; Bown and Wang, 2023). As of the end of 2020, China ranked 18th overall in U.S. land holdings, owning 352,140 acres—less than 1% of all foreign-held acres in the United States (Figure 3a). The largest agricultural land acquisition by a Chinese entity was in 2013, when Chinese firm WH Group acquired Smithfield Foods. The acquisition included subsidiary Murphy Brown, LLC, which collectively held 146,538 acres of land across North Carolina, Missouri, Utah, Virginia, Colorado, Oklahoma, Texas, South Carolina, and Illinois. Since then, Texas saw major land acquisitions by Chinese entities in 2017 and 2018 totaling 105,269 acres according to the AFIDA records in 2021. Of the acquisitions made by Chinese entities in 2017 and 2018, the vast majority, over 102,000 acres, were bought by an entity owned by a Xinjiang-based billionaire, Sun Guangxin, who intended the land for solar and wind developments (Hyatt, 2021). According to AFIDA records, 99% of the agricultural land bought by Chinese entities falls into the “other agricultural land” category.

Land use of acquired agricultural land by a foreign buyer falls into several categories—forestland accounts for 46% of all reported foreign-held acreage, cropland accounts for 29%, pasture and other agricultural land accounts for 23%, and nonagricultural land accounts for 2% (USDA, 2021). It is impossible to know what a new landowner will decide to do with the agricultural land once it is in their control. However, the name of the entity can provide some indication. AFIDA reports list entity names, and it is very common to find the words “wind” and “solar” in the names of the foreign entities. In fact, when we categorize entities based solely on the inclusion of those words, wind and solar entities comprised 74.8% of all foreign entities buying land in 2020. In terms of acreage, wind and solar entities account for 88.5% of cropland and 84.1% of pastureland acquisitions in 2020, which suggests that a big motivation for acquiring U.S. land is not solely to produce food but rather renewable energy.

While the issue of foreign investment in U.S. agricultural land is currently a popular topic, it is important to know that much of the recently acquired cropland by foreign entities is held under long-term leases rather than purchased outright. Based on the names of entities listed in the AFIDA database, most of the acquisitions are by natural resource entities. Wind and solar development have become a major driver for investment by foreign entities and will continue as long as there are business opportunities in the United States for this type of venture. Will foreign leases of U.S. agricultural land for wind and solar development affect the food supply chain? It is more likely that the small footprint of the wind towers and the continued cultivation and grazing of the remaining acres will reduce the impact on food production to a very small amount. Data from AFIDA suggest that the motivation of foreign buyers is to develop natural resources in the United States. Understanding recent trends in foreign leases of U.S. agricultural land may help policy makers as they consider new legislation on this topic.

American Enterprise Institute (AEI). 2023. China Global Investment Tracker. Available online: https://www.aei.org/china-global-investment-tracker/

Bown, C., and Y. Wang. 2023. “China Is Becoming Less Dependent on American Farmers, but US Export Dependence on China Remains High.” Peterson Institute for International Economics. Available online: https://www.piie.com/research/piie-charts/china-becoming-less-dependent-american-farmers-us-export- dependence-china

Brown, M. 2022. “Congressional Considerations on Amending AFIDA.” University of Arkansas National Agricultural Law Center. Available online: https://nationalaglawcenter.org/congressional-considerations-on- amending-afida/

Hyatt, J. 2021, August 9. “Why a Secretive Chinese Billionaire Bought 140,000 Acres of Land in Texas.” Forbes. Available online: https://www.forbes.com/sites/johnhyatt/2021/08/09/why-a-secretive-chinese-billionaire-bought-140000-acres- of-land-in-texas/?sh=68f30e9d78c3

National Agricultural Law Center. 2023a. Foreign Ownership of Agricultural Land: FAQs and Resource Library. Fayetteville, AR: University of Arkansas. Available online: https://nationalaglawcenter.org/foreign-investments-in-ag/

———. 2023b. Corporate Farming Laws. Fayetteville, AR: University of Arkansas. Available online: https://nationalaglawcenter.org/research-by-topic/corporate-farming-laws/

U.S. Department of Agriculture. 2021. “Foreign Holdings of U.S. Agricultural Land through December 31, 2020.” Washington DC: USDA Farm Service Agency and the Farm Production and Conservation Business Center. Available online: http://www.fsa.usda.gov/programs-and-services/economic-and-policy-analysis/afida/index

Zhang, W. 2021. “The Case for Healthy U.S.-China Agricultural Trade Relations despite Deglobalization Pressures.” Applied Economic Perspectives and Policy 43(1):225–247.