Avocado, a tropical fruit originating in Mexico, has become one of the most popular “superfoods” in the world. From authentic to inventive, savory to sweet, avocado is the main ingredient of many popular dishes, including guacamole, avocado toast, California rolls, avocado smoothies, and more. As consumers find more creative ways to eat them, avocados are becoming more versatile and salable. While consumers greatly enjoy the creamy texture and delicious taste of avocados, their health benefits are another important factor driving the purchases of the fruit. The nutritional value and other health benefits of avocado have led to it being classified as a superfood, increasing its marketability. In the United States, the largest avocado consuming country, over 70% of consumers consider avocado to be an exceptional source of nutrients (Hass Avocado Board, 2021). Believing avocados are healthy and knowing avocadoes contain good fats are U.S. consumers’ top two reasons for purchasing them (Hass Avocado Board, 2021). In Asia, a region with over 4 billion people (approximately 60% of the world’s population), the rising awareness of a healthy diet and lifestyle is one of the main drivers of growth in the avocado market (IndexBox, 2021). A U.S. Department of Agriculture (USDA) report also showed that consumers seeking healthy diets and food are the main driver of the increasing popularity and consumption of avocados in South Africa (USDA, 2021).

Even though avocados are high in calories, with about 80% of these calories coming from fats, most of these fats are monounsaturated fatty acids, a heart-healthy fat that helps support cardiovascular health (Dreher and Davenport, 2013). Avocados are also one of the best sources of potassium, an essential mineral that maintains normal blood pressure and helps muscles to contract (Harvard T.H. Chan School of Public Health, 2022). In addition, a normal-sized, 5-ounce avocado provides 40% of the recommended adult daily value for fibers, which can help reduce the risk of cardiovascular diseases, type 2 diabetes, and obesity (Dreher, Cheng,and Ford, 2021). Finally, avocados are rich in otherimportant nutrients, including vitamins B6, C, and E;magnesium; and folate, which are often lacking in daily diets (Kubala, 2021).

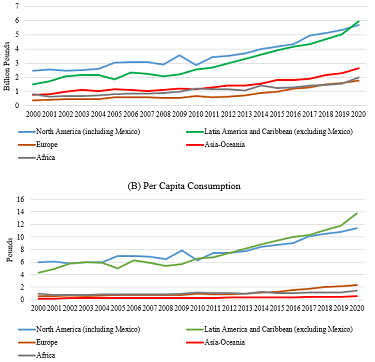

In 2020, avocado consumption from the Americas (North America and LAC) made up almost two-thirds of world consumption, while consumption from the rest of the world (Europe, Asia-Oceania, and Africa) accounted for the remaining 36% (Figure 2). As individuals become increasingly health-conscious, worldwide avocado consumption has tripled from 6 billion pounds in 2000 to 18 billion pounds in 2020 (FAO, 2022). Over the last two decades, avocado consumption has experienced significant growth across all continents, (Figure 1A). In North America (including Mexico) and Africa, avocado consumption has more than doubled, while in Asia-Oceania and Latin America and the Caribbean (excluding Mexico), it has more than tripled. Avocado consumption in Europe has increased more than fourfold. Africa has experienced a notable 53% increase in per capita avocado consumption. Rapid population growth of 65% in Africa over the past two decades explains why a more than doubling in total avocado consumption “only” resulted in a 53% increase in per capita consumption.

This accelerating growth in avocado consumption reflects consumers’ changing food preferences. The upward consumption trend has likely not yet reached its peak. For instance, on a per capita basis, 2020 avocado consumption in the Americas (North America and LAC) is multiple times higher than that in other continents (Europe, Asia-Oceania, and Africa) (Figure 1B). If people from outside the Americas start to eat avocados close to anything like the rate at which the fruit is eaten in the Americas, worldwide consumption would continue to rise rapidly. In fact, the Organization for Economic Co-operation and Development (OECD) predicts that worldwide avocado production will reach 26 billion pounds by 2030, a 50% increase in ten years, making it the fastest growing tropical fruit for this decade (OECD and FAO, 2021).

To better understand this rapidly growing market and identify potential business opportunities, this article focuses on the consumption side of the avocado story, discussing the booming consumption patterns in the major consuming countries around the world, continent by continent. We explore the factors contributing to the booming consumption trends by country. In this study, consumption is calculated as domestic production plus imports minus exports of fresh avocados. This measurement overestimates fresh avocado consumption of the exporting countries, as these calculations may include some avocados that are processed and later exported under a different category. While this potential drawback may prevent us from presenting precise consumption figures for a few avocado exporting countries, the trends of fresh avocado consumption in the non-exporting countries are still valid and representative. Finally, we discuss the significant water usage linked to avocado production and explore how scientists and agricultural economists can help identify solutions to address this concern.

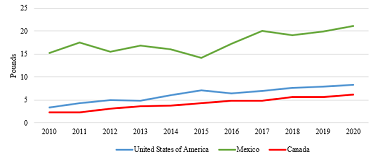

North America (including Mexico)North America—including the United States, Canada, and Mexico—is one of the most “avocado-demanding” regions in the world. Nearly one-third of avocados produced on the planet were consumed by North Americans in 2020 (Figure 2). Among the three North American countries, the United States led the world, with a total consumption of 2.7 billion pounds in 2020. Mexico was second, with only a slight difference of 6 million pounds from the United States, even though Mexico has less than half the population of the United States (FAO, 2022). Despite a much smaller population, Canadians still consumed over 235 million pounds of avocados in 2020. Collectively, total North America avocado consumption nearly doubled in ten years and reached its historical high of nearly 5.7 billion pounds in 2020. Figure 3 shows that the avocado consumption trends of all three countries grew steadily in the past decade, doubling in both the United States (an 141% increase, from 3.4 pounds to 8.2 pounds) and Canada (170%, from 2.3 pounds to 6.2 pounds) and growing by 39% in Mexico (39%, from 15.2 pounds to 21.1 pounds).

The burgeoning consumption trends of avocados in both the United States and Canada can be attributed to two significant factors: the widespread belief that avocados are a healthy food choice and the increasing availability and affordability of the fruit. The North America Free Trade Agreement, which stimulated avocado and other fresh produce exports from Mexico to the United States and Canada, further enhanced avocado availability in the latter two countries (USDA, 2020; Huang, Guan, and Hammami, 2022). In Mexico, avocados are a key ingredient in many traditional cuisines, and they have been an important component in Mexican diets for ages. This may explain why per capita consumption in Mexico is high. Perhaps due to the already high per capita consumption, the growth rate in the last decade has been moderate. Overall, the total and per capita avocado consumption trends in all three countries have shown steady growth in the past decade, and the North America avocado market is expected to continue expanding in the years to come (OECD and FAO, 2021).

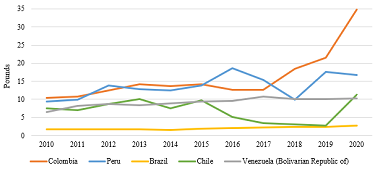

We group all Central and South American countries as defined by the United Nations Food and Agriculture Organization (FAO), except Mexico, and all FAO-defined Caribbean countries and territories into Latin America and the Caribbean (LAC). In 2020, LAC consumed one-third of the world’s avocados (Figure 2), with over half of this consumption coming from the top five avocado consumers in the region: Colombia (30%), Brazil (10%), Peru (9%), Venezuela (5%), and Chile (4%) (FAO, 2022). It is worth noting that the Dominican Republic was the second largest avocado producing country in LAC in 2020, but it did not report its 2010–2020 avocado import/export data to FAO. For this reason, we are not able to calculate avocado consumption in Dominican Republic nor include such information in this article. Avocado consumption in all the top avocado consumer markets of LAC has grown significantly from 2010 to 2020. It has tripled in Colombia, doubled in Peru, and increased by 72% in Brazil, 66% in Chile, and 59% in Venezuela (FAO, 2022). Collectively, the total LAC avocado consumption doubled between 2010 and 2020, reaching almost 6 billion pounds in 2020 (Figure 1A). On a per capita basis, the consumption of each of the five countries was 34.7 pounds (Colombia), 16.7 pounds (Peru), 11.2 pounds (Chile), 10.2 pounds (Venezuela), and 2.7 pounds (Brazil) (Figure 4). The per capita consumption grew by 232% (Colombia), 76% (Peru), 48% (Chile), 59% (Venezuela), and 58% (Brazil) over the past decade. Overall, the total and per capita avocado consumption in these LAC markets has shown strong upward trends over the past decade.

Avocados are a principal component of many Latin American dishes, especially in Central America. This reality is due to avocados being native to Mesoamerica, having been cultivated in this region for over 10,000 years and considered one of the gifts of the gods in Aztec and Mayan cultures (Ayala Silva and Ledesma, 2014). The Inca empire brought the fruit to South America in the 1500s, before the Spanish conquest, where it became a popular component of the diet farther south, even into modern day Chile (Irazabal, 2001). While LAC has always consumed large amounts of avocados in relation to the rest of the world, recent growth in avocado consumption in LAC follows the trends in North America and Europe with greater recognition of the health benefits of the crop, worldwide popularity of dishes that use avocados (such as avocado toast), and a growing middle class that can afford to purchase higher value products. Although the middle class in LAC was adversely affected by the pandemic, they made up a majority of the population for the first time in 2018 and can afford to purchase higher value food products like avocados (Andrango and Blare, 2021; Jaramillo, Canuto, and Zhang, 2021). Because of its centrality to many dishes in LAC, avocado may be considered almost a staple ingredient in the region, as evidenced by Venezuela, where consumption continued to grow even as the country faced severe economic challenges.

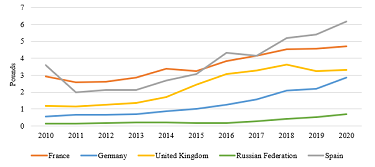

Europe is an emerging market for avocados, but most European countries do not domestically produce avocados and rely heavily on imports to meet their demand. Due to rapidly growing demand, avocado imports in Europe continued to grow. Consumption nearly tripled over the past decade, reaching 1.7 billion pounds in 2020, accounting for 10% of world consumption. The top five avocado consumer markets in Europe are France (317 million pounds), Spain (292 million pounds), Germany (238 million pounds), the United Kingdom (223 million pounds), and Russia (104 million pounds) (FAO, 2022). These five countries combined accounted for over 60% of European avocado consumption in 2020. Over the past decade, total consumption rose fivefold in Germany and Russia, nearly tripled in the United Kingdom, and increased by 75% in Spain and 67% in France. On a per capita basis, over the past decade, avocado consumption in these five European countries grew by 60% (France), 210% (Spain), 404% (Germany), 177% (United Kingdom), and 446% (Russia). In 2020, per capita consumption of avocados in these countries was 4.7 pounds (France), 6.2 pounds (Spain), 2.9 pounds (Germany), 3.3 pounds (United Kingdom), and 0.7 pounds (Russia) (Figure 5).

In France, the increasing popularity of ready-to-eat meals and derived avocado products has fueled the growth in avocado consumption in recent years (CBI, 2023). Similarly, in the United Kingdom, the surge in avocado consumption is driven by lifestyle changes, particularly the growing interest in plant-based diets (CBI, 2023). In Germany and Spain, the growing consumption is largely due to increased promotion efforts by major producers and retailers like Trops (Spain) and Aldi (Germany) (Fresh Plaza, 2021). Avocado consumption is also on the rise in Russia as the urban population increasingly prioritizes nutrition and recognizes the health benefits of avocados (Seymenler, 2023). The demand for avocados in the European market is expected to remain strong in growth in the coming years (OECD and FAO, 2021), as the trend of healthy eating and vegetarianism gains more popularity and consumers look for more diverse options in their diets.

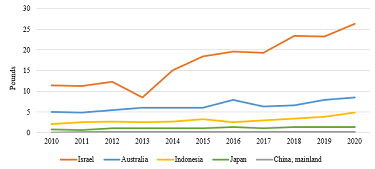

Asia-Oceania, home to over 60% of the world’s population, consumed approximately 2.6 billion pounds of avocados in 2020, accounting for 15% of the world’s consumption (Figure 2). Like the rest of the world, avocado consumption in Asia-Oceania has increased rapidly, doubling from 2010 to 2020, and continues to grow. It doubled in every country except China, where consumption increased by 40%. The top consumer market of avocados in the region is Indonesia. In 2020, Indonesia alone accounted for about half of Asia-Oceania consumption, followed by China (12%), Israel (9%), Australia (8%), and Japan (8%) (FAO, 2022). On a per capita basis, avocado consumption across these countries increased by 141% (Indonesia), 131% (Israel), 117% (Japan), 71% (Australia), and 35% (China) over the period of 2010–2020. In 2020, per capita avocado consumption reached 26.3 pounds (Israel), 8.6 pounds (Australia), 4.9 pounds (Indonesia), 1.4 pounds (Japan), and 0.2 pounds (China) (Figure 6).In Israel and Australia, a significant portion of avocados is exported. With the expansion of avocado planting areas and increased production within the two countries, the growing availability of avocados has also fostered domestic consumption (Imbert, 2018; Fresh Plaza, 2022). In Indonesia, avocados are marketed as an exotic food. With the country's robust economic growth and growing influx of foreign tourists, avocado consumption has surged significantly in recent years (Freshela, 2023a). In contrast, avocados are no longer considered exotic in Japan, but the rising demand for high-quality, nutritious food continues to drive an increase in consumption (Freshela, 2023b). Recently, more avocado exporters—such as Kenya—have gained market access in China, so both the availability and consumption areexpected to rise (USDA, 2022). As the popularity of Western cuisines and the awareness of healthy diets and lifestyles continue to rise among Asian consumers, avocado consumption should continue to increase steadily in the years to come (IndexBox, 2021).

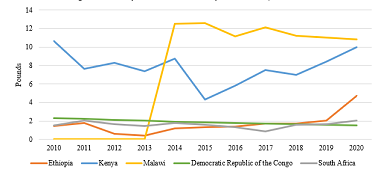

In Africa, total avocado consumption grew from 1.2 billion pounds in 2011 to 2.0 billion pounds in 2020, a 72% increase in ten years. This growth is more moderate than in other emerging avocado markets, such as Europe and Asia-Oceania, where avocado consumption more than doubled over the same period (Figure 1A). In 2020, the top avocado consuming African countries were Kenya and Ethiopia, each accounting for 27% of total African consumption, followed by Malawi (10%), the Democratic Republic of the Congo (7%), and South Africa (6%) (FAO, 2022). Among these countries, the Democratic Republic of the Congo is the only country that experienced a decrease in total consumption over the past decade, with consumption decreasing from 147 million pounds in 2010 to 138 million pounds in 2020 (a 6% decrease) (FAO, 2022). In contrast, the total consumption grew rapidly across the other four African countries from 2010 to 2020. Malawian consumption increased from 0 to over 206 million pounds; Ethiopian consumption more than tripled from 161 million pounds to 541 million pounds; Kenyan consumption increased by 20% from 446 million pounds to 538 million pounds; and South African consumption increased by 14% from 105 million pounds to 120 million pounds (FAO, 2022). On a per capita basis, avocado consumption in these markets was 10.8 pounds (Malawi), 10.0 pounds (Kenya), 4.7 pounds (Ethiopia), 2.0 pounds (South Africa), and 1.5 pounds (Democratic Republic of the Congo) in 2020 (Figure 7). Due to rapidpopulation growth among African countries, increasingtotal consumption may not always result in a positive change in per capita consumption. For instance, per capita consumption in Kenya and the Democratic Republic of the Congo decreased by 6% and 33%, respectively, from 2010 to 2020. Nonetheless, per capita consumption in Ethiopia and South Africa in the same timeframe grew by 215% and 36%, respectively, and per capita consumption in Malawi skyrocketed from 0 pounds to 10.8 pounds.

The African avocado industry owes much of its flourishing demand to the active participation of organizations and associations representing avocado producers. One such example is the South African Avocado Growers Association, which works to promote the consumption of avocados across African countries by educating consumers about their health benefits and advocating for the purchase of locally sourced produce (Fresh Plaza, 2023). Like consumers in the rest of the world, the desire for a healthy diet is another main force driving the increasing popularity of avocados in African consumer markets (USDA, 2021).

Global consumption of avocados has boomed over the past two decades and is expected to continue to grow. This trend, coupled with higher prices, has driven global production from 6 billion pounds in 2000 to nearly 18 billion pounds in 2020, almost tripling within two decades (FAO, 2022). When examining per capita consumption across the continents (Figure 1B), a significant disparity exists between per capita consumption in the Americas and per capita consumption in Europe, Asia-Oceania, and Africa. This gap indicates that the increasing global trend in avocado consumption has not yet reached its peak. If more consumers outside the Americas increasetheir avocado consumption, the gap will gradually decrease, and global consumption would continue to surge in the coming years. To meet the rapidly growing market demand, avocado production across major avocado producing countries—such as Mexico, Colombia, Peru, and Indonesia—has significantly increased over the past two decades (FAO, 2022).

Given the significant increases in global demand for avocados and avocado acreage worldwide a substantial surge in avocado supply is anticipated over the next decade. The growth rates of global avocado supply and demand will determine the landscape of the market in the coming years, with various potential equilibrium scenarios. If demand continues to outstrip the supply growth, avocado prices will keep increasing steadily. In contrast, if the rate of supply growth outpaces that of demand, avocado prices will decrease. In this situation, the avocado industry will require additional marketing efforts or new markets to absorb the upcoming surplus supply. With its large population and comparatively lower per capita avocado consumption, Asia undoubtedly represents a vast untapped market for avocados. As an illustration, avocados are typically found only in upscale supermarkets located in major cities in China (USDA, 2022). Expanding the accessibility of avocados to non-major cities in China could lead to a significant boost in demand and consumption. In addition, alternative marketing strategies could be implemented, such as highlighting the health advantages of avocados andintroducing new culinary approaches that cater to consumers' taste preferences in regions whereavocados have not traditionally been a common ingredient in local cuisine.

While consumers enjoy this creamy and healthy superfruit, and growers’ profit from its increasing demand, it is important to address significant challenges associated with the intensive water demand of avocado crops during their growing periods. For instance, growing a single avocado requires, on average, around 70 liters (18.5 gallons) of surface or fresh groundwater, excluding rainfall (Lazzaris, 2020). In contrast, tomatoes and oranges only require about 5 and 22 liters (1.3 and 5.8 gallons) per fruit, respectively (Voller, 2017). Agricultural and horticultural researchers and scientists have made significant efforts in avocado-related water-saving research, including the development of efficient irrigation systems and salinity management techniques (Chartzoulakis et al., 2002; Crowley, 2008; Reints, Dinar, and Crowley, 2020; Guillermo et al., 2021). Agricultural economists can also contribute to this research by exploring optimal strategies for redistributing crop mixes, which involve incorporating avocados and crops with lower water requirements, to make better use of varying climates and rainfall patterns. By making these efforts, it should be possible to keep up with the growing worldwide avocado demand for avocados while also addressing water concerns, ensuring that more people get to put this superfood on their plates.

Andrango, G., and T. Blare. 2021. “Theme Overview: Functional Foods: Fad or Path to Prosperity?" Choices 35(4).

Ayala Silva, T., and N. Ledesma. 2014. “Avocado History, Biodiversity and Production.” In D. Nandwani, ed. Sustainable Horticultural Systems: Issues, Technology and Innovation. Cham, Switzerland: Springer, pp. 157–205.

Chartzoulakis, K.S., A.A. Patakas, G. Kofidis, A.M. Bosabalidis, and A. Nastou. 2002. “Water Stress Affects Leaf Anatomy, Gas Exchange, Water Relations and Growth of Two Avocado Cultivars.” Scientia Horticulturae 95(1-2): 39–50.

Crowley, D. 2008. “Salinity Management in Avocado Orchards.” California Avocado Society Yearbook 91:83–104.

Dreher, M.L., F.W. Cheng, and N.A. Ford. 2021. “A Comprehensive Review of Hass Avocado Clinical Trials, Observational Studies, and Biological Mechanisms.” Nutrients 13(12):4376.

Dreher, M.L., and A.J. Davenport. 2013. “Hass Avocado Composition and Potential Health Effects.” Critical Reviews in Food Science and Nutrition 53(7):738–750.

Food and Agriculture Organization of the United Nations (FAO). 2022. FAOSTAT: Trade Indices. Available online: https://www.fao.org/faostat/en/#data/TI [Accessed November 2022]

Fresh Plaza. 2021. “Trops Launches Ambitious Promotional Campaign to Boost Avocado Consumption in Spain.” Available online: https://www.freshplaza.com/europe/article/9301280/trops-launches-ambitious-promotional- campaign-to-boost-avocado-consumption-in-spain/

———. 2022. “Australian Avocado Production and Consumption on the Rise According to Latest Statistics.” Available online: https://www.freshplaza.com/europe/article/9479393/australian-avocado-production-and- consumption-on-the-rise-according-to-latest-statistics/

———. 2023. “Intelligent Marketing Will Drive Avocado Consumption in South Africa.” Available online: https://www.freshplaza.com/europe/article/9517144/intelligent-marketing-will-drive-avocado-consumption-in- south-africa/

Freshela. 2023a. “The Complete Guide to Importing Avocado into Indonesia 2023.” Available online: https://www.freshelaexporters.com/avocado/imports/indonesia

———. 2023b. “The Complete Guide to Importing Avocado into Japan 2023.” Available online: https://www.freshelaexporters.com/avocado/imports/japan

Guillermo, M.O., Z. Adela, M. Antonio, N.A. Olivier, N. van den Berg, E. Palomo-Ríos, M.F. Elsa, and P. Clara. 2021. “Physiological and Molecular Responses of ‘Dusa’ Avocado Rootstock to Water Stress: Insights for Drought Adaptation.” Plants 10(10):2077.

Harvard T.H. Chan School of Public Health. 2022. “Potassium.” The Nutrition Source. Available online: https://www.hsph.harvard.edu/nutritionsource/potassium/

Hass Avocado Board. 2021. Avocados Tracking 2021- General Sample Segment Report. Report prepared by Cooper Roberts Research. Available online: https://hassavocadoboard.com/wp-content/uploads/hab-research-insights-consumer-market-segment-report-2021.pdf

Huang, K.M., Z. Guan, and A. Hammami. 2022. “The US Fresh Fruit and Vegetable Industry: An Overview of Production and Trade.” Agriculture 12(10):1719.

Imbert, E. 2018. “The Avocado in Israel: Producer Country File.” FruiTrop Magazine 259:74–79.

IndexBox. 2021. “The Asian-Pacific Avocado Market Peaks near $1.4B.” Global Trade. Available online: https://www.globaltrademag.com/the-asian-pacific-avocado-market-peaks-near-1-4b/

Irazabal, F.G. 2001. “History and Development of the Avocado in Chile.” California Avocado Society Yearbook 85: 113– 128.

Jaramillo, C.F., O. Canuto, and P. Zhang. 2021. “Building an Inclusive Recovery in Latin America and the Caribbean.” Project Syndicate. Available online: https://www.project-syndicate.org/commentary/ensuring-inclusive-latin-america-economic-recovery-by-carlos-felipe-jaramillo-et-al-2021-10?barrier=accesspaylog

Kubala, J. 2021. “7 Potential Health Benefits of Avocado.” Healthline: Nutrition. Available online: https://www.healthline.com/nutrition/avocado-nutrition

Lazzaris, S. 2020. “Avocado: The Cost of Production.” Food Unfolded. Available online: https://www.foodunfolded.com/article/avocado-the-cost-of-production

Netherlands Ministry of Foreign Affairs Centre for the Promotion of Imports from Developing Countries (CBI). 2023. “The European Market Potential for Avocados.” Available online: https://www.cbi.eu/marketinformation/fresh-fruit-vegetables/avocados/market-potential

Organisation for Economic Co-operation Development (OECD), and Food and Agriculture Organization of the United Nations (FAO). 2021. “OECD-FAO Agricultural Outlook 2021-2030.” OECD Publishing.

Reints, J., A. Dinar, and D. Crowley. 2020. “Dealing with Water Scarcity and Salinity: Adoption of Water Efficient Technologies and Management Practices by California Avocado Growers.” Sustainability 12(9):3555.

Seymenler, E. 2023. “Imports of Fresh Avocado to Russia.” Latmek Exporters. Available online: https://latmekexporters.com/imports-of-fresh-avocado-to-russia-avocado-in-russia/

U.S. Department of Agriculture. 2020. “Avocado Annual: Mexico 2020.” Washington, DC: USDA, Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Avocado%20Annual_Mexico%20City_Mexico_12-01-2020

———. 2021. “Strong Domestic and Export Demand Drives Growth in South African Avocado Plantings.” USDA Foreign Agricultural Service Report SF2021-0012. Washington, DC: USDA, Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Strong Domestic and Export Demand Drives Growth in South African Avocado Plantings_Pretoria_South Africa -Republic of_02-24-2021 - :~:text=Post estimates that the export,19 to logistics and demand

———. 2022. “2022 Fresh Avocado Report: China.” Washington, DC: USDA, Foreign Agricultural Service. Available online: https://www.fas.usda.gov/data/china-2022-fresh-avocado-report

Voller, L. 2017. “Avocados and Stolen Water.” Danwatch. Available online: https://old.danwatch.dk/en/undersogelse/avocados-and-stolen-water/

World Bank. 2022. “Population.” World Bank Open Data.