Agricultural trade has played an important role in supporting U.S. rural and urban communities, boosting farm incomes, and generating employment from trade-related economic activities. While U.S. agricultural production is mostly consumed domestically, exports make up approximately 20% of total U.S. produced agricultural and food products, in value (USDA, 2020a). However, several key commodities—notably grains, oilseeds, and cotton—rely heavily on exports. For example, more than 80% of cotton and over 40% of soybeans produced in the United States are exported (USDA, 2021a). Consequently, improving market access abroad has been a priority within the agricultural industry.

In 2021, five single-country markets—China, Mexico, Canada, Japan, and South Korea—made up 60.6% ($107.1 billion) of total U.S. agricultural exports (USDA, 2022). In addition to our close North American neighbors, the United States has had a strong presence in Asia’s agricultural markets. The United States has especially benefited from being a market leader in then-growing markets in East Asia such as Korea, Japan, and Taiwan, all of which have become top agricultural importers in the world. In addition, China’s accession to the World Trade Organization (WTO) opened one of the biggest markets for agricultural trade, which allowed U.S. farmers and producers to enjoy considerable gains (Gale, Hansen, and Jewison, 2015; USDA, 2020b). In recent years, however, exports to these top Asian markets have become not only increasingly competitive but also less likely to see significant market growth (Regmi, 2021; USDA, 2020b). These East Asian markets have matured and become saturated, and trading conditions have become less advantageous for the United States.

Increased competition, market saturation, and the threat of export fluctuations due to relatively high dependence on these few markets call for agricultural exports to diversify and expand market access to other regions and partners (Regmi, 2021; Regmi et al., 2021). This article explores U.S. agricultural exports to ASEAN countries (often interchangeably referred to as SEA) and makes a case as to why the ASEAN market is a good candidate for expanding U.S agricultural exports. We show that ASEAN is already a major partner for U.S. agricultural exports, but ASEAN is considered to have higher growth potential than other top U.S. export destinations. We also highlight ASEAN countries with surging agricultural imports and high growth potential for U.S. agricultural exports.

Limited market diversification can be quite devastating when trading relationships with major partners are compromised due to trade policy differences. This was evident when, in 2017, the United States was hit by retaliatory tariffs from trading partners who levied additional tariffs on over 800 U.S. agricultural products and nearly $30 billion in response to U.S. Section 232 and Section 301 actions, making U.S. exports less competitive (Grant et al., 2019). Section 232 of the Trade Expansion Act of 1962 allows the President to adjust imports if the Department of Commerce finds that certain products are imported in such quantities or under such circumstances as to threaten to impair U.S. national security. Section 301 of the Trade Act of 1974 allows the United States Trade Representative (USTR) to suspend trade agreement concessions or impose import restrictions if it determines a U.S. trading partner is violating trade agreement commitments or engaging in discriminatory or unreasonable practices that burden or restrict U.S. commerce. The Section 232 tariffs were applied to aluminum and steel as of June 1, 2018, while the Section 301 penalty tariffs were applied between July and September 2018 to a range of Chinese imports.

China’s retaliatory tariffs on U.S. agricultural products were particularly damaging. In 2018, agricultural exports to China declined 52.7% from the previous year, dropping from $19.6 billion in 2017 to $9.2 billion in 2018. Soybean exports fell especially sharply, from $12.2 billion in 2017 to $3.1 billion in 2018, a 74.5% decrease (USDA, 2022). Although the China Phase 1 agreement resulted in a recovery of U.S. exports to China in 2020 and 2021, soybean exports were less than expected as China fell short of its purchase targets (Muhammad, Smith, and Grant, 2021). Trading shifts based on tariff disadvantages associated with imports of U.S. products in favor of some of the U.S. competitors suggest the need for agricultural policies that minimize market risks for U.S. exporters.

The impact of U.S. trade loss and decreased market share from the U.S.-China trade war resulted in placing greater emphasis on increasing market diversification to reduce market risks and unpredictability for exporters. In 2018, during the height of the trade war, Ted McKinney (then the Undersecretary for Trade and Foreign Agricultural Affairs at the USDA) expressed the need for expanding the markets for U.S. agricultural exports to minimize the recurrence of major losses in trade with the loss of one market. Southeast Asia was identified as a potential market for this expansion and McKinney led a trade mission to promote U.S. agriculture. As part of the renewed emphasis on market diversification, trade expansion to Africa came into focus. Formal trade agreement negotiations between the United States and Kenya began in 2020. More recently, current USDA Secretary Tom Vilsack noted, “We need to be less reliant on one or two countries and more reliant on a number of countries,” signaling that agricultural policy makers continue to look for countries and regions with high export potential for U.S. agricultural products (Harker, 2021).

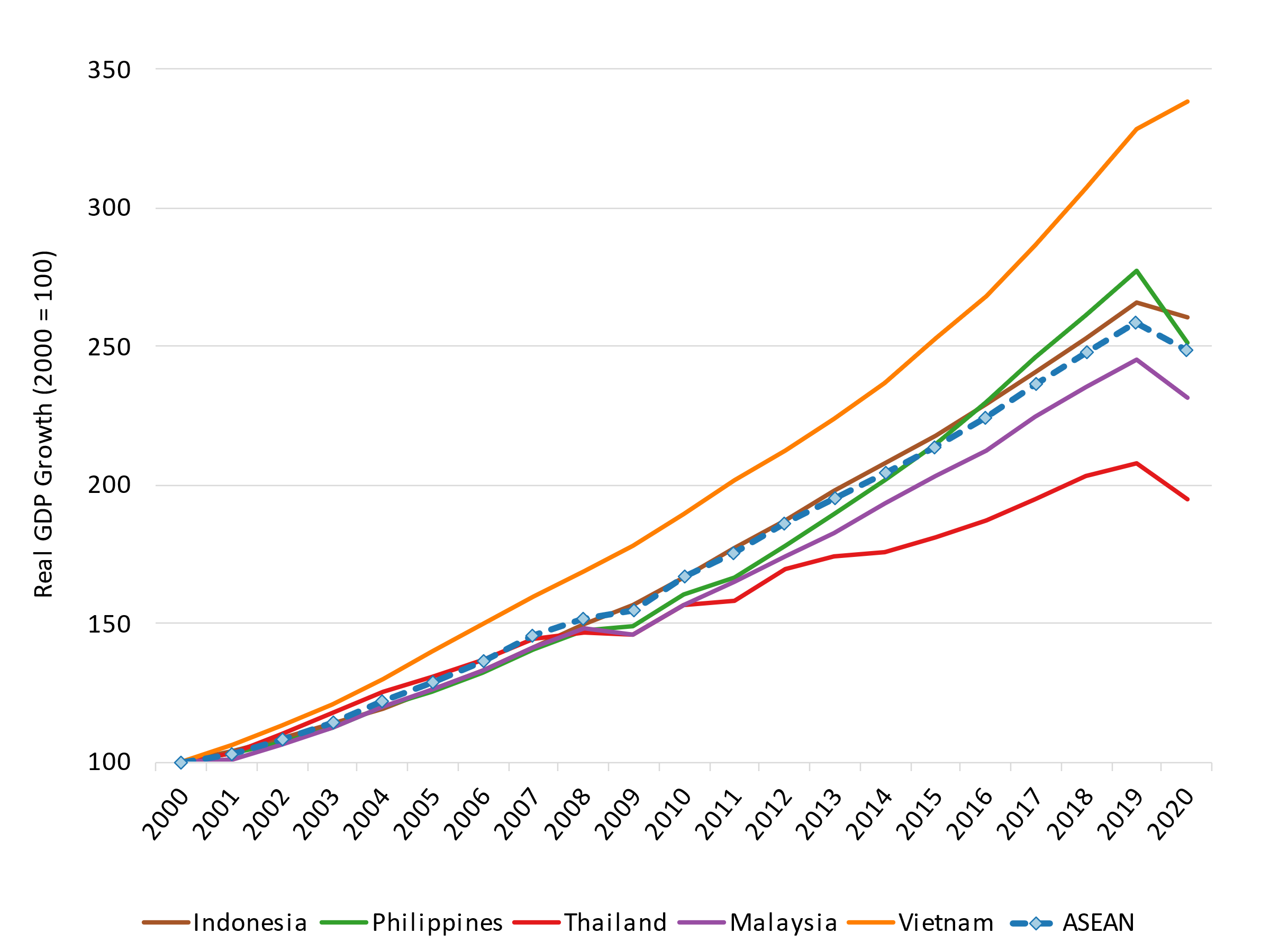

Source: USDA ERS International Macroeconomic Dataset

Ten Southeast Asian member states—Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam—make up the Association of Southeast Asian Nations (ASEAN). Powered by tourism, manufacturing, and investment in infrastructure, ASEAN has been one of the fastest-growing economic blocs in the world (HV, Thompson, and Tonby, 2014). While the Asia/Pacific region continues to show relatively strong economic performance, much of the regional growth, outside of China, is coming from emerging markets, notably ASEAN countries. The International Monetary Fund (IMF) projects that, in 2026, the Southeast Asia region, aggregated as ASEAN countries and Timor-Leste, will post a 4.9% real gross domestic product (GDP) growth, the second highest regional growth in the world, behind only South Asia. Figure 1 shows that ASEAN’s real GDP has increased steadily and has more than doubled in the past 2 decades. Top economies in ASEAN, especially Vietnam and the Philippines, have shown robust economic growth.

Urbanization and nonfarm income levels are on the rise in ASEAN countries. As these countries aspire to replicate success stories of high-performing Asian economies, notably China, they have the potential to continue robust economic growth (Vu, 2020). Given China’s rising labor costs and continued trade tensions with the United States, global supply chain actors have looked to ASEAN as alternative production sites (Pananond, 2019). Southeast Asia has become a viable target, helping propel a rise in nonfarm income levels and urbanization. As a result, ASEAN countries’ reliance on domestic agriculture for their primary source of GDP growth has diminished. While major ASEAN economies such as Indonesia and Vietnam still have sizable agricultural sectors contributing to their overall GDP, ASEAN as a group is transitioning from agrarian-focused economies to services- and industry-focused economies (Anderson, 2010; Le and Lam, 2021).

The transition to service- and industry-focused economies has further strengthened urbanization, resulting in increased migration to urban areas for better economic opportunities. With rising population and incomes in urban centers, diets are changing: People consume more protein products and processed foods (Hawkes, Harris, and Gillespie, 2017). International dining options are also popular in urban centers, and consumers with changing taste preferences can conveniently try nontraditional food products. As a result, modern retailers and supermarkets face the issue of securing year-round supplies of food items—both in quantity and variety. Domestic food supply is affected by seasonality and limited production—rising urbanization and industrialization are adding pressure to an already lack of cropland and pasture, especially producing nongrain foods such as meat and dairy products, to keep with up with rising food demand (OECD and FAO, 2017). Consequently, ASEAN countries have increasingly looked to agricultural trade to satisfy the growing domestic demand for food (USDA, 2018).

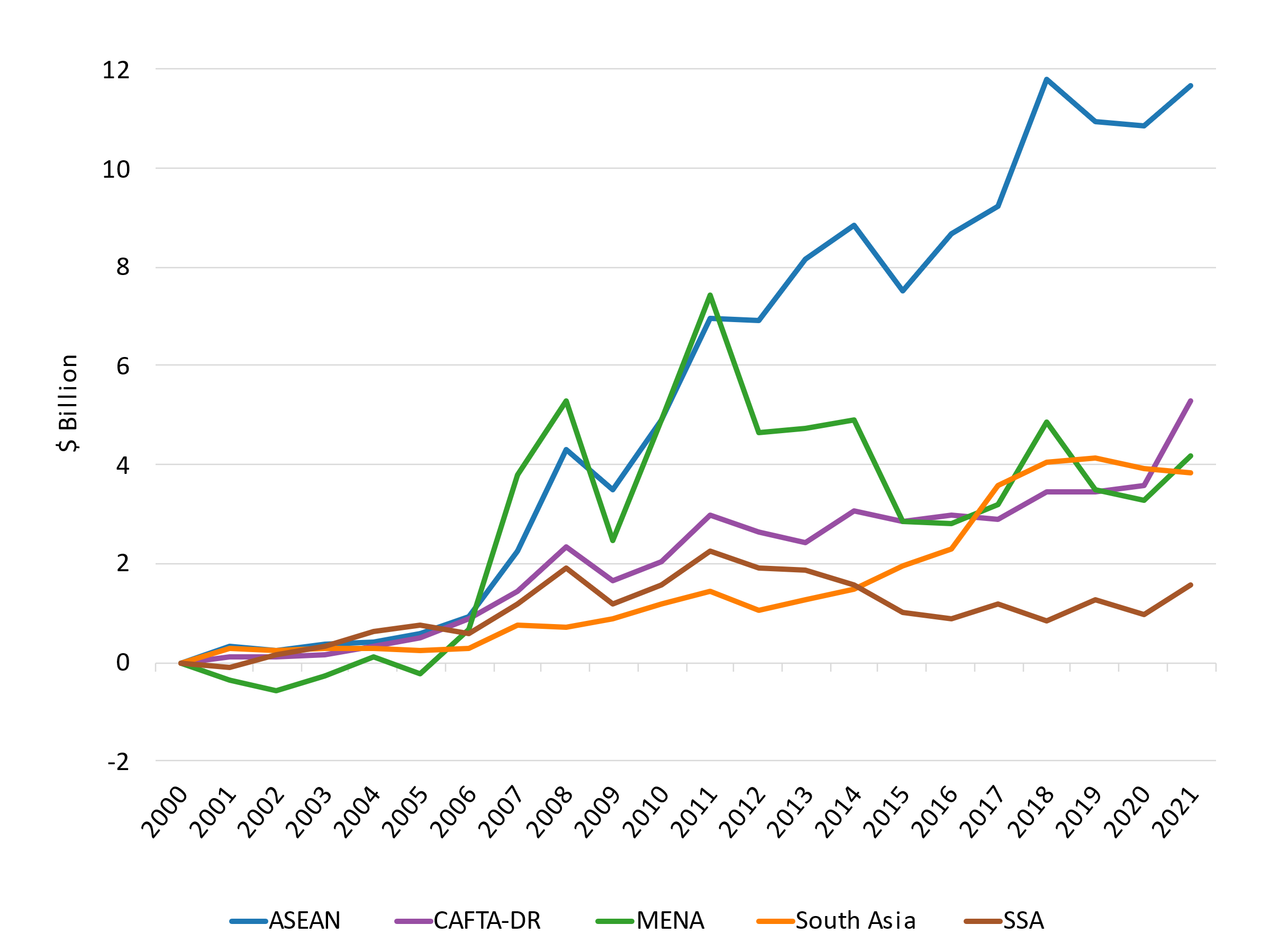

Note: CAFTA-DR = Dominican Republic-Central America Free

Trade Agreement; MENA = Middle East and North Africa;

SSA = Sub-Saharan Africa

Source: USDA FAS Global Agricultural Trade System (GATS)

Over the last 2 decades, U.S. agricultural exports to ASEAN have risen substantially, growing from $2.7 billion in 2000 to $14.3 billion in 2021. As a single market, ASEAN is the United States’ fourth biggest export market, behind only China, Canada, and Mexico, surpassing the European Union (EU) and Japan during the last decade. U.S. agricultural exports to ASEAN also stand out among other regional partners with growth potential. Over the last decade, gains in U.S. agricultural exports to ASEAN were significantly higher than gains in other regional markets, such as the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) countries, the Middle East and North Africa (MENA), South Asia, and Sub-Saharan Africa (SSA). Figure 2 shows changes in U.S. agricultural exports to selected regions since 2000.

ASEAN is already a significant market for several U.S. agricultural products. For example, the United States exported $5.7 billion of cotton globally, of which $1.4 billion (25.4% export share) was exported to ASEAN (USDA, 2022). Other bulk and intermediate products with sizable export shares to ASEAN include wheat (18.3%), distillers grains (25.4%), and soybean meal (23.5%), products for which the United States has a comparative advantage in producing and where the potential to expand exports remains high. In addition to exports that support ASEAN’s domestic feed and food processing sectors, U.S. exports are also seeing growth in value-added, consumer-oriented products as well. The United States exported $4.6 billion of consumer-oriented products in 2021, up from $3.2 billion in 2011. Notable products include dairy products, food preparations, and meat products, all with high growth potential as urban households consume more protein products and prioritize convenience—processed foods and dining out—over cooking meals at home.

The United States is the second biggest agricultural supplier to ASEAN after China. Other competitors include the EU, Thailand, Brazil, Indonesia, and Australia. Interestingly, Australia and Indonesia, two main intra-regional suppliers to ASEAN, have lost market share over the last decade. This suggests that geographic proximity, although an important advantage for regional partners, is not the only deciding factor regarding export performance. Factors such as commodity-level economic factors and consumer preferences also have an impact on export competitiveness.

With rising income and strong GDP growth, Vietnam has continued to increase imports at a significant rate. In 2010, Vietnam imported $10.2 billion of agricultural products. Within 5 years, Vietnam doubled its agricultural imports levels and reached $29.8 billion in 2018. Although there has been a drop off in 2019 and 2020, Vietnam’s agricultural imports grew at an annual average rate of 9.9% over the past decade.

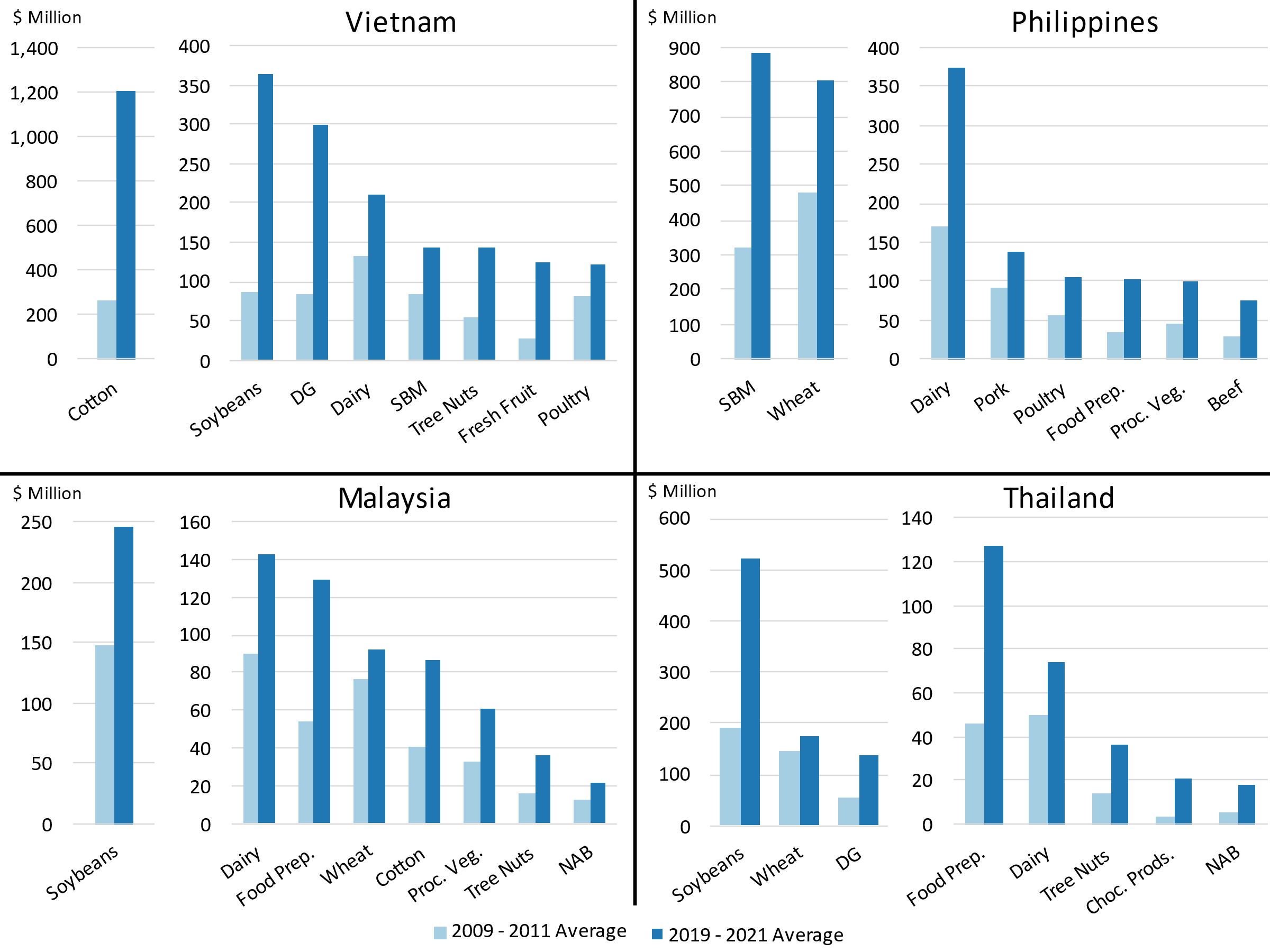

Note: 3-year averages from 2009 to 2011, and from 2019 to2021.

DG = Distillers Grains; Dairy = Dairy Products; SBM = Soybean

Meal; Poultry = Poultry Meat and Products (excluding eggs);

Pork = Pork and Pork Products; Food Prep. = Food Preparations;

Proc. Veg. = Processed Vegetables; Beef = Beef and Beef

Products; NAB = Nonalcoholic Beverages (excluding juices);

Choc. Prods. = Chocolate and Cocoa Products

Source: GATS–BICO (HS-10)

Figure 3 shows that U.S. agricultural exports to Vietnam have increased significantly over the last decade. Bulk products such as cotton, soybeans, and distillers grains have seen tremendous growth while demand for consumer-oriented products such as dairy products, fresh fruit, and meat products has continued to grow. The two main agricultural suppliers to Vietnam have been the United States and China. Although China, using its proximity to its advantage, has gained market share in Vietnam in recent years, export competition between the United States and China is not as direct. For example, the United States competes primarily against Brazil, Argentina, Russia, and Ukraine for oilseeds and grain and feed and against Australia and New Zealand for dairy products. In 2021, the Vietnamese government revised its most-favored-nation (MFN) tariff rates for agricultural products such as wheat, corn, and pork (USDA, 2021b). The United States does not currently enjoy preferential tariffs with Vietnam—the newly lowered MFN rates apply for the United States. Although Vietnam’s free trade agreement (FTA) partners retain a tariff advantage, the lower MFN tariff rates help reduce the tariff gap between the United States and FTA partners and make U.S. exports to Vietnam more competitive.

Alongside Vietnam, the Philippines has also shown strong growth in agricultural imports. Since 2010, agricultural imports grew at an annual average rate of 6.7%, reaching $12.0 billion in 2020. As the Philippines’ economy continues support increasing urbanization, modern retail markets have expanded and domestic food production has faced challenges to keep up with rising food demand. Thus, imports to support food demand have increased. While top imports, in terms of value, are mostly bulk and intermediate products to facilitate domestic food processing, products such as nonalcoholic beverages, dog and cat food, meat products, and bakery goods and pasta have shown growth in the last decade and continue to show potential for future growth (Figure 3). The United States can compete in many of these high-growth products, either by directly producing them or by supplying ingredients for the value-added products. As the biggest single agricultural supplier to the Philippines, the United States exported $3.5 billion of agricultural products, up $1.4 billion (68.4%) since 2011.

Malaysia and Thailand, two countries in ASEAN categorized by the World Bank as upper-middle-income economies, have a growing middle class with rising disposable income. Coupled with high urbanization in Malaysia—more than 70% of the total population—and rising urbanization in Thailand, there is a growing demand for nontraditional, high-quality food and beverages (USDA 2018, 2021c). From 2009 to 2011, the United States exported on average $344.8 million and $235.1 million worth of consumer-oriented agricultural products to Malaysia and Thailand, respectively. In comparison, from 2019 to 2021, the United States exported on average $531.2 million (54.0% increase) to Malaysia and $401.9 million (71.0% increase) worth of goods to Thailand. Notable gains include food preparations, dairy products, and tree nuts (Figure 3). Despite tariff disadvantages—regional partners such as China, Australia, and New Zealand enjoy preferential tariffs from free trade agreements—the United States is a major supplier of consumer-oriented food and beverage products. In 2020, the United States was Malaysia’s fifth largest and Thailand’s third largest supplier of agricultural products.

With favorable demographic and macroeconomic conditions, the ASEAN market remains promising for expanding U.S. agricultural exports. ASEAN’s shifting economies, from agriculture-based to industry- and services-based, is driving the demand for imported agricultural products to satisfy growing domestic food needs. In addition to importing primary goods such as soybeans and cotton to support domestic food and manufacturing industries, ASEAN is positioned to increasingly import high-value, consumer-oriented products as modern retail outlets in urban cities continue to expand their reach to households with rising income. As a result, top agricultural exporting countries see ASEAN as a priority market.

Looking ahead, the United States will continue to address non-tariff barriers in ASEAN and look for opportunities to increase market promotion activities emphasizing the quality and reliability advantages of U.S. agricultural products. In the absence of a free trade agreement, the United States will continue to face tariff disadvantage relative to members of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Recently, CPTPP members agreed to open accession talks with the United Kingdom while China, Taiwan, and Ecuador have applied to join the Partnership; also, the Philippines and Thailand have also announced their interest to join. Nonetheless, the fast-growing economies of ASEAN, their expanding demand for feed and animal protein, and their evolving diets favoring high-valued foods, will continue to present ample opportunities for U.S. suppliers to increase agricultural exports to ASEAN.

Anderson, K. 2010. “Globalization's Effects on World Agricultural Trade, 1960–2050.” Philosophical Transactions of the Royal Society B: Biological Sciences 365(1554): 3007-3021.

Cheng, E., and Y. Luo. 2021. “Sino-US Agricultural Trade in the Past 40 Years: Retrospect and Prospects on the Signing of the First Phase Sino-US Economic and Trade Agreement.” International Journal of Advance Agricultural Research 9(1): 1-21.

Davis, C.G., and J. Cessna. 2020. Prospects for Growth in U.S. Dairy Exports to Southeast Asia. Washington, DC: U.S. Department of Agriculture, Economic Research Service, ERR-278, December.

Gale, F., J. Hansen, and M. Jewison. 2015. China’s Growing Demand for Agricultural Imports. Washington, DC: U.S. Department of Agriculture, Economic Research Service, EIB-136, February.

Grant, J., S. Arita, C. Emlinger, S. Sydow, and M.A. Marchant. 2019. “The 2018-2019 Trade Conflict: A One-Year Assessment and Impacts on the U.S. Agricultural Exports” Choices 2019(4).

Hawkes, C., J. Harris, and S. Gillespie. 2017. “Changing Diets: Urbanization and the Nutrition Transition.” In 2017 Global Food Policy Report, Chapter 4, pp. 34-41. Washington, DC: International Food Policy Research Institute.

Harker, J. 2021, July 1. “Vilsack Says USDA Focus Shifting to Profit Focus for Farmers.” Brownfield Ag News. Available online: https://brownfieldagnews.com/news/vilsack-says-usda-focus-shifting-to-profit-focus-for-farmers/

HV, V., F. Thompson, and O. Tonby. 2014, May 1. “Understanding ASEAN: Seven Things You Need to Know.” McKinsey & Company. Available online: https://www.mckinsey.com/industries/public-and-social-sector/our-insights/understanding-asean-seven-things-you-need-to-know

International Monetary Fund. 2021. World Economic Outlook: Managing Divergent Recoveries. Washington, DC: IMF, April.

Kastner, T., K. Erb, and H. Haberl. 2014. “Rapid Growth in Agricultural Trade: Effects on Global Area Efficiency and the Role of Management.” Environmental Research Letters 9(3): 034015.

Le, H.B., and T.H. Lam. 2021. Vietnam-China Agricultural Trade: Huge Growth and Challenges. Singapore: ISEAS-Yusof Ishak Institute.

Muhammad, A., and J. Grant. 2021, May 12. “What American Farmers Could Gain by Rejoining the Asia-Pacific Trade Deal that Trump Spurned.” The Conversation. Available online: https://theconversation.com/what-american-farmers-could-gain-by-rejoining-the-asia-pacific-trade-deal-that-trump-spurned-152148

Muhammad, A., S.A. Smith, and J. Grant. 2021. “Can China Meet Its Purchase Obligations under the Phase One Trade Agreement?” Applied Economic Perspectives and Policy 44(3): 1393-1408.

Organisation for Economic Co-operation and Development and the Food and Agriculture Organization. 2017. "Southeast Asia: Prospects and Challenges.” In OECD-FAO Agricultural Outlook 2017-2026. Available online: https://www.oecd-ilibrary.org/ agriculture-and-food/oecd-fao-agricultural-outlook-2017-2026_agr_outlook-2017-en

Pananond, P. 2019, October 9. “Southeast Asia Moves from World's Factory to Regional Powerhouse.” Nikkei Asia. Available online: https://asia.nikkei.com/Opinion/Southeast-Asia-moves-from-world-s-factory-to-regional-powerhouse

Philippines Statistics Authority. 2021, July 7. “2020 Census of Population and Housing (2020 CPH) Population Counts Declared Official by the President.” Available online: https://psa.gov.ph/content/2020-census-population-and-housing-2020-cph-population-counts-declared-official-president

Reardon, T., D. Tschirley, M. Dolislager, J. Snyder, C. Hu, and S. White. 2014. Urbanization, Diet Change, and Transformation of Food Supply Chains in Asia. Ann Arbor, MI: Michigan State University.

Regmi, A. 2021. U.S. Agricultural Export Programs: Background and Issues. Washington, DC: Congressional Research Service, Report R46760, April.

Regmi, A., G.G. Croft, J.L. Greene, J. Renée, and R. Schnepf. 2021. Major Agricultural Trade Issues in the 117th Congress. Washington, DC: Congressional Research Service, Report R46653, January.

U.S. Department of Agriculture. 2018. Trade Opportunities in Southeast Asia: Indonesia, Malaysia, and the Philippines. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service, International Agricultural Trade Report, July.

U.S. Department of Agriculture. 2020a, December 7. “U.S. Agricultural Trade at a Glance.” Washington, DC: U.S. Department of Agriculture, Economic Research Service. Available online: https://www.ers.usda.gov/topics/international-markets-us-trade/us-agricultural-trade/us-agricultural-trade-at-a-glance/

U.S. Department of Agriculture. 2020b. China: Evolving Demand in the World’s Largest Agricultural Import Market. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service, International Agricultural Trade Report, September.

U.S. Department of Agriculture, 2021a. Production, Supply, and Distribution. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/psdonline/app/index.html

U.S. Department of Agriculture. 2021b. Vietnam Eliminates and Reduces MFN Tariff Rates on Select Agricultural Products. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service, GAIN Report VM2021-0097, November.

U.S. Department of Agriculture. 2021c. Thailand: Exporter Guide. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service, GAIN Report TH2021-0087, December.

U.S. Department of Agriculture. 2022. Global Agricultural Trade System. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/gats/

Vu, K. 2020. ASEAN Economic Prospects amid Emerging Turbulence: Development Challenges and Implications for Reform. Washington, DC: Brookings Institution, July.