Multiple states have now passed or are considering legislation to remove agricultural worker exemptions from overtime laws. California was the first to adopt these rules with the Agricultural Workers’ Assembly Bill (AB-1066) which passed in 2016. Since then, New York, Washington, Oregon, and Colorado have passed similar legislation, and the issue is gaining traction in many other states. Farm workers and the agricultural operations employing them have been historically exempt from overtime laws due to their exclusion from the 1938 Fair Labor Standards Act. At the federal level, employees of agricultural operations remain uncovered by overtime standards, but growing numbers of industry stakeholders and activists have argued that the overtime exemptions for agricultural workers should be removed, driving recent state legislation changes.

Despite the increasing prevalence of these laws, no work has documented their impacts. Given that these laws are relatively new—the California legislation involves a gradual phase-in first implemented in 2019—causally estimating effects ex post remains an empirical challenge due to data limitations and availability as well as separating labor market outcomes from effects from the COVID-19 pandemic. However, a thorough characterization of the industry regarding hours worked and wages can shed light on likely impacts a priori. Here we summarize and compare state policies relating to overtime for agricultural workers, including differences in overtime hours thresholds, phase-in schedules, and exemptions. Next, we summarize available information on the hours and wages of U.S. crop workers across the United States. We conclude with a discussion, rooted in economic theory, of the potential impacts of agricultural overtime laws for employers and employees.

Our aim is to provide up-to-date information on recent state policy changes that are likely to have impacts across the agricultural system and to demonstrate their potential implications for workers and employers. We find that in the 10 years prior to the first state implementation of these laws, the majority (57%) of agricultural workers worked more than 40 hours perweek (the standard threshold for overtime compensation outside of agriculture). This varies geographically—the largest concentration of overtime and highest weekly hours of work occur on the West and East coasts—across worker characteristics—males and undocumented workers work longer hours and are more likely to work overtime, compared with females and those with work authorization, respectively. Our findings suggest that overtime laws will impact males more than females and undocumented workers more than those with legal work authorization. We conclude that recent overtime rules for agricultural workers will have sizable impacts for employees and employers that will be amplified by rising wages. The magnitude and direction of effects depend on the availability of qualified workers and employer response.

At the federal level, the Fair Labor Standards Act (FLSA) sets requirements related to minimum wages, overtime pay, recordkeeping, and youth employment. Since the inception of the FLSA in 1938, overtime pay has been set at 1.5 times the regular rate of pay after working 40 hours in one workweek. States are permitted to set their own rules that are more stringent in these terms of employment, but requirements in the FLSA must be met as a minimum. States can also opt to cover federally exempt employees and industries in their wage and hours laws but cannot exempt workers who are covered under the FLSA. Several types of workers and industries are exempt from aspects of the FLSA, including salaried workers, learned professionals, commissioned sales employees in the retail or service sector (for example, servers), and certain agricultural employees (Society for Human Resource Management, 2019).

Under the FLSA, all agricultural employees are exempt from overtime pay regulations and some workers are additionally exempt from minimum wage regulations (see US Department of Labor, 2020, for information on minimum wage exemptions). Several states either don’t have their own overtime or minimum wage provisions or have provisions that are less stringent than the FLSA. By default, these states exempt agricultural workers from overtime pay and exempt some agricultural workers from their minimum wage laws (Nagele-Piazza, 2017). Most states, however, have their own overtime and minimum wage regulations that are more stringent than the FLSA. For example, many states have minimum wages above the federal level or mandate daily, in addition to weekly, overtime pay. However, a few states have removed federal overtime exemptions for agricultural workers, but this has been changing in recent years.

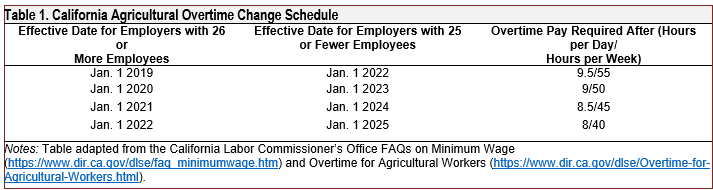

Since 2016, five states have passed legislation extending overtime to agricultural employees. California was the first to officially pass such legislation with AB-1066. Prior to this legislation, all California farmworkers were subject to overtime pay (equal to 1.5 times regular pay) after 10 hours in one day or 60 in one week and to the state’s standard minimum wage laws (Martin, 2020). AB-1066 mandated a gradual phase-in of new overtime hours for all agricultural employers in the state. Table 1 shows this phase-in schedule as mandated for employers of different sizes. The schedule annually lowers the daily and weekly overtime threshold by 0.5 and 5 hours, respectively, until reaching the standard for other industries of 8 hours per day and 40 hours per week. Employers with more than 25 employees are required to pay 1.5 times regular pay after the standard 8 hours per day or 40 hours per week beginning in 2022, while employers with 25 or fewer employees will reach this new standard in 2025 (California State Legislature 2016).

New York and Washington were the next states to enact new overtime hours thresholds for agricultural workers in 2019 and 2021, respectively. New York’s Farm Laborers Fair Practices Act mandates overtime pay for all farm workers after 60 hours per week and established a wage board responsible for determining future changes to the overtime hours threshold (New York Department of Labor, 2020). Washington State’s SB 5172 mandates a phase-in of new overtime hour thresholds for agricultural employees at a faster pace than implemented in California (Washington State Legislature, 2021). The legislation requires all agricultural employers to provide overtime pay for weekly hours exceeding 55 hours in 2022, 48 hours in 2023, and 40 hours in 2024.

Oregon and Colorado have more recently followed suit. Like California’s legislation, Oregon’s HB 4002, passed in 2022, implemented a gradual phase-in of overtime hours (Oregon State Legislature, 2022). The legislation requires all agricultural employers to provide overtime pay for weekly hours exceeding 55 hours in 2023 and 2024, 48 hours in 2025 and 2026, and 40 hours

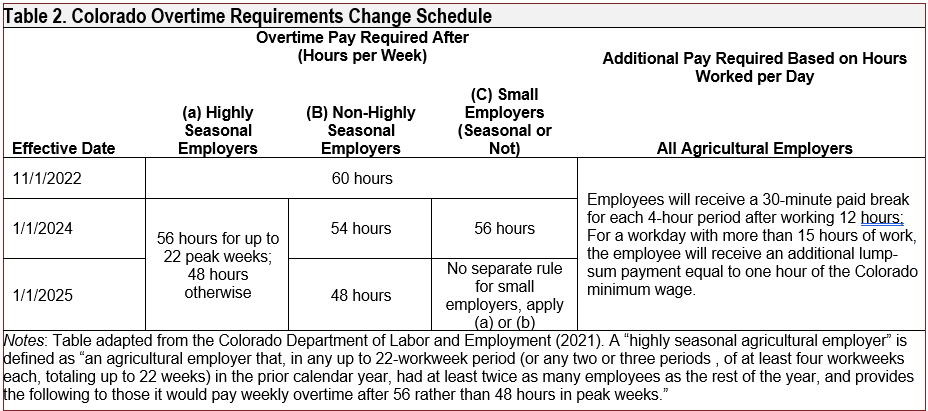

beginning in 2027. Colorado’s SB21-07 also implemented a gradual phase-in of overtime hours, with differences based on employer type, and with additional provisions for worker coverage under minimum wage laws (Colorado General Assembly, 2021).

Table 2 shows the phase in schedule for overtime requirements for Colorado agricultural employers. The Colorado rulemaking specifies different overtime thresholds for seasonal and nonseasonal agricultural employers, with the lowest overtime threshold set at 48 hours per week. These thresholds are distinct from those set by other states in recent years, but there are precedents in states with longer-standing overtime rules in agriculture. For example, agricultural employers in Hawaii can select any 20 weeks out of the year during which to compensate workers for overtime hours exceeding 48 hours per week and are required to pay overtime for hours exceeding 40 hours per week for the remainder of the year.

These recent state legislations will impact agricultural operations with employees working above the new overtime thresholds, ranging from 40 to 60 hours per week. Agricultural employers paying workers at or near the current minimum wage rate will also be impacted by concurrent minimum wage hikes, magnifying the effects of the new overtime standards. Understanding these effects is important as similar legislation is being considered in other states and at the federal level. For example, a 2021 legislative document in Maine (LD  1022) proposed to remove overtime and minimum wage exemptions for agricultural workers in the state (Maine Legislature, 2021). At the federal level, the Fairness for Farm Workers Act (HR 6230) would remove overtime exemptions for agricultural workers nationally. Even states like Maryland, Minnesota, and Hawaii—which have historically covered agricultural workers under overtime laws but to a lesser extent than other workers—might be impacted by future changes to such laws. In the remainder of the paper, we discuss potential implications of agricultural overtime legislations.

1022) proposed to remove overtime and minimum wage exemptions for agricultural workers in the state (Maine Legislature, 2021). At the federal level, the Fairness for Farm Workers Act (HR 6230) would remove overtime exemptions for agricultural workers nationally. Even states like Maryland, Minnesota, and Hawaii—which have historically covered agricultural workers under overtime laws but to a lesser extent than other workers—might be impacted by future changes to such laws. In the remainder of the paper, we discuss potential implications of agricultural overtime legislations.

The impact of these laws on agricultural employees and employers will depend on multiple factors. These laws will have no effect if agricultural workers are not currently and will never be working above overtime hours thresholds. Given that this is not the case, the effect of these laws will depend on how employers respond, which we can consider in two extremes to bound the potential impacts.

At one extreme, employers could take actions so that all employees work below the overtime hours threshold. In this case, current workers would take a pay cut and work fewer hours. Possible mechanisms to accomplish this include adopting labor-saving technology, reducing overall production or production of labor-intensive crops, relocating to other states or countries, or hiring more workers (Martin, 2017). Employers would incur some fixed costs or face lower revenues from taking these actions but generally report that this will be how they respond. For example, in a 2016 survey conducted by the Western Growers Association, 80% of agricultural operations reported that they would scale back hours to align with the new overtime thresholds (Lunde, 2016). Despite these claims, the ability of employers to take these actions is limited by institutional constraints. For example, employers are unlikely to accomplish this by hiring additional workers as this would necessitate availability of qualified workers willing to fill these jobs despite ongoing, nationwide, industry labor shortages (Gunders, 2012; Richards, 2018; Rosenblatt, 2021).

At another extreme, employers could make no changes to their operation and maintain their current workforce size and hours. In this case, workers would earn more money while employers would face higher payroll costs. While we cannot perfectly predict how employers will respond to these laws, we can use these two extremes to bound the likely effects. To do so, we present evidence on the hours and wages of crop workers prior to the implementation of overtime laws using data from the National Agricultural Workers Survey (NAWS).

The NAWS is a repeated cross-sectional survey administered to a nationally representative sample of hired U.S. crop workers at their place of work. Data from the NAWS are available through 2018 and include detailed information on each worker’s current employment. The NAWS data are representative in 2-year increments and for 5 multistate regions and California. Relevant to the topic at hand, the main limitations to the NAWS are that the sample is restricted to crop workers (that is, workers employed in animal agriculture are omitted), workers are only asked to report the number of hours they worked for the most recent pay period, and—due to the sampling methodology—it cannot be used to study within-year seasonality in outcomes or outcomes at a refined geographical level. As such, we present summary statistics in 2-year increments and for each of the six NAWS regions where appropriate.

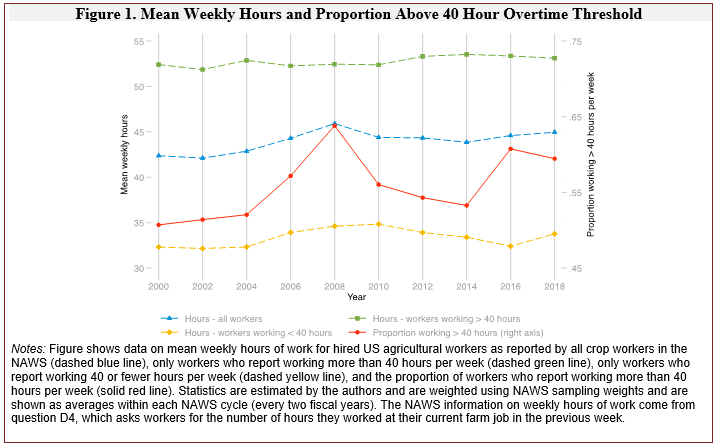

Figure 1 shows trends in mean hours worked by all U.S. crop workers in recent years. The average crop worker was working 42 hours per week from 1999 to 2002; this increased until peaking at 46 hours per week in 2007/2008 and has since remained stable at around 45 hours per week. Figure 1 also shows trends in mean hours worked for crop workers working above or below the standard overtime threshold of 40 hours per week. Mean hours worked by workers below the threshold peaked in 2009/2010 at 35 hours per week and is currently near 34 hours per week. Mean hours worked by workers above the threshold have remained stable over this period, near 53 hours per week. Finally, Figure 1 shows trends in the proportion of workers working more than 40 hours per week—this peaked in 2007/2008 with 64% of workers reporting working more than 40 hours per week. Most recently, approximately 60% of workers reported weekly

Figure 1 shows trends in mean hours worked by all U.S. crop workers in recent years. The average crop worker was working 42 hours per week from 1999 to 2002; this increased until peaking at 46 hours per week in 2007/2008 and has since remained stable at around 45 hours per week. Figure 1 also shows trends in mean hours worked for crop workers working above or below the standard overtime threshold of 40 hours per week. Mean hours worked by workers below the threshold peaked in 2009/2010 at 35 hours per week and is currently near 34 hours per week. Mean hours worked by workers above the threshold have remained stable over this period, near 53 hours per week. Finally, Figure 1 shows trends in the proportion of workers working more than 40 hours per week—this peaked in 2007/2008 with 64% of workers reporting working more than 40 hours per week. Most recently, approximately 60% of workers reported weekly

hours above this standard overtime threshold.

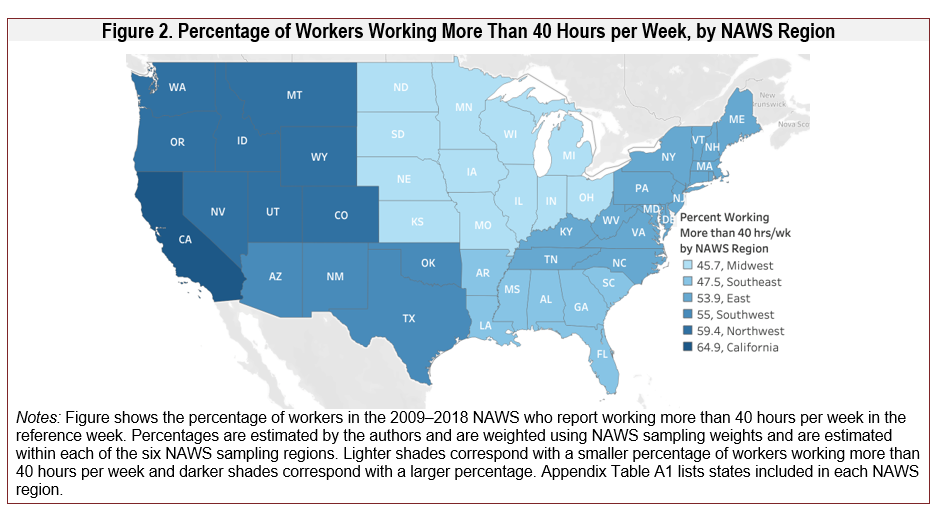

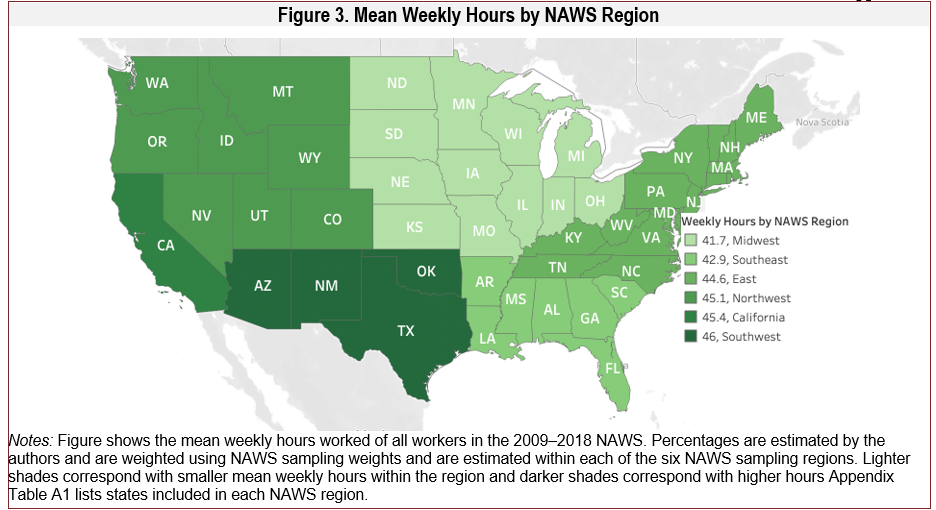

Because attributes of the agricultural sector vary both over time and by region, another important consideration is whether workers in some locations work more hours. Figure 2 shows the percentage of workers working more than 40 hours per week in each of the six NAWS regions from 2009 through 2018. In these years, the Midwest region has the fewest workers working more than 40 hours per week (46%), followed by the Southeast (48%). California has the largest proportion of workers working more than 40 hours per week (65%), followed by the Northwest (59%). Figure 2 suggests some spatial heterogeneity in the prevalence of working more than 40 hours per week: Workers in the west are most likely to be working these hours, followed by workers

in the east, and  workers in more central states are least likely. These patterns are similar when examining spatial variation in mean hours worked by NAWS region (Figure 3): Weekly mean hours worked are highest in the Southwest (46), followed by California (45) and the Northwest (45) and lowest in the Midwest (42), followed by the Southeast (43) and East (45).Finally, hours of work vary across worker demographics. The most recent NAWS data (from 2017/2018) indicate that female workers are less likely to work more than 40 hours per week than males: 49% of female farm workers and 64% of male farm workers work above this threshold. Female workers also work, on average, fewer hours per week (41) than males (47). Hours of work also vary across citizenship status. Workers who self-report as undocumented are more likely to work more than 40 hours a week (62%) compared with workers with work authorization (52%), although workers in both groups report the same mean hours of work per week (45). Differences across such demographic characteristics are important in understanding the distributional impacts of overtime policies. These data suggest that males will be more impacted than females and undocumented workers will be more impacted than those with legal work authorization.

workers in more central states are least likely. These patterns are similar when examining spatial variation in mean hours worked by NAWS region (Figure 3): Weekly mean hours worked are highest in the Southwest (46), followed by California (45) and the Northwest (45) and lowest in the Midwest (42), followed by the Southeast (43) and East (45).Finally, hours of work vary across worker demographics. The most recent NAWS data (from 2017/2018) indicate that female workers are less likely to work more than 40 hours per week than males: 49% of female farm workers and 64% of male farm workers work above this threshold. Female workers also work, on average, fewer hours per week (41) than males (47). Hours of work also vary across citizenship status. Workers who self-report as undocumented are more likely to work more than 40 hours a week (62%) compared with workers with work authorization (52%), although workers in both groups report the same mean hours of work per week (45). Differences across such demographic characteristics are important in understanding the distributional impacts of overtime policies. These data suggest that males will be more impacted than females and undocumented workers will be more impacted than those with legal work authorization.

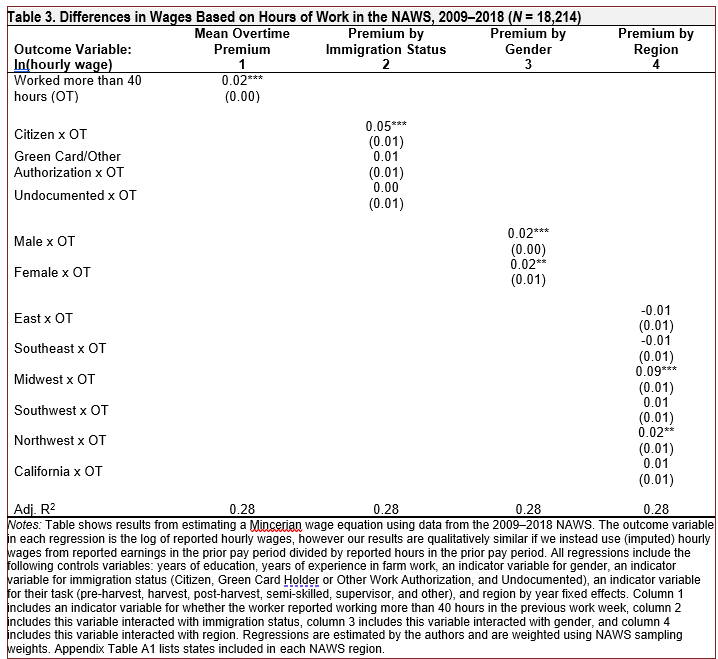

Wages are also an important determinant of the impacts of overtime legislation. One consideration is that some employers may already be compensating workers for overtime hours to remain competitive. Evidence from the NAWS suggests that prior to overtime legislations, workers were paid a small premium for working overtime. Table 3 shows results from estimating a Mincerian wage equation to calculate percentage difference in hourly wages for workers who work more than 40 hours per week compared with those working less. This regression approach enables us to control for a multitude of worker characteristics that might be correlated with wages and the likelihood of working longer hours. Using data from the 2009–2018 NAWS, we regress the logged hourly wages of a worker on an indicator variable equal to 1 if they report working more than 40 hours per week in their most recent work week and include control variables for years of education, years of experience in farm work, gender, immigration status, type of task they are performing, and region by year fixed effects.

Results in column 1 of Table 3 indicate that working more than 40 hours per week was associated with a 2% (or approximately $0.20) higher hourly wage rate for the average worker. Results in column 2 suggest that only U.S. citizens were receiving this overtime premium: Citizens working more than 40 hours per week had hourly wages 5% (or approximately $0.50) higher than citizens working below this threshold, whereas there was no statistically significant overtime premium for workers with green cards, other work authorization, or undocumented workers. Results in column 3 suggest

that the overtime premium was similar for males and females, associated with 2% higher hourly wages. Finally, results in column 4 highlight geographical differences in the prevalence of overtime premiums. There is evidence of an overtime premium for workers in the Midwest and Northwest regions, but not for workers in other parts of the country. Overtime legislation typically requires that employers pay workers 1.5 times their normal pay rate for hours worked above the overtime threshold. Our estimated premiums for work hours above the typical 40-hour threshold are low relative to what they would be if all workers were subject to overtime pay but suggest that some workers are being compensated for overtime hours.Current wage rates and differences in wage rates are critical determinants of the impacts of mandating overtime pay for all crop workers. According to the most recent NAWS data, from the 2017/2018 cycle, the mean hourly wage of agricultural workers is $12.31 per hour. This wage is lower for females ($11.86) than for males ($12.51) and lower for undocumented workers ($12.01) than for those with work authorization ($12.49). Table 3 also demonstrates geographical variation in wages. Workers in the Northwest region typically have the highest hourly wages, followed by California, the Midwest, Southwest, East, and Southeast. This holds true in the most recent NAWS data which suggest workers in the Northwest have the highest hourly wages ($13.20), followed by California ($12.90), and workers in the Southeast have the lowest wages ($10.40).

Taken as a whole, our analysis of hours and wages suggests that many agricultural employers and employees will be impacted by new overtime legislations. From 2009 to 2018, 57% of U.S. crop workers reported working more than 40 hours per week, and mean hours ranged from 41 to 46 hours per week. Data suggest that employers were paying some, but not all, workers a premium for working more than 40 hours a week over this period. Premiums for overtime work were concentrated among U.S. citizen workers and those working in the Midwest and Northwest regions, suggesting that these workers will be less impacted by new legislations.

The impacts of these legislations for the agricultural sector as a whole depend on starting employment conditions, future availability of technologies and workers, and employer responses. We quantify these effects using back of the envelope calculations that combine information on mean hours (for example, the average worker in the most recent NAWS worked roughly 45 hours per week) and wages ($12.31 per hour in the most recent survey round) to estimate potential income effects. Evaluating these data at the two extremes discussed above, we estimate that a policy that mandates overtime pay after 40 hours a week could lead to changes in weekly income for the average worker ranging from a $60 decrease to a $30 increase. For workers currently working more than 40 hours per week, we estimate that such a policy would lead to changes in weekly earnings ranging from a $160 decrease to a $80 increase. These effects differ by geographic area. For example, worker impacts in California could range from a weekly income loss of $168 to a gain of $84, whereas in the East impacts could range from a weekly income loss of $134 to a gain of $67. Effects also vary by worker demographics. Potential effects range from a weekly loss of $131 to a gain of $65 for females who are currently working more than 40 hours per week, a loss of $175 to a gain of $87 for males, a loss of $144 to a gain of $72 for undocumented workers, and a loss of $175 to a gain of $86 for work-authorized workers. However, average effects within these groups also depend on the proportion of workers who are currently working above the hourly threshold as well as the overtime threshold set by the legislation.

While our estimated effects for workers include the possibility of increases in income, all of these scenarios will lead to increased production costs for employers in the short run. Employers are likely to reduce worker hours by hiring more workers, investing in labor-saving technologies, or making other changes to their business that reduce labor needs but are also likely to be paying some workers a premium for working overtime. Given the declining availability of domestic workers, many employers will only be able to supplement their workforce by hiring workers on the H-2A visa (the U.S. visa for temporary agricultural workers). This program imposes additional costs on employers including higher hourly wages set by the state-level adverse effect wage rate and costs associated with worker housing, travel, and program fees.

Other employer responses, including mechanizing, shifting production to less labor-intensive crops, relocating, or reducing overall production will either increase costs or reduce revenues in the short run as employers invest in new physical capital or reduce production. In sum, in the short run, overtime policies have the potential to either increase or decrease income for crop workers but are almost certain to increase costs for employers. Long-run impacts for employers are less clear. Investments in new technologies are likely to reduce variable production costs; eventually, increases in production costs—for example from hiring more H-2A or compensating workers for overtime—are likely to be passed through to retailers and consumers. Thorough, ex post, analyses of both the short- and long-run impacts of these legislations for employees and employers is warranted as data become available. Understanding the impacts of these overtime legislation is pivotal to the growing number of states considering such policies.

California State Legislature. 2016. AB 1066: Agricultural Workers: Wages, Hours, and Working Conditions. Available online: https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201520160AB1066

Colorado Department of Labor and Employment. 2021. Colorado Overtime and Minimum Pay Standards Order (COMPS Order) 38. 7 CCR 1103-1. Available online: https://cdle.colorado.gov/sites/cdle/files/7 CCR 1103-1 COMPS Order #38.pdf

Colorado General Assembly. 2021. SB21-087: Agricultural Workers' Rights. Available online: https://leg.colorado.gov/bills/sb21-087

Fairness for Farm Workers Act, H.R. 6230, 115th Congress. 2018. Available online: https://www.congress.gov/bill/115th-congress/house-bill/6230/all-actions?r=6&overview=closed&s=1#tabs

Gunders, D. 2012. “Wasted: How America is Losing up to 40 percent of its Food from Farm to Fork to Landfill.” Natural Resources Defense Council Issue Paper 12-06-B. Available online: https://www.nrdc.org/sites/default/files/wasted-food-IP.pdf

Lunde, C. 2016. “Survey Concludes Minimum Wage and Agricultural Overtime Laws will Reduce Potential Farmworker Earnings.” Western Growers. Available online: https://www.wga.com/sites/default/files/Survey Results_Summary For Legislature and Media_Final_0.pdf

Maine Legislature House of Representatives, H.P. 760, Regular Session. 2021. Legislative Document 1022: An Act to Make Agricultural Workers and Other Workers Employees under the Wage and Hour Laws. Available online: https://legislature.maine.gov/legis/bills/getPDF.asp?paper=HP0760&item=1&snum=130

Martin, P.L. 2017. “Immigration and Farm Labor: Challenges and Opportunities.” Giannini Foundation Information Series 017-1. Available online: https://s.giannini.ucop.edu/uploads/giannini_public/dd/d9/ddd90bf0-2bf0-41ea-bc29-28c5e4e9b049/immigration_and_farm_labor_-_philip_martin.pdf

Martin, P.L. 2020. “Overtime and California Farm Workers.” Rural Migration News. Available online: https://migration.ucdavis.edu/rmn/blog/post/?id=2401

Nagele-Piazza, L. 2017. “How do State Overtime Pay Rules Differ from Federal Law?” Society for Human Resource Management. Available online: https://www.shrm.org/resourcesandtools/legal-and-compliance/state-and-local-updates/pages/state-overtime-pay-rules-differ-from-federal-law.aspx

New York State Department of Labor. 2020. Farm Laborers Fair Labor Practices Act. Available online: https://dol.ny.gov/farm-laborers-fair-labor-practices-act

Oregon State Legislature. 2022. HB 4002: Relating to Overtime for Agricultural Workers; and Prescribing an Effective Date. Available online: https://olis.oregonlegislature.gov/liz/2022R1/Measures/Overview/HB4002

Richards, T.J. 2018. “Immigration Reform and Farm Labor Markets.” American Journal of Agricultural Economics 100: 1050–1071.

Rosenblatt, L. 2021. “Farm Labor Shortage Nothing New, Getting Worse, Farmers Say.” Pittsburgh Post-Gazette. Relating to overtime for agricultural workers; and prescribing an effective date: https://apnews.com/article/immigration-health-coronavirus-pandemic-business-50121aa858e9f7cb2c708d94602ef366

Society for Human Resource Management. 2019. “Understanding Overtime Exemptions under the FLSA.” Available online: https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/understanding-overtime-exemptions-.aspx

U.S. Department of Labor. 2020. “Fact Sheet #12: Agricultural Employers under the Fair Labor Standards Act (FLSA).” Washington, DC: US DOL, Wage and Hour Division. Available online: https://www.dol.gov/sites/dolgov/files/WHD/legacy/files/whdfs12.pdf

Washington State Legislature. 2021. SB 5172 - 2021-22: Concerning the Retroactivity of Overtime Claims in Exceptional Cases. Available online: https://app.leg.wa.gov/billsummary?BillNumber=5172&Initiative=false&Year=2021