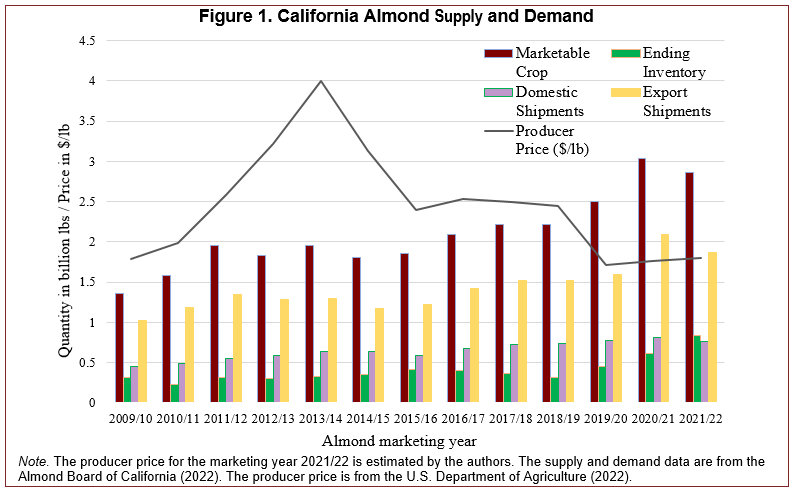

California produces about 80% of the world’s almonds, and the industry is worth almost $5.6 billion. Almonds are grown on over a million acres in California (U.S. Department of Agriculture, 2022). The industry generates more than 100,000 jobs and contributes about $11 billion in added value to California’s economy (Sumner et al., 2016). Since the 2009/10 marketing year (based on an August–July marketing year for almonds), the marketable crop has more than doubled, as shown in Figure 1. About 70% of that crop is exported to more than 100 countries worldwide, making almonds the number one U.S. specialty crop. These exports go mainly to Western Europe and the Asia-Pacific region (U.S. Department of Agriculture, 2021). California almond exports (measured in billion lb kernel) have grown considerably, reaching about 1.9 billion lb in the 2021/22 marketing year. Although the industry experienced strong growth since the 2015/16 marketing year, this trend was interrupted after the implementation of retaliatory tariffs in 2018. In addition, the 2021/22 almond exports have fallen behind compared to the prior marketing year. These trends are driven by trade retaliation and supply chain disruptions that impede the almond industry from competing in foreign markets (Carter and Steinbach, 2022; Steinbach and Zhuang, 2023).The U.S. government implemented unilateral tariffs on global imports of steel and aluminum products for national security reasons in 2018. Several countries responded to the Section 232 and 301 tariffs by imposing retaliatory tariffs on unrelated imports from the United States, including tree nuts, pork, and whiskey (Bown, 2019). These duties restrict U.S. almond exports and distort international trade, reducing the competitiveness of California almonds in major export markets. China levied 45% and Turkey 10% higher tariffs on in-shell and shelled almonds from California. India followed in June 2019, increasing import tariffs to Rs41/kg for in-shell and Rs120/kg for kernels, exceeding India’s WTO-bound rates. The tariffs were detrimental to California almond producers, reducing export volumes and puttingbdownward pressure on prices (Carter and Steinbach, 2020; Grant et al., 2021).

While the almond industry saw record exports in the 2020/21 marketing year, the 2021/22 container shipping disruptions were detrimental, reducing the export potential considerably. According to Carter, Steinbach, and Zhuang (2023) and Steinbach and Zhuang (2023), almond exports were significantly below the counterfactual level between April 2021 and January 2022. Almonds destined for the export market filled warehouses and container yards as growers, handlers, and shippers grappled with ongoing transportation disruptions at California’s ports. Several factors have contributed to the shipping challenges. One of the primary causes of continued disruption is a backlog of high-value products headed to U.S. West Coast ports from Asia. Rather than filling export containers with almonds or other agricultural products before returning to Asia, shipping companies returned empty containers as quickly as possible to take advantage of record-high rates for Asian goods destined for the United States. This makes it difficult for almond exporters to obtain empty containers and lock up space on ships returning to Asia. Considering the record crops, significant carryover, and limited storage capacities, the almond industry is eager to boost exports without the headaches of multiple supply chain disruptions and trade policy uncertainties, compounding the adverse trade effects of retaliatory tariffs imposed by China, India, and Turkey.

To measure the forgone California almond exports due to trade retaliation, we estimate retaliatory tariff elasticities for almonds following the approach used by Carter and Steinbach (2020) and Fajgelbaum et al. (2020), detailed in Appendix A. We use high-frequency trade data and high-dimensional regression models to measure the trade destruction effects of the 2018–2020 trade war. U.S. almond exports were 38% below the counterfactual level in the first 12 months after the retaliatory tariffs were implemented overseas. During this period, the monthly average tariff levied on almonds was 22%. Using these trade elasticity estimates and data on the level and timeline of retaliatory tariffs imposed by China, India, and Turkey, we estimate the monthly export losses faced by California almond producers due to trade retaliation.

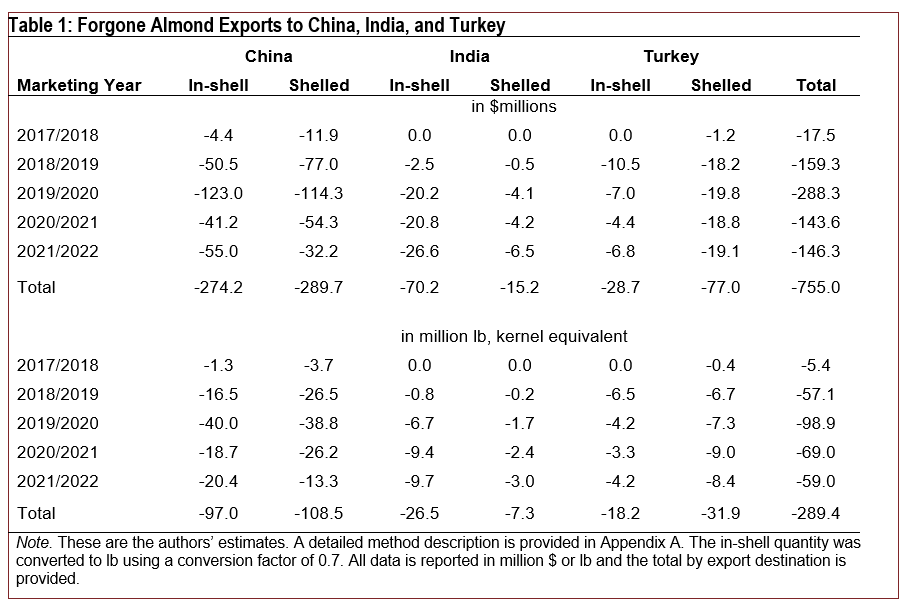

Table 1 shows that California almond export losses  due to retaliatory tariffs exceed $755 million in marketing years 2017/18–2021/22. The annual export losses peaked in the 2019/20 marketing year, when almond exports to retaliatory countries were almost $290 million below the counterfactual level. However, since then, the losses have been halved due to the Chinese exemptions from Section 301 tariffs in response to the Phase One deal implemented in March 2020. Turkey also unilaterally reduced its retaliatory tariff on California almond imports from 20% to 10% in May 2019. At the same time, the Section 232 tariffs remain in place. A reduction in exports to China drives the trade retaliation losses (-$565 million), followed by Turkey (-$105 million) and India (-$85 million). The estimates also reveal that the trade losses were heterogeneous for in-shell and shelled almonds. The almond industry lost almost 290 million lb in exports due to retaliatory tariffs. The trade effects are equally large for in-shell and shelled almonds for China but more pronounced for in-shell almond exports to India. Note that the potential for the Chinese government to end the current tariff exemption process could severely limit imports of California almonds in the future. In addition, U.S. almondproducers face increasing competition in the Chinese and Indian markets. Both countries have negotiated favorable trade agreements with Australia. Australian almonds can be imported into China at a 0% tariff rate and, after their agreement with India is ratified, can be imported to India under a tariff-rate quota of 34,000 MT at 50% of the current MFN tariff levels.

due to retaliatory tariffs exceed $755 million in marketing years 2017/18–2021/22. The annual export losses peaked in the 2019/20 marketing year, when almond exports to retaliatory countries were almost $290 million below the counterfactual level. However, since then, the losses have been halved due to the Chinese exemptions from Section 301 tariffs in response to the Phase One deal implemented in March 2020. Turkey also unilaterally reduced its retaliatory tariff on California almond imports from 20% to 10% in May 2019. At the same time, the Section 232 tariffs remain in place. A reduction in exports to China drives the trade retaliation losses (-$565 million), followed by Turkey (-$105 million) and India (-$85 million). The estimates also reveal that the trade losses were heterogeneous for in-shell and shelled almonds. The almond industry lost almost 290 million lb in exports due to retaliatory tariffs. The trade effects are equally large for in-shell and shelled almonds for China but more pronounced for in-shell almond exports to India. Note that the potential for the Chinese government to end the current tariff exemption process could severely limit imports of California almonds in the future. In addition, U.S. almondproducers face increasing competition in the Chinese and Indian markets. Both countries have negotiated favorable trade agreements with Australia. Australian almonds can be imported into China at a 0% tariff rate and, after their agreement with India is ratified, can be imported to India under a tariff-rate quota of 34,000 MT at 50% of the current MFN tariff levels.

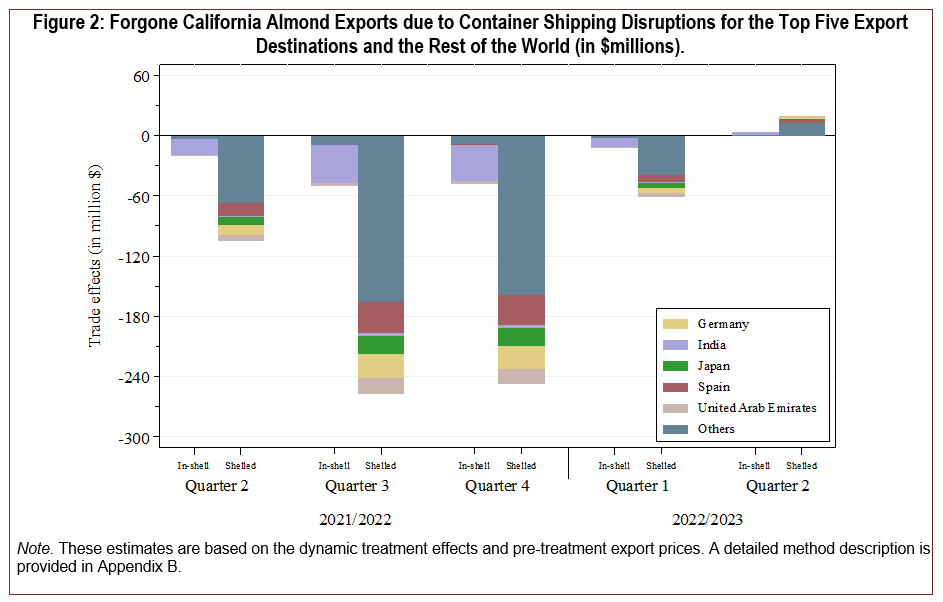

The 2021/22 container shipping disruptions significantly affected California’s almond exporters. Carter, Steinbach, and Zhuang (2023) found that fruit and tree nuts exports were 19% below the counterfactual level between May 2021 and January 2022. The estimated trade effects are driven by limited access to containers for agricultural exports, port congestion, and various other factors (for a detailed discussion, see Carter, Steinbach, and Zhuang, 2021; Carter and Steinbach, 2022). To estimate the forgone foreign sales for California almond producers, we implemented the empirical strategy by Carter, Steinbach, and Zhuang (2022). We extended it to include the entire 2021/22 marketing year, as detailed in Appendix B. We used the dynamic treatment estimates to predict in-shell and shelled almond trade for all export destinations with and without container shipping disruptions.

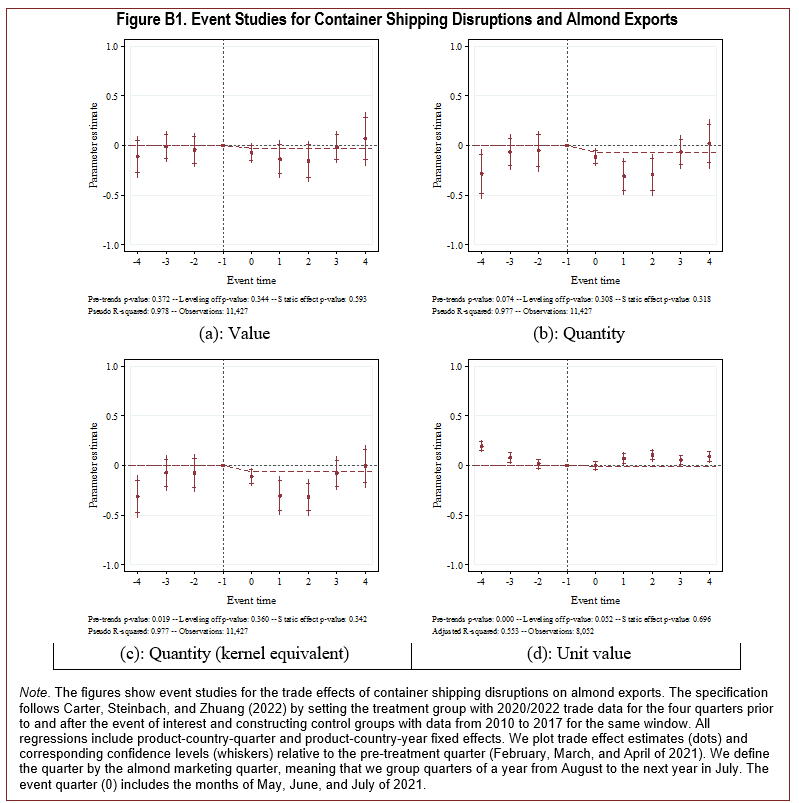

Figure 2 shows the projected almond exports  without container shipping disruptions in 2021/22. Global shipping container disruptions reduced California almond exports by more than $775 million or 365 million lb between Q2/2021 and Q1/2022. Although Figure B1 provides some evidence for positive unit value effects, the magnitude of the adverse quantity effects substantially surpasses them. The combination of these two effects contributes to a decline in overall export sales. The largest forgone export sales were recorded during Q4/2021 and Q1/2022, when almond exports were about 25% below the counterfactual level. These trade losses translate into aggregated forgone sales of about $310 million in Q4/2021 and $295 million in Q1/2022. Comparing in-shell with shelled almonds, we estimate that about 84% of lost export opportunities occurred in shelled almonds, with major losses occurring in India (-$100 million) and Spain (-$80 million). We find evidence for trade recovery from May to July 2022, which indicates that the almond industry has recovered some of the lost ground caused by container shipping disruptions. Last, compared to the 2019/20 marketing year, export prices have been 25% below in the 2020/21 and 2021/22 marketing years. The U.S. exports almonds mainly to EU and Asian markets, with Germany, Spain, India, and Japan being the key importers. Carter, Steinbach, and Zhuang (2022) showed that global shipping container disruptions have adversely affected U.S. agricultural exports to most of these destinations. Consequently, other destinations have not offset the trade losses stemming from maritime shipping disruptions. Figure 1 illustrates that the ending inventory for the marketing years 2020/2021 and 2021/2022 exceeds thatof the previous year, suggesting that the U.S. domestic market could not absorb the forgone foreign sales.

without container shipping disruptions in 2021/22. Global shipping container disruptions reduced California almond exports by more than $775 million or 365 million lb between Q2/2021 and Q1/2022. Although Figure B1 provides some evidence for positive unit value effects, the magnitude of the adverse quantity effects substantially surpasses them. The combination of these two effects contributes to a decline in overall export sales. The largest forgone export sales were recorded during Q4/2021 and Q1/2022, when almond exports were about 25% below the counterfactual level. These trade losses translate into aggregated forgone sales of about $310 million in Q4/2021 and $295 million in Q1/2022. Comparing in-shell with shelled almonds, we estimate that about 84% of lost export opportunities occurred in shelled almonds, with major losses occurring in India (-$100 million) and Spain (-$80 million). We find evidence for trade recovery from May to July 2022, which indicates that the almond industry has recovered some of the lost ground caused by container shipping disruptions. Last, compared to the 2019/20 marketing year, export prices have been 25% below in the 2020/21 and 2021/22 marketing years. The U.S. exports almonds mainly to EU and Asian markets, with Germany, Spain, India, and Japan being the key importers. Carter, Steinbach, and Zhuang (2022) showed that global shipping container disruptions have adversely affected U.S. agricultural exports to most of these destinations. Consequently, other destinations have not offset the trade losses stemming from maritime shipping disruptions. Figure 1 illustrates that the ending inventory for the marketing years 2020/2021 and 2021/2022 exceeds thatof the previous year, suggesting that the U.S. domestic market could not absorb the forgone foreign sales.

Foreign markets are essential for California’s almond industry. The industry exports to more than 100 countries and enjoyed significant trade growth, sending about 70% of the annual crop to foreign markets, which makes almonds the number one exported specialty crop in the United States. The leading position of California almond exporters is under scrutiny due to trade retaliation in response to the U.S. Section 232 and 301 tariffs and trade ramifications caused by the global container shipping disruptions. These trade impairments cost California’s almond industry dearly, jeopardizing jobs and threatening an industry that adds significant value to California’s economy.

We estimated that retaliatory tariffs reduced California almond exports by almost $755 million or 290 million lb through the 2021/22 marketing year. These trade losses occurred in major export markets that experienced significant growth due to rising incomes and shifting demand for high-quality tree nuts. Due to the retaliatory tariffs faced in those markets, California almond producers have lost market share to competition from Australia and other countries. The Australian government has negotiated free trade agreements with China and India that will allow Australian almonds to enter these growth markets under favorable terms, undercutting U.S. market share in the Chinese and Indian markets.

Global container shipping disruptions harmed California almond exports even more than the retaliatory tariffs. Within a shorter period from April 2021 and August 2022, almond exports were about $775 million or 365 million lb below the counterfactual level. These export losses are heterogeneously distributed across export destinations and over time. The most significant losses are observed for India, followed by Spain and Germany. The container shipping disruptions peaked in Q4/2021 when California almond producers experienced forgone sales of about $310 million. Considering back-to-back record crops, significant carryover, and limited storage capacities, the almond industry could expand exports without facing major supply chain disruptions and an uncertain trade policy environment. The industry lost considerable export opportunities during that period, compounding the trade effects of retaliatory tariffs and having implications for the domestic market by putting downward pressure on producer prices and increasing inventory/storage costs. Without trade retaliation and container shipping disruptions, the unsold ending inventory in 2022 could have been about 50% below the current level. The trucker protest at the Port of Oakland against the AB5 law in July 2022 further undermined the recovery of containerized almond exports. The trucking delays raised the expected carryover by 50–65 million pounds, putting the ending inventory for the 2022 marketing year at a record of 30% of the marketable crop. This considerable increase in almond inventories will likely depress prices for the nextfew years and force almond producers to adjust to the new realities of an uncertain global trade environment. Whilegthe maritime shipping disruptions started to attenuate in late 2022, the trade disruptions caused by retaliatory tariffs will likely remain a major challenge for U.S. almond exports without decisive policy actions.

California almond exports even more than the retaliatory tariffs. Within a shorter period from April 2021 and August 2022, almond exports were about $775 million or 365 million lb below the counterfactual level. These export losses are heterogeneously distributed across export destinations and over time. The most significant losses are observed for India, followed by Spain and Germany. The container shipping disruptions peaked in Q4/2021 when California almond producers experienced forgone sales of about $310 million. Considering back-to-back record crops, significant carryover, and limited storage capacities, the almond industry could expand exports without facing major supply chain disruptions and an uncertain trade policy environment. The industry lost considerable export opportunities during that period, compounding the trade effects of retaliatory tariffs and having implications for the domestic market by putting downward pressure on producer prices and increasing inventory/storage costs. Without trade retaliation and container shipping disruptions, the unsold ending inventory in 2022 could have been about 50% below the current level. The trucker protest at the Port of Oakland against the AB5 law in July 2022 further undermined the recovery of containerized almond exports. The trucking delays raised the expected carryover by 50–65 million pounds, putting the ending inventory for the 2022 marketing year at a record of 30% of the marketable crop. This considerable increase in almond inventories will likely depress prices for the nextfew years and force almond producers to adjust to the new realities of an uncertain global trade environment. Whilegthe maritime shipping disruptions started to attenuate in late 2022, the trade disruptions caused by retaliatory tariffs will likely remain a major challenge for U.S. almond exports without decisive policy actions.

The research allows us to draw three main policy recommendations. First, policymakers should review U.S. Section 232 tariffs on steel and aluminum products and negotiate the withdrawal of retaliatory tariffs imposed by China, India, and Turkey. As a result of the Phase One deal, China implemented a waiver program on their Section 301 retaliatory tariffs. If no progress is made, China could eliminate this waiver program, which would have a detrimental impact on California almond exports to China. Lifting the remaining retaliatory tariffs could increase U.S. almond exports to key growth markets by about $145 million or 60 million lb annually.

Second, federal and state governments must invest in port infrastructure, ensure the availability of shipping containers/equipment, and facilitate maritime market access for the U.S. almond industry. Global container shipping disruptions reduced California almond exports by more than $295 million in Q1/2022 alone, causing significant disruptions in international and domestic almond markets. The bipartisan Ocean Shipping Reform Act of 2022 (passed on June 13, 2022) is a step in the right direction. It levels the playing field for U.S. almond exporters by providing the Federal Maritime Commission with the tools to oversee international ocean carriers effectively. USDA programs, such as the Partnership to Ease Port Congestion and Restore Disrupted Shipping Services, are critical to increasing capacity at the Port of Oakland and the Northwest Seaport Alliance. They could help to develop alternative solutions for domestic and international shipping, which will help improve services for shippers of California almonds in the future. Additional measures must be taken to reduce foreign trade barriers and ensure the almond industry’s long-term economic success and sustainability.

Third, trade negotiators must engage with policymakers in crucial export markets to ensure fair and equitable access to those markets under similar conditions as the leading competitor. California’s almond industry lost significant market share in China and India to Australia, which enjoys preferential access to those markets. This preferential market access makes California almonds less competitive in international markets, implying that it should be a goal of federal policy makers to provide fair and equitable conditions for U.S. almond exports.

Almond Board of California. 2022. “Crop Reports.” Available online: https://www.almonds.com/tools-and-resources/crop-reports

Bown, C.P. 2019. “Trump’s Mini-Trade War with India.” Trade and Investment Policy Watch. Peterson Institute for International Economics. Available online: https://www.piie.com/blogs/trade-and-investment-policy-watch/trumps-mini-trade-war-india

Carter, C.A., and S. Steinbach. 2019. “Impact of the U.S.-China Trade War on California Agriculture.“ Agricultural and Resource Economics Update 23(3): 9–11.

Carter, C.A., and S. Steinbach. 2020. “The Impact of Retaliatory Tariffs on Agricultural and Food Trade.” NBER Working Paper w27147.

Carter, C.A., and S. Steinbach. 2022. “California Almond Industry Harmed by International Trade Issues.” Agricultural and Resource Economics Update 26(1): 1–4.

Carter, C.A., S. Steinbach, and X. Zhuang. 2021. “‘Containergeddon’ and California Agriculture.” Agricultural and Resource Economics Update 25(2): 1–4.

Carter, C.A., S. Steinbach, and X. Zhuang. 2022a. “Global Shipping Container Disruptions and US Agricultural Exports.” Working Paper 943-2022-718. Available online: https://10.22004/ag.econ.320397

Carter, C.A., S. Steinbach, and X. Zhuang. 2023. “Supply Chain Disruptions and Containerized Agricultural Exports from California Ports.” Applied Economic Perspectives and Policy 45(2): 1–21.

Fajgelbaum, P.D., P.K. Goldberg, P.J. Kennedy, and A.K. Khandelwal. 2020. “The Return to Protectionism.” Quarterly Journal of Economics 135(1): 1–55.

Grant, J.H., S. Arita, C. Emlinger, R. Johansson, and C. Xie. 2021. “Agricultural Exports and Retaliatory Trade Actions: An Empirical Assessment of the 2018/2019 Trade Conflict,” Applied Economic Perspectives and Policy 43(2): 619–640.

Sumner, D.A., W.A. Matthews, J. Medellín-Azuara, and A. Bradley. 2016. “The Economic Impacts of the California Almond Industry.” UC Agricultural Issues Center. Available online: https://aic.ucdavis.edu/almonds/Economic Impacts of California Almond Industry_Full Report_FinalPDF_v2.pdf

Steinbach, S., and X. Zhuang. 2023. “The Impact of Maritime Shipping Disruptions on US Tree Nut Exports and Inventories.” Agribusiness: forthcoming. First published online, https://doi.org/10.1002/agr.21809

U.S. Department of Agriculture. 2021. “Tree Nuts: World Markets and Trade.” Washington, DC: USDA Foreign Agricultural Service. Available online: https://downloads.usda.library.cornell.edu/usda-esmis/files/tm70mv16z/n296xz43s/6682z4061/TreeNuts.pdf

U.S. Department of Agriculture. 2022. “Crop Values 2021 Summary - February 2022.” Washington, DC: USDA National Agricultural Statistical Service. Available online: https://downloads.usda.library.cornell.edu/usda-esmis/files/k35694332/gb19g8865/jd474051x/cpvl0222.pdf

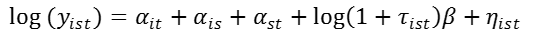

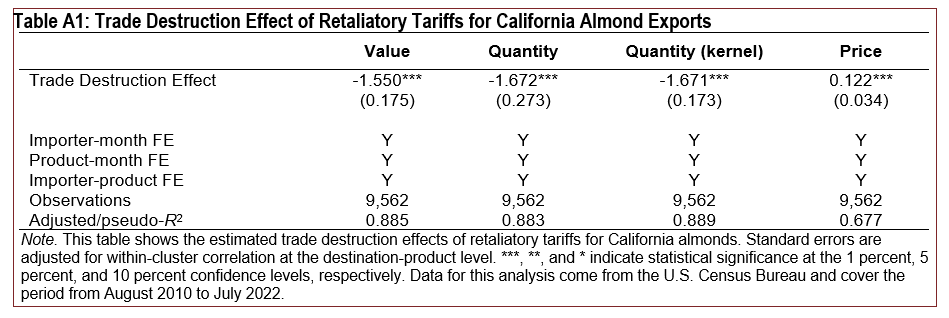

To measure the impact of the retaliatory tariff increases on exports of California almond products, we follow Carter and Steinbach (2020) and Fajgelbaum et al. (2020) to quantify the trade effects for export quantities, values, and prices with the following specification:

where τist represents the ad valorem retaliatory tariff imposed by export destination i against product s at time t. β is the parameter of interest and measures the trade destruction effect of retaliatory tariffs imposed against California almond exports. The exponential regression model includes destination-product (αis), product-time (αst), and destination-time (αit) fixed effects, which allows us to exploit retaliatory tariff variation between targeting countries (India, China, and Turkey) and nontargeting countries over time. We follow Fajgelbaum et al. (2020) and estimate the relationship using the ordinary least squares (OLS) method while accounting for the high-dimensional fixed effects with a modified version of the iteratively reweighted least-squares (IRLS) algorithm that is robust to statistical separation and convergence issues. Following standard practice, we assume that the standard errors are correlated at the destination-product level, prompting us to cluster them at this level. Table A1 summarizes the estimated trade destruction effects of r

where τist represents the ad valorem retaliatory tariff imposed by export destination i against product s at time t. β is the parameter of interest and measures the trade destruction effect of retaliatory tariffs imposed against California almond exports. The exponential regression model includes destination-product (αis), product-time (αst), and destination-time (αit) fixed effects, which allows us to exploit retaliatory tariff variation between targeting countries (India, China, and Turkey) and nontargeting countries over time. We follow Fajgelbaum et al. (2020) and estimate the relationship using the ordinary least squares (OLS) method while accounting for the high-dimensional fixed effects with a modified version of the iteratively reweighted least-squares (IRLS) algorithm that is robust to statistical separation and convergence issues. Following standard practice, we assume that the standard errors are correlated at the destination-product level, prompting us to cluster them at this level. Table A1 summarizes the estimated trade destruction effects of r etaliatory tariffs for California almond exports. The results indicate that California almond exports contracted by 1.7% (in value terms) with each additional percentage point of retaliatory tariffs imposed in response to the trade war. The estimates align with earlier work by Carter and Steinbach (2019) and Grant et al. (2021), which showed that retaliatory tariffs imposed by China are the major driver of trade destruction for almonds.

etaliatory tariffs for California almond exports. The results indicate that California almond exports contracted by 1.7% (in value terms) with each additional percentage point of retaliatory tariffs imposed in response to the trade war. The estimates align with earlier work by Carter and Steinbach (2019) and Grant et al. (2021), which showed that retaliatory tariffs imposed by China are the major driver of trade destruction for almonds.

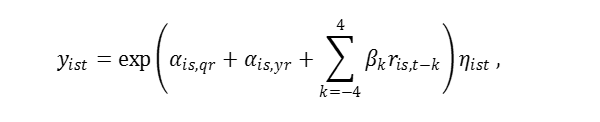

To assess the dynamic treatment effects of container shipping disruptions on California almond exports, we follow Carter, Steinbach, and Zhuang (2022) and use a non-linear panel regression model for count data with dynamic treatment effects specified as follows:

where we denote the foreign destination with i, the product with s, and the quarter with t. We define the outcome variable with yist and study four primary outcomes, namely the free-on-board value, the quantity without and without kernel conversion, and the unit value (defined as the value/divided by the kernel quantity). The model indicates fixed effects at the product-destination-quarter level with αis,qr and the product-destination-year level with αis,yr. These fixed effects account forunobserved factors that could confound the relationship of primary interest at the product-destination level. The term k=-44βkris,t-k measures the dynamic treatment effects of container shipping disruptions on California almond exports. We center the event study on the fourth (May to July) almond marketing quarter in the 2021/22 marketing year. The reason for implementing this setting is that port congestion and container shortages became major bottlenecks in this period (Carter, Steinbach, and Zhuang, 2021). Following standard practice in the event study literature, we use a symmetric event window that extends four quarters before and after the event. This approach allows us to account for potential pre-trends and test for leveling off treatment effects. We rely on the Poisson pseudo maximum likelihood (PML) estimator to identify the relationship between the count outcome and the treatment variables. We follow standard practice in the trade literature and cluster standard errors at the destination-product level.

We present the event study estimates for the trade effects  of container shipping disruptions on California almond exports in Figure B1. The value specification in panel (a) provides evidence for gradually increasing adverse treatment effects for three consecutive quarters before reaching the largest negative treatment effects in event quarter 3 (November, December, and January of the marketing year 2021/2022). We observe an easing of the adverse trade effects in the following event quarter. The average post-event treatment effect is -0.051 log points for the value specification. Although the event coefficients are not statistically significant, the trends of post-treatment effects are consistent for all specifications. The quantity specification with and without kernel conversion presented in panels (b) and (c) draw similar robust pictures of adverse treatment effects for almond exports. The average post-event treatment effects are -0.137 and -0.157 log points. They are considerably larger than that for the value specification, pointing toward positive price effects during the post-event periods, as shown in panel (d). For the kernel quantity specification in panel (c), the event coefficients are statistically significant from event quarter 0 (May, June, and July of the marketing year 2021/2022) to event quarter 2 (November, December, and January of the marketing year 2022/2023). The average treatment effect reaches its largest level at -0.321 log points below the counterfactual in event quarter 2. At the same time, almond export recovery is observable for event quarters 3 and 4.

of container shipping disruptions on California almond exports in Figure B1. The value specification in panel (a) provides evidence for gradually increasing adverse treatment effects for three consecutive quarters before reaching the largest negative treatment effects in event quarter 3 (November, December, and January of the marketing year 2021/2022). We observe an easing of the adverse trade effects in the following event quarter. The average post-event treatment effect is -0.051 log points for the value specification. Although the event coefficients are not statistically significant, the trends of post-treatment effects are consistent for all specifications. The quantity specification with and without kernel conversion presented in panels (b) and (c) draw similar robust pictures of adverse treatment effects for almond exports. The average post-event treatment effects are -0.137 and -0.157 log points. They are considerably larger than that for the value specification, pointing toward positive price effects during the post-event periods, as shown in panel (d). For the kernel quantity specification in panel (c), the event coefficients are statistically significant from event quarter 0 (May, June, and July of the marketing year 2021/2022) to event quarter 2 (November, December, and January of the marketing year 2022/2023). The average treatment effect reaches its largest level at -0.321 log points below the counterfactual in event quarter 2. At the same time, almond export recovery is observable for event quarters 3 and 4.