On May 18, 2017, the Trump administration notified Congress of its plans to renegotiate the 23-year-old North American Free Trade Agreement (NAFTA), whose partners include Canada, Mexico, and the United States (U.S. Trade Representative, 2017). In general, any notification to Congress is followed by a 90-day period of consultation between Congress and the U.S. Trade Representative (USTR) (U.S. Trade Representative, 2017). Mexico expects the NAFTA renegotiation to be completed by the end of 2017, before Mexico’s next general election in July 2018 (Rampton, 2017). However, many experts believe that it may take longer to reach agreement among the NAFTA partners.

In light of the renegotiation, it is important to understand and highlight potentially thorny issues that may crop up among NAFTA partners. This article focuses on the sweetener trade between the United States and Mexico and includes a timeline of historical disputes. Sugar, high fructose corn syrup (HFCS), and glucose constitute approximately 93% of total sweetener consumption in the United States (Lakkakula, Schmitz, and Ripplinger, 2016), with other sweeteners—such as honey, maple syrup, and artificial sweeteners—accounting for the remaining 7%. In this article, “sweeteners” refers mainly to sugar (derived from cane and beets) and HFCS unless otherwise stated.

In order to understand NAFTA, it is important to note its origins. NAFTA came into effect on January 1, 1994. As part of NAFTA, tariffs were reduced on U.S. sugar imports exceeding predetermined volumes from Mexico. For more information on phased-out tariffs, see Haley and Suarez (1999). Essentially, NAFTA served as a transition phase (between 1994 and 2007) for the integration of the North American market. However, sugar and sweeteners are the least integrated sector compared to other major agricultural sectors, due mainly to the influence of U.S. and Mexican sugar lobbies (Hendrix, 2017).

Due to NAFTA integration in 2008, U.S. sugar imports from Mexico increased moderately from 2008-2012, with substantial increases in imports from 2012 onwards. This was primarily due to the rise in cultivated acres and a good crop year in Mexico, which led to increased competition between the U.S. and Mexican sugar industries (Zahniser et al., 2016). Subsequently, the American Sugar Coalition and its members filed anti-dumping (AD) and countervailing (CV) duties to the U.S. Department of Commerce and the U.S. International Trade Commission (USITC) about the negative effects of increased Mexican sugar imports to the United States (see Zahniser et al., 2016, for a comprehensive review of domestic sugar policies in both the United States and Mexico). Figure 1 illustrates U.S. domestic sugar policy, which consists of supply controls, price supports, tariff rate quotas (TRQs), and import access under free trade agreements, while Mexican sugar policy consists of price supports, tariffs, and import access under free trade agreements (Zahniser et al., 2016). For example, the United States imposes an in-quota tariff of 0.625 cents per pound on sugar imports and over-quota tariffs of 15.36 cents per pound on raw sugar imports and 16.21 cents per pound on refined sugar imports, while Mexico imposes an import tariff of 16 cents per pound on sugar (for more details, refer to Zahniser et al., 2016).

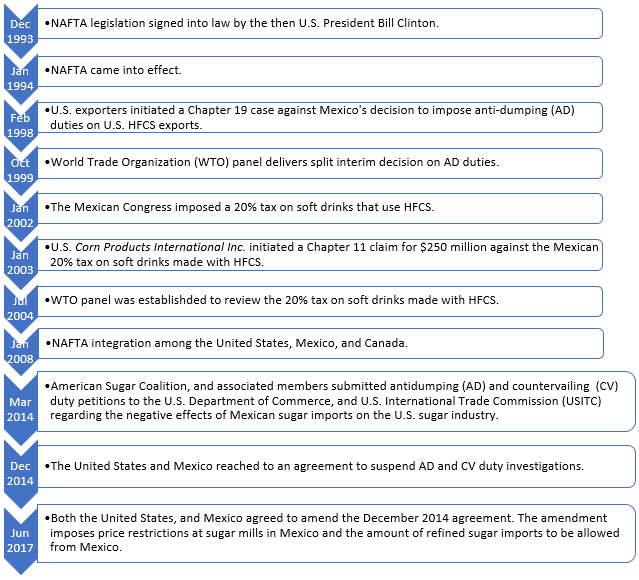

Since NAFTA’s inception, there have been widespread sweetener-related disputes between the United States and Mexico. Table 1 shows a timeline of major events and disputes related to sweeteners between the two countries (Hufbauer and Schott, 2005; Zahniser et al., 2016). In the timeline, two terms (Chapters 11 and 19) need clarification. In NAFTA, Chapter 11 provides investors with guidelines for a dispute settlement mechanism among NAFTA countries. Chapter 19 contains a mechanism for resolving trade disputes, including anti-dumping (AD) and countervailing (CV) duties between any two NAFTA countries (Hufbauer and Schott, 2005).

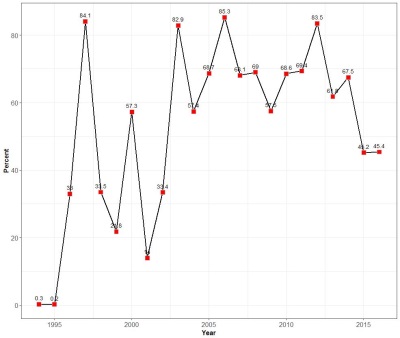

In the upcoming NAFTA renegotiation, the quantity of refined sugar imports from Mexico into the United States could be a significant issue. Figure 2 shows the share of the U.S. refined sugar imports as a percentage of total sugar imports from Mexico between 1994 and 2016. The percentage of U.S. refined sugar imports increased from 0.3% in 1994 to 85.3% in 2006 before decreasing to 45.4% in 2016. The American Sugar Alliance (ASA), which represents sugar processors, believes that current levels of refined sugar imports are too high and wants Mexican refined sugar imports to be below 30%.

Notes: Refined sugar includes two Harmonized System (HS)

codes: 1701.91 and 1701.99, while total U.S. sugar imports

includes HS codes 1701.11, 1701.12, 1701.13, 1701.14, and

1702.90 in addition to the two refined sugar HS codes.

Source: Authors’ calculations based on data collected from

the USDA-Foreign Agricultural Service (U.S. Department of

Agriculture, 2017a).

U.S. refined sugar imports from Mexico are currently about 53% (U.S. Department of Commerce, 2017). Although the issue seems to have been resolved in a recent trade agreement on June 6, 2017, this agreement could be temporary. In renegotiation, the issue of raw versus refined sugar imports could be re-examined, depending on other sweetener trade concessions that might take place between the United States and Mexico.

On July 17, 2017, the USTR office released a document laying out the U.S. objectives for the NAFTA renegotiation. One of the main objectives is reducing the trade deficit with other NAFTA countries (U.S. Trade Representative, 2017). However, it is unclear whether the reference to reducing trade deficit is in terms of overall trade or trade in a particular commodity between the countries.

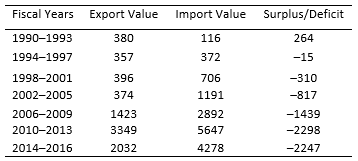

Table 2 shows the sweetener trade balance in value terms between the United States and Mexico between 1990 and 2016. Before 1994, when NAFTA came into effect, the United States had a cumulative $264 million surplus in sweetener trade for 1990–1993. After 1994, Mexico has consistently enjoyed an increasing trade surplus with the United States (Table 2).

Notes: Sweetener trade between the United States and

Mexico included all 19 HS codes referring to various

forms of sugar, fructose, glucose, molasses, syrups, etc.

Source: Authors’ calculations based on data collected

from the USDA-Foreign Agricultural Service (U.S.

Department of Agriculture, 2017a).

The United States could possibly try to (re)negotiate to reduce the sweetener trade deficit with Mexico. There are several ways this could be accomplished. A country’s trade deficit may be reduced through several different policy instruments, including import controls, exchange rate devaluation, price restrictions, and policies that improve the competitiveness of goods. Import controls may include tariffs, quotas, and TRQs.

Price restrictions could include both the price at which Mexican sugar enters the United States and price restrictions within Mexico. For example, in the recent agreement between the United States and Mexico, both parties agreed to increase the price of raw sugar from 22.25 cents per pound to 23 cents per pound and the price of refined sugar from 26 cents per pound to 28 cents per pound at sugar mills in Mexico (U.S. Department of Commerce, 2017). With the price increase at Mexican mills, the U.S. sugar industry hopes to prevent the dumping of Mexican sugar imports into the United States.

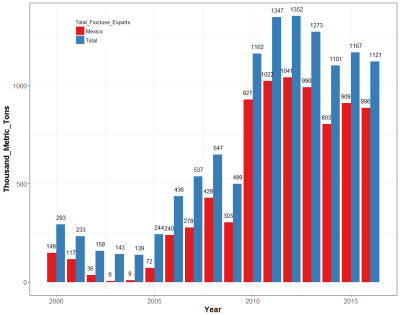

Figure 3 shows the importance of U.S. total fructose exports to Mexico. Total fructose exports include HFCS–42, HFCS–55, and crystalline fructose. HFCS–42 contains 42% fructose and HFCS–55 contains 55% fructose. Total U.S. fructose exports grew from 647 thousand metric tons in FY2008 to 1,121 thousand metric tons in FY2016 (Figure 3). Similarly, U.S. fructose exports to Mexico have increased from 428 thousand metric tons in FY2008 to 886 thousand metric tons in FY2016. The U.S. share of total fructose exports to Mexico increased from 50% in FY2000 to 66% in FY2008 and to 79% in FY2016 (authors’ calculations from USDA sugar and sweeteners yearbook tables). Essentially, almost the entire growth in total fructose exports from the United States has been due to increased exports to Mexico. Hence, it is expected that the Corn Refiners Association (CRA), which safeguards the interests of U.S. HFCS, will continue to push total HFCS/fructose exports to Mexico in light of decreased per capita consumption of HFCS in the United States (Lakkakula and Schmitz, 2013).

Source: Authors’ computations based on data collected from

the USDA’s Sugar and Sweeteners Yearbook Tables 34a and

34b (U.S. Department of Agriculture, 2017b).

The Mexican soft drink industry first began to use HFCS in 1996 (Flores and Francis, 1998). Mexico’s per capita consumption of soft drinks is second only to that of the United States worldwide (Buzzanell, 1997). The share of HFCS consumption as a percentage of overall sweetener consumption has been growing steadily in Mexico. For example, Lakkakula and Schmitz (2013) find that the share of HFCS consumption as a percentage of total sweetener consumption in Mexico increased from about 5% in 2001/2002 to about 27% in 2011/2012.

Like the CRA in the United States, the Maize Food and Chemical Derivatives Industry (IDAQUIM)—the industry group that safeguards the interests of HFCS producers in Mexico—indicated that Mexico’s two wet milling plants for HFCS are operating at full capacity (Flores and McLeod, 2017). These two plants are subsidiaries of U.S. firms: 1) Arancia, associated with the U.S. firm Corn Products International, and 2) Almidones Mexicanos, associated with Archer Daniels Midland (ADM) Co. (Hufbauer and Schott, 2005). Currently, the Mexican HFCS industry uses about 2 million tons of yellow corn for annual HFCS production of approximately 520 thousand metric tons (Flores and McLeod, 2017). Like the sugar associations in the United States, the sugar industry in Mexico is very influential. Historically, Mexico’s sugar industry has successfully restricted the use of HFCS in Mexican soft drinks (Buzzanell, 1997).

Mexico is also an important market for U.S. corn. In marketing year 2015/16, 27.9% of total corn exports originating from the United States are exported to Mexico (authors’ calculations based on USDA export data). In the same marketing year, Mexico replaced Japan as the top export destination for U.S. corn. For HFCS production in Mexico, the domestic HFCS industry utilizes about 10–20% of No. 2 yellow corn produced in Mexico through contracts with Mexican farmers (Flores and McLeod, 2017). The remaining 80–90% of yellow corn needed for producing HFCS in Mexico comes from the United States (Flores and McLeod, 2017).

Enforcing trade agreements is one of the key issues that may emerge during the NAFTA renegotiation. In the recent amendment to the suspension agreements, the United States and Mexico agreed to impose penalties on parties violating the trade agreement. For example, if the party from Mexico is found to be in violation of the agreement, the amount of their sugar exports to the United States will be penalized. Depending on the frequency of the violations, sugar exports from Mexico to the United States could be reduced by 50% or more, compared to pre-violation volumes (U.S. Department of Commerce, 2017).

Overall, the sweetener trade between the United States and Mexico is likely an example of a “tit-for-tat” strategy between sugar industry groups and HFCS industry groups in both countries, especially in Mexico. For example, if the United States intends to restrict the quantity of sugar imports from Mexico, then Mexico will restrict HFCS imports from the United States. If the United States successfully restricts sugar imports, then Mexico might be better off substituting their sugar for HFCS in the soft drink industry rather than exporting their excess sugar to countries other than the United States, which may not be profitable.

The U.S. and Mexican sweetener industries have long been involved in disputes and have agreed to several side agreements apart from NAFTA. Sugar associations filed antidumping (AD) and countervailing (CV) duty petitions to U.S. institutions in response to an increase in Mexican sugar imports. Later, both the United States and Mexico reached to an agreement to suspend AD and CV duty investigations in order to facilitate new quantity and price restrictions on Mexican sugar imports.

This article highlights key issues that may crop up during the NAFTA renegotiation and the complexities in the North American sweetener market. The key issues include the U.S. sweetener trade balance, price restrictions on Mexican sugar, refined versus raw sugar imports into the United States, total fructose exports and corn exports into Mexico, and enforcing agreements.

Despite the continuous disputes surrounding sweeteners, the U.S. and Mexican sugar industries have one common goal—maintaining high sugar prices and adequate supplies in their respective countries. All strategies related to the sweetener trade between the United States and Mexico are intended to increase the economic rent of one sweetener group at the expense of the other.

Buzzanell, P. 1997. “The North American Sugar Market: Recent Trends and Prospects Beyond 2000.” Paper presented at the Fiji/FAO 1997 Asia Pacific Sugar Conference, October 29–31, Fiji.

Flores, D., and N.E. Francis. 1998. Mexican Sugar Exports to Increase. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/scriptsw/attacherep/display_gedes_report.asp?Rep_ID=25330710

Flores, D., and L. McLeod. 2017. Mexico Sugar Annual Report 2017. Washington, DC: U.S. Department of Agriculture, Foreign Agricultural Service, GAIN Report MZ7012, April. Available online: https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Sugar%20Annual_Mexico%20City_Mexico_4-20-2017.pdf

Haley, S., and N. Suarez. 1999. US–Mexico Sweetener Trade Mired in Dispute. Washington, D.C.: U.S. Department of Agriculture, Agricultural Outlook (September): 17–20.

Hendrix, C.S. 2017. “Agriculture in the NAFTA Renegotiation.” In C.F. Bergsten and M. de Bolle, eds. A Path Forward for NAFTA. Washington, DC: Peterson Institute for International Economics, pp. 101–112.

Hufbauer, G.C., and J.J. Schott. 2005. NAFTA Revisited: Achievements and Challenges. Washington D.C.: Peterson Institute for International Economics.

Lakkakula, P., and A. Schmitz. 2013. “Sugar and High Fructose Corn Syrup Consumption Shifts: Change in Tastes or Relative Prices?” International Sugar Journal 115(1376):556–559.

Lakkakula, P., A. Schmitz, and D. Ripplinger. 2016. “US Sweetener Demand Analysis: A QUAIDS Model Application.” Journal of Agricultural and Resource Economics 41(3):533–548.

Rampton, R. 2017, July 7. “Trump Hails NAFTA Progress, Mexico Eyes General Deal by End-2017.” Reuters. Available online: https://www.reuters.com/article/us-g20-germany-trump-mexico/trump-hails-nafta-progress-mexico-eyes-general-deal-by-end-2017-idUSKBN19S1WI

U.S. Department of Agriculture. 2017a. Global Agricultural Trade System Online. Foreign Agricultural Service, Washington, D.C. Available online: https://apps.fas.usda.gov/gats/ExpressQuery1.aspx

U.S. Department of Agriculture. 2017b. Sugar and Sweeteners Yearbook Tables. Economic Research Service, Washington, D.C. Available online: https://www.ers.usda.gov/data-products/sugar-and-sweeteners-yearbook-tables.aspx

U.S. Department of Commerce. 2017. U.S. and Mexico Strike Deal on Sugar to Protect U.S. Growers and Refiners, Ensure Supply to Consumers. Bureau of the Census, Washington, D.C., June. Available online: https://www.commerce.gov/news/press-releases/2017/06/us-and-mexico-strike-deal-sugar-protect-us-growers-and-refiners-ensure

U.S. Trade Representative. 2017. Summary of Objectives of the NAFTA Renegotiation. Washington, D.C., July. Available online: https://ustr.gov/sites/default/files/files/Press/Releases/NAFTAObjectives.pdf

Zahniser, S., L. Kennedy, G. Nigatu, and M. McConnell. 2016. A New Outlook for the US-Mexico Sugar and Sweetener Market. Washington, D.C.: U.S. Department of Agriculture, Economic Research Service, SSSM-335-01, August.