After a bruising trade war, China imported world record levels of corn in 2020/21, well beyond the record from any other importer ever and well above the official tariff-rate quota (TRQ) for corn of 7.2 million metric tons (MMT) in 2020. While imports have remained strong since, it is still unclear whether we are seeing a shift where China is now the largest structural importer of corn. As has occurred in the past, the current import surge could be a temporary phenomenon and corn imports could revert to levels at or below the 7.2 MMT TRQ.

I argue in this article that China’s corn imports will likely continue at robust levels, with the 7.2 MMT TRQ no longer relevant as a cap on imports. China’s underlying corn supply and demand, however, are unknown, making it impossible to estimate or forecast corn import demand directly. Instead, I point to China’s efforts to modernize swine and other livestock industries, which I argue will increase demand for corn and corn imports in particular. I also argue that China’s eventual adoption of genetically engineered (GE) corn will not result in dramatic yield increases. Last, I argue that the greater role of state-trading enterprises (STEs) for corn imports in recent years addresses the concerns of some senior officials about over reliance on foreign suppliers. Together, these trends will likely result in China becoming a sustained large corn importer for several years. Because a corn import program would help China better manage scarce land and water resources, industry stakeholders and policy advocates in China have been arguing for decades that increased corn imports would be good for China.

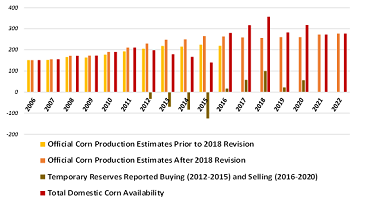

Estimating corn production and consumption, necessary to estimate import demand, is challenging in any country but especially difficult in China. While this has been the case for many years, several events over the last decade further elucidate the difficulty of using officialcorn production and availability estimates. One event (or series of events) was China’s “temporary reserve” program to purchase corn and hold it off the market temporarily to support prices. This program reportedly accumulated over 300 MMT of domestic corn from China’s 2012–2015 corn harvests in Northeast China (Figure 1). These temporary reserves were then sold at auctions carried out over the summer in 2016 through 2020, which reportedly sold over 250 MMT of corn. Also in 2018, China’s National Bureau of Statistics (NBS) published a major upward revision of corn sown area, and thus production, for the years 2006–2016 in their 2018 Statistical Yearbook. The revision caused production estimates for 2016 alone to increase by 20%, or over 44 MMT, above the estimate published in the 2017 Statistical Yearbook, and the cumulative total increase in production estimates over 2006–2016 summed to 223 MMT.

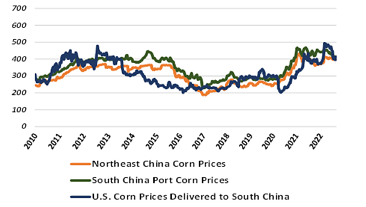

While the temporary reserve program clearly had an effect on corn prices in China, particularly in 2013–2015, the purchases and auction sales were implausibly large. For example, the temporary reserve program reportedly procured 125 MMT of China’s 2015 corn crop, which is nearly half of the entire crop and far more than the roughly 100 MMT of production in China’s Northeast Provinces, where the program was carried out. Even the record imports of corn, distiller’s dried grains with solubles (DDGS), barley, and sorghum that year—which summed to 23 MMT—do not come close to filling the gap in supply that would occur if 125 MMT of corn were purchased and held off the market. Despite the aggressive purchases, prices softened through latter half 2015, then held at around $300/MT through the fall and into the spring of 2016, the period when these purchases occurred (Figure 2). This seems to be a fairly modest impact if such a large volume of corn had actually been taken off the market and put into storage. A few years later, in 2018, the temporary reserves held auctions over the summer that reportedly sold 100 MMT of corn and, again, prices hardly changed.

Implausible or not, China’s leaders apparently believed the large corn stock numbers under the temporary reserve program. To draw down the reported large corn stocks, 15 ministries in China jointly announced ambitious corn ethanol expansion plans in September 2017, with the goal of nearly all of China’s gasoline to be blended with 10% ethanol (E10) by 2020. The ethanol program introduced in 2017 echoed the ethanol expansion plans China embarked on in the early 2000s, which also were motivated by the belief that China held excessive corn stocks. But the ethanol expansion plans in early 2000s were scaled back mid-decade as China’s leaders realized that the excessive stocks did not truly exist, and corn and pork prices rose significantly (Dong, 2007). The same thing happened following the 2017 ethanol expansion plans. Only a few regions actually established E10 programs, and China’s leadership quietly backed off its ambitious plans in 2020 when corn prices rallied. This reversal in ethanol expansion is an indication that even China’s leaders are not certain about aggregate corn availability and are concerned that is it not sufficient to embark on an ethanol program.

While a solid understanding of corn production and availability in China is elusive, understanding corn demand is even more elusive. Estimating corn feed demand is always tricky, but in China, major inconsistencies in livestock production and consumption estimates—coupled with widespread use of other, non-corn products in feed rations—makes estimates of corn feed demand particularly difficult (Lohmar, 2015, 2016). Despite this uncertainty, nearly all observers were certain that the outbreak of African Swine Fever (ASF), which hit China in latter half of 2018 and resulted in an estimated 40% reduction in China’s swine inventories by Spring 2019, would cause corn feed demand to decline significantly.

This, however, did not appear to occur. When live hog prices in China finally responded to the ASF outbreak in the latter half of 2019, indicating that swine inventories had indeed been significantly reduced by the outbreak, corn prices had been holding steady in the preceding months, causing many observers to wonder whether and when corn prices would be affected by what should have been a major decrease in corn demand. But not only did corn prices not soften, they began to rally in January 2020.

The 2020 corn price rally in China surprised everyone. Prices rose from roughly $280/MT in South China in January 2020 to $460/MT in January 2021, an over 60% increase in corn prices over the year (see Box 1). This rally occurred despite not only significantly reduced swine inventories and associated reduced feed demand but also near-record corn production in 2019 and 2020, corn supplies bolstered by continued reserve auction sales over the summers of 2019 and 2020, and record corn imports prompted by the U.S.-China Phase One agreement signed in January 2020.

The events from 2012 through 2021 generated considerable uncertainty over China’s underlying corn supply and demand and underscore the ineffectiveness of relying on sources of corn supply and demand information to forecast China’s corn import demand. China’s leaders, however, have made several decisions in recent years that suggest sustained corn imports going forward.

The huge spike in hog and pork prices from the ASF outbreak not only generated record pork imports but also induced China’s leaders to issue a tranche of approvals for new, large production facilities, approvals that had been slowed by environmental concerns since 2015. These approvals were followed by enormous investments in modern swine production facilities, many of which are among the largest swine facilities in the world (Xiong, Zhang, and Chen, 2021). By one account, investments into new swine facilities in 2020 were four times the level seen in 2019 (Euromeat News, 2023). While these investments are nearly all by private enterprises, the wave of approvals, after years of reluctance by local environmental officials to approve new facilities, is an indication that China’s leadership wants to foster domestic swine production and not rely on imported pork.

Many argue that since modern swine operations exhibit improved feed efficiency (a lower feed conversion ratio, or FCR), swine industry modernization in China will decrease overall feed demand and the demand for corn. However, the increased feed efficiency is brought about in part by increasing corn use to replace inferior products in feed rations in China. As demonstrated in Box 1, the increased corn inclusion effect greatly overcompensates for the feed efficiency effect, resulting in an overall increase in corn feed demand.

A more modern swine industry in China may also generate more demand for, and tolerance of, corn imports. Prominent and influential stakeholders in China’s feed and livestock industry have been among the most outspoken advocates of increasing the corn TRQ and allow for more corn imports in the past. These operations want access to imports not only to increase overall corn supplies but also to blend with local corn that contains mycotoxins. China’s domestic corn is still predominantly stored, at least initially, outside in yards or on the roofs of houses, exposing it to moisture and pests that can result in fungus; as a result, China’s domestic corn supply exhibits significant incidences of mycotoxins (Sun, Su, and Shan, 2017). Corn produced in the large exporting countries is much less likely to be exposed to these risks as it is stored and marketed. U.S. corn markets, in particular, have measures in place to prevent corn with moderate levels of some mycotoxins from entering export markets.

Whether the new, large swine operations can effectively operate while ASF remains endemic is a major question. High-quality feed with low mycotoxin levels will certainly help, but ASF is highly contagious, and an outbreak could still cause a major disruption in pork production. However, the approvals for these operations are a strong indication that China seeks to maintain its own domestic pork production, and other decisions made by China’s leadership suggest that domestic swine production may rely more on imported corn.

China’s adoption of genetically engineered (GE) corn, which has been imminent for well over a decade now, has long been viewed as a “silver bullet” to finally bring corn yields in China close to yields enjoyed in the United States. Two decades ago, China was on the forefront of the development of GE technologies, with significant public research expenditures and widespread public acceptance of the technology. Around 2010–2012, a series of events and scandals caused public acceptance to plummet, and commercialization of new technologies developed under the public research programs was put on hold (Xiao and Kerr, 2022). This opposition to GE crops included high-level leaders of the government and military describing an imperialist plot to poison China’s population with GE corn (and soybeans, Pray et. al, 2016, and conversations with various stakeholders by the author). Despite continued concerns about the safety of genetic engineering among the general public and high-level leaders, China’s Ministry of Agriculture and Rural Affairs (MARA) announced a tranche of approvals for the domestic cultivation of GE crops since late 2021, including eight new corn traits, as well standards for developers applying for GE corn (and soybean) regulatory approval (USDA, 2022).

Given the tense and fraught political economy over GE crops in China, the fact that MARA is decidedly moving forward with the development of this technology is yet another indication that China’s leaders are concerned about future corn supplies and their capacity to meet domestic corn demand. These approvals are only the first step in the ultimate commercialization of GE corn, and one can expect that the road to widespread legal adoption of GE corn will be rocky, with continued bumps and reversals.

GE corn varieties, however, may not have a significant impact on corn yields in China. Indeed, given reports of farmers in China already using “pest-resistant” corn that is widely believed to be illegal GE corn, the impact may have already occurred. Moreover, China does not have rootworm, a tenacious pest that is very difficult to combat with pesticides and prevalent in corn-producing regions of North and South America. Pest pressure in China is from primarily above-ground pests that can be addressed through costly but effective pesticide applications. The findings of research into the effects of Bt cotton adoption in China, which occurred over 20 years ago, and research on experimental plots of Bt rice echo the idea that GE corn won’t be a silver bullet for corn yields in China. In those studies, labor and pesticide costs decreased substantially, farmer health outcomes improved, but yields increased less than 10%, with some studies finding no statistically significant yield effect (Pray et al., 2002; Huang et al, 2005). General equilibrium scenarios reported in Pray et. al (2016) indicate that GE corn adoption will have no impact on China’s food security (defined as corn self-sufficiency).

Such conclusions should not be a surprise when comparing China’s corn yields to major corn producers other than the United States. Both Brazil and South Africa have corn yields below the official yield estimates in China, and both those countries have embraced GE corn. Argentina has also embraced GE corn and has yields that are above China’s but also well below yields in the United States.

China’s soils may well be the real constraint on increasing corn yields, which will require increasing plant populations. After decades of planting corn after corn and engaging in practices that reduce organic matter (such as removing all stalks and leaves and using chemical fertilizer rather than manure), China’s soils are likely depleted of nutrients and lack soil structure. It is no wonder that even at the low plant populations seen in China’s corn fields, ears exhibit tip-back, a sign that the still low plant population has exhausted the nutrient availability in the soil, leaving insufficient nutrients to increase the plant population and, therefore, yields.

Prior to joining the WTO in 2001, China imported all grains through COFCO, the state-trading enterprise (STE) that held a monopoly on grain imports. WTO accession broke this up with a TRQ that was partly allocated to private end users, who received 40% of the 7.2 MMT quota (or 2.88 MMT of corn imports), with COFCO granted the remaining 60%, or 4.32 MMT, of the TRQ. COFCO, however, never imported its entire 4.32 MMT quota prior to 2020, even during the period 2013–2016, when China’s corn prices were well above global prices, at some points reaching a $150/MT import margin. Because of this, China’s corn imports remained well below its 7.2 MMT TRQ despite strong incentives to import. This is an indication that, when it comes to grain trade, China’s leaders are willing to intervene in COFCO’s commercial decisions, even when there are hundreds of millions of dollars in profits at stake. The United States challenged China’s TRQ administration in 2016, with non-filled quota during the period of high import margins central to the overall case. The WTO’s Dispute Settlement Body (DSB) sided with the United States, and China decided not to appeal the DSB’s decision.

China’s obligation to import large volumes of U.S. agricultural products under Phase One trade deal negotiated by the Trump administration, along with the domestic corn price rally over the year 2020, caused China not only to fill the TRQ but also to import well beyond the 7.2 MMT for the first time ever for corn in 2020, importing 11.3 MMT of corn over the calendar year. (China’s TRQs are allocated by calendar year, not crop marketing year.)

China’s corn import pace has remained well beyond the TRQ level since then, with imports beyond the TRQ coming mostly from COFCO. By granting COFCO permission to import beyond the TRQ, China’s leadership gives COFCO significant market power to negotiate with global grain-trading companies and allows leaders to exert some control over import levels and determine which countries, and companies, to favor as corn suppliers. Together, this can allay the concerns of a conservative faction in China’s leadership, many of whom believe that global grain markets are controlled by a few large, multinational grain-trading companies and therefore want to strive for self-sufficiency to avoid dependence on them and exporting countries. It also allows China to develop a corn import program for which many industry stakeholders and policy advocates in China have been calling for decades.

China’s state-owned enterprises are not only importing more corn, but they have also made several investments in foreign grain shipping assets. These include COFCO’s purchases of grain trading companies in 2014 and other investments in land and grain shipping infrastructure in Ukraine, Brazil, Argentina, and even the United States, where COFCO has hired senior traders, expanded its trading team, and reached a throughput agreement with a large grain loading facility in the Port of New Orleans. China is also pursuing and revising trade protocols with foreign suppliers to establish more secure sources of grain supplies from abroad, including the recently revised corn import protocol with Brazil, and approving foreign grain shipping facilities for export. Together, these actions and investments will serve to give China market information and more influence to support their corn (and other grain and oilseed) procurement decisions and are a strong indication that China seeks to rely more on global suppliers for feed grain in the future.

The points made above are controversial and indeed often used to argue to the opposite: that China’s corn feed demand will decrease as the swine industry modernizes, and that China’s corn production will increase dramatically with the development and adoption of genetic engineering. In this paper, I lay out why I think the opposite will be true: that swine industry modernization will increase demand for corn, particularly imported corn, and that genetic engineering will bring many benefits to corn farmers in China, but a significant yield boost will not be among them, at least not right away. Greater reliance on STEs for corn imports will also help to allay the concerns of conservatives in China’s leadership wary of relying on greater corn imports.

Expectations that China will become a major structural importer of corn have been around for decades. USDA Baseline 10-year forecasts in the late 1990s indicated that China’s corn imports would increase after China imported a tranche of corn in the mid-1990s, only to be disappointed when China instead became a major corn exporter by the early 2000s. China’s reemergence as a corn importer in 2010 also sparked speculation that it would become a major corn importer, along with optimistic USDA Baseline China corn import forecasts, but those expectations also never materialized (although China did import large amounts of other feed grains). Together, these events caused many U.S. producers and industry stakeholders to take a “wait and see” approach to China becoming a major structural importer of corn, a point of view that has only solidified in the last decade as China’s imports of U.S. corn, DDGS, and sorghum have peaked and plummeted multiple times.

China’s recent large corn import program, however, may well augment the beginning of the era that many stakeholders inside and outside of China have been waiting for. China’s corn prices have not softened since the price rally in 2020, indicating continued strong demand for corn. If China’s imports are maintained at levels we have seen since 2020, then this will be a welcomed change for end users in China and their suppliers in corn exporting countries. It will also, according to many policy advocates in China, be good for China.

Cheng, J., and M. Ward. 2021. “Risk Factors for the Spread of African Swine Fever in China: A Systematic Review of Chinese Language Literature.” Transboundary and Emerging Diseases 69:e1289–e1298

Dong, F. 2007. “Food Security and Biofuels Development: The Case of China” Briefing Paper 07-BP 52. Ames, Iowa: Iowa State University Center for Agricultural and Rural Development.

Euromeat News. 2023. “$61 Billion Invested in the Chinese Swine Sector.” Available online: https://euromeatnews.com/Article-$61-billion-invested-in-the-Chinese-swine-sector/4398

Huang, J., R. Hu, S. Rozelle, and C. Pray. 2005. “Insect-Resistant GM Rice in Farmers’ Fields: Assessing Productivity and Health Effects in China.” Science 308:688–690.

Lohmar, B. 2015. “Will China Import More Corn?” Choices 30(2).

———. 2016. “China’s Potential Future Imports of Feed Grains and Oilseeds.” Presentation to USDA’s Agricultural Outlook Forum. Available online: https://www.usda.gov/sites/default/files/documents/Lohmar.pdf

———. 2021. “China’s Corn Imports: How Much and For How Long?” Presentation to USDA’s Agricultural Outlook Forum. Available online: https://www.usda.gov/sites/default/files/documents/S12_LOHMAR_USDA-AOF- 2021-Slides_FINAL.pdf

Pray, C., J. Huang, R. Hu, H. Deng, J. Yang, and X. Morin. 2016. “Prospects for Cultivation of Genetically Engineered Food Crops in China.” Global Food Security 16:133–137.

Pray, C., J. Huang, R. Hu, and S. Rozelle. 2002. “Five Years of Bt Cotton in China: The Benefits Continue.” Plant Journal 31(4):423–430.

Sun, X., P. Su, and H. Shan. 2017. “Mycotoxin Contamination of Maize in China.” Comprehensive Reviews in Food Science and Food Safety 16:835–849.

U.S. Department of Agriculture. 2022. “China: Agricultural Biotechnology Annual.” GAIN Report CH2022-0112. Washington, DC: USDA Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Agricultural Biotechnology Annual_Beijing_China - People's Republic of_CH2022-0112.pdf

Xiao, Z., and W. Kerr. 2022. “The Political Economy of China’s GMO Commercialization Dilemma.” Food and Energy Security 11:e409.

Xiong, T., W. Zhang, and C. Chen. 2021. “A Fortune from Misfortune: Evidence from Hog Firm’s Stock Price Response to China’s African Swine Fever Outbreaks.” Food Policy 105:102150.