Retail markets for locally sourced food products have grown well beyond farmers’ markets. Food retailing opportunities embraced by grocers, restaurants, and others seek to capture a slice of the lifestyle of health and sustainability (LOHAS) pie. LOHAS consumers are demonstrated social influencers with buying habits that are less price sensitive, values-driven, and intensely loyal, currently making up about 22% of the U.S. shopper population (Wells and Haglock, 2008; Drake et al., 2016; National Marketing Institute, 2017). Increased retailer engagement with local farms is a key signal of shared values important to this group. In this paper, we apply the concept of legitimacy—developed in the business strategy literature—to understand how retailers can use local food sourcing to establish themselves as viable market partners with LOHAS consumers. We differentiate consumers as “core,” “midlevel,” and “periphery” local food consumers, as a measure of their relative preferences for local sourcing, similar to approaches used by the Hartman Group’s (2008) study of organic food preferences.

Local sourcing by retailers is inherently problematic, especially when using intermediated distribution. Without having direct interactions with producers, consumers rely on in-store signage, product labelling, and/or recognized farm brands to identify local items. However, the criteria for what counts as local can vary by store; something “local” can be from within the county, state, region, or even the United States. Local could refer to “not from Mexico,” as one author of this manuscript was told by a store manager. In some cases, local can refer to the manufacturing location of a processed food or beverage, as in Kentucky’s state branding program (Downs, 2016).

Even when products are identified as originating from within a very short radius from their places of sale, consumers may find reasons to doubt the accuracy of these claims. A telling series of articles in the Tampa Bay Times (Reily, 2016) highlights the difficulties of verifying local food provenance, which are becoming more widely experienced. This pointed exposé uncovered weak or nonexistent links between products promoted as local in retail settings and actual farmers in the Tampa Bay area.

Reily waved the food fraud flag, calling for more direct-to-consumer (DTC) engagement, but consumer engagement isn’t always practical. Consumer are more likely to engage with DTC market channels if they have a higher income, education, and overall demand for produce (Stewart and Dong, 2018). Similarly, having leisure time and interest in activities such as food preparation and gardening are associated with DTC engagement. These attributes outline a particular type of consumer that is not representative of the wider U.S. population. As such, the majority of consumers will experience local food only in the context of intermediated channels. Additionally, local food marketing through intermediated channels is three times the sales value of that marketed directly to the consumer (Low and Vogel, 2011; U.S. Department of Agriculture, 2016). Intermediated markets for local products, while inherently struggling with certain weaknesses, are not going away, especially as consumer demand continues (National Grocers Association (NGA), 2015). Indeed, intermediated markets often provide useful services to growers and retailers, with efficiencies in aggregation and distribution, food safety verification, sustainability, and marketing (Brunori et al., 2016; Low et al., 2015).

Retailers’ value-signaling strategies merit consideration—both for fair representation and for effective engagement of consumers valuing local products. Weak efforts have been made to develop industry-standard definitions of local—using food miles, for example—but the attribute is difficult to define. Retailers and distributors don’t always have an incentive to exercise full transparency as they try to approximate the “local” value proposition to their shoppers. Further, without strong standards, it is inherently difficult to exclude bad actors who introduce questionable products and also contribute to a market of “lemons” (Akerlof, 1970). Retailers sometimes use “local-washing”—similar to its cousin “greenwashing”—strategies to remediate their image when coming under fire for practices perceived to be unsustainable (Zanasi et al., 2017). While greenwashing has led to the creation of indices to measure violation and other prescriptive consumer protection measures, the concept of local-washing is less developed. Local-washing, if considered as the act of over- or mis-promoting products as being local, has the same potential to undermine the value or equity of local brands through similar systematic misrepresentation.

At the same time, many retailers have a history of working to offer local products, long before the concept of “local food” became an important marketing category. In recent years, local-sourcing has become complicated by emerging food safety and audit requirements for producers (e.g., good agricultural practices) when working with larger grocery chains and their distributors. Additionally, certain chains require product volumes that can serve multiple store locations with a consistent supply throughout the year as a precondition for accessing a local store. As such, few locally oriented producers have the requisite scale and/or consistent quality to work with medium/large distribution networks (Rossi, Meyer, and Knappage, 2018). The evolution of retail decision-making and distribution structure has created barriers to entry for smaller-scale local producers, which can diminish the overall supply and visibility of local items at certain retailers, even when these items are present. Retailers, then, would benefit from reconsidering how to achieve legitimacy for their local products in a way that is more visible and trustworthy to LOHAS and general consumers.

The concept of legitimacy has been the focus of a growing literature in strategic management, exploring and measuring signals of trust across prospective partners in a value chain. Suchman (1995) considered the various components of legitimacy as the “generalized perception or assumption that the actions of an entity are desirable, proper, or appropriate within some socially constructed system of norms, values, beliefs, and definitions” (p. 574). Later, Zimmerman and Zeitz (2002) adapted the framework as a more explicit strategic course pursued by firms seeking to enter an industry, suggesting that legitimacy should be regarded as the “social judgment of acceptance, appropriateness, and desirability, enables organizations to access other resources needed to survive and grow” (p. 414).

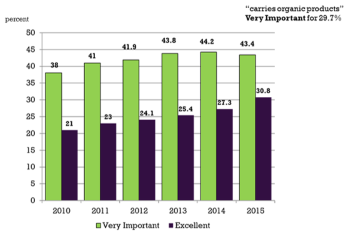

Source: NGA, 2015 Consumer Survey Report and

previous issues.

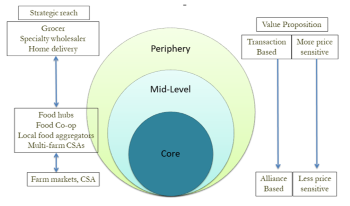

Source: Adapted from Woods and Tropp (2015).

In the case of local food markets, more traditional retailers are in many cases challenging the standards of more traditional direct market channels and actually pursuing market entry and legitimacy, seeking—with mixed success—a larger share of the LOHAS market and local core and to legitimize their products as “local” against the mix of more traditional vendors that have occupied this space (farm markets, CSAs, etc.). Figure 1 uses data from the NGA to show how consumer perceptions of the performance of their primary grocer around local food offerings has steadily improved. Many cooperative grocers are able to source locally, largely because they are owned and operated locally. Engaging local producer suppliers is often a core mission of these stores. Owner–shoppers have their own demanding standards to recognize local (Katchova and Woods, 2013).

The strategic management literature identifies four broad classes of legitimacy: i) regulatory—relating to compliance with various market or product standards or regulations; ii) normative—business behavior related to societal norms and values; iii) cognitive—relating to the product or service quality expectation of the market, and ive) industry—derived from industry’s practices, norms, standards, and technology, as well as past actions of industry members. Legitimacy frames conventional grocers as entities that need to overcome the liability of newness, the reputation-building required of new entrants into a market. This is particularly the case as grocers seek to establish themselves as a legitimate market partner for local core consumers, even as many retailers have historically had some relationship with local growers.

Woods and Tropp (2015) summarized this market tension by exploring the strategic reach and battle for the local food market share between DTC retailers (farmers) and conventional grocers. The former start with a strong and incumbent position of legitimacy, with core consumers placing a particularly high value on the bundle of attributes associated with local products. The latter may be drawn to local core consumers due to their lower price sensitivity, market loyalty, and preference for differentiated products. Figure 2, adapted from Woods and Tropp, represents the consumer types, the strategic reach compression to consumers of different values around local food, and the corresponding value proposition.

Note: *, **, *** indicate statistical significance at the 90%, 95%, 99% level, respectively. Statement

agreement used five categories, ranging from “strongly disagree” to “strongly agree,” as the

dependent variable. “Periphery” consumers are the reference variable.

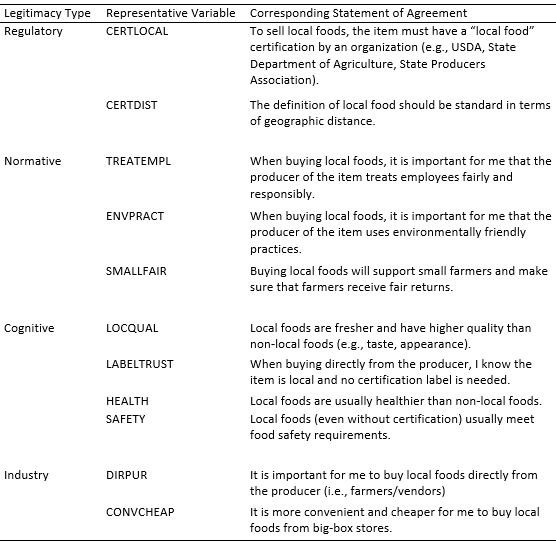

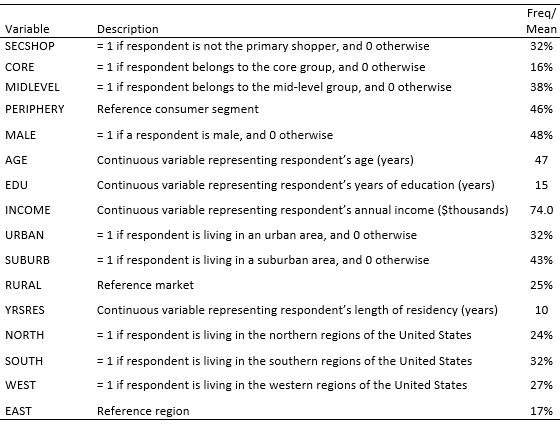

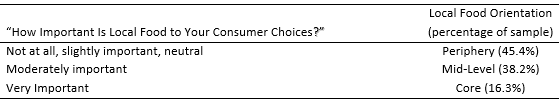

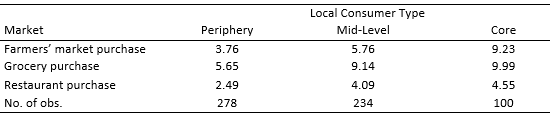

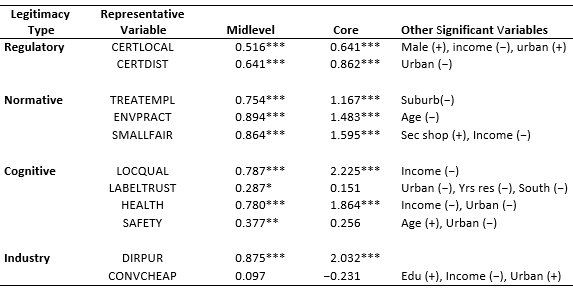

Asgari (2016) attempted to explore these initial linkages through a national survey of food consumers. Consumers were classified by how important local food purchases were to them (creating periphery, mid-level, and core groups) and asked to address a series of representative questions related to the four legitimacy groups, summarized in Table 1. Ordered logit models were used to examine determinants of variation as to the extent to which consumers agreed with the representative statements applying each type of legitimacy to the local food context. The dependent variable was created using a 4-point scale (where 0 = “strongly disagree” and 4 = “strongly agree”). Table 2 reports summary statistics. Table 3 defines periphery, mid-level, and core in the context of local food preferences in this study.

Several compelling observations are evident in the basic purchase patterns of core, mid-level, and periphery groups shopping for local products at different types of markets. Grocery and, in some cases, restaurants would typically be regarded as more dependent on intermediated services. The frequency of purchases of local products in all settings, as reported in Table 4, is higher for core consumers, as expected. Core consumers also place proportionally higher emphasis on DTC purchases at farmers’ markets but still purchase very actively at the grocery, suggesting that this channel remains important to this consumer segment. Additionally, peripheral and mid-level consumers are more likely to acquire local foods in a retail grocery setting. While it is not possible to compare actual expenditures, these findings emphasize the relative importance by frequency of intermediated local products across all types of consumers. In a related paper, Zare and Woods (2018) provide a more detailed analysis of these purchase patterns.

We estimated ordered logit regressions using explanatory variables that included local preference measures and other demographic determinants to explain shopper agreement with various strategies corresponding to the four legitimacy categories. Table 5 reports the regression results examining the relationships among various legitimacy measures and consumer types.

Most regulatory legitimizing involves some kind of certification that independently verifies some aspect of an attribute. In the case of local products, core and mid-level consumers place more value on statements of local certification compared to periphery consumers. State branding programs have already been widely utilized by retailers in this capacity (see Naasz, Jablonski, and Thilmany in this Choices theme). Standards that would enforce distance definitions of local were similarly more strongly supported by core consumers, although more difficult to apply. Retailers could improve in-store consumer education via signage to explain the meaning and criteria of various certification and branding programs. This approach may bring more attention to products and farms that already exist as part of the store’s supply. They may also consider identifying specific farm brands or displaying a map that locates specific farms and product sources. In any case, the opportunity for transparency in defining “local” in terms of distance to sources is a viable merchandising strategy particularly valued by core consumers.

Shoppers bundle many types of variously related normative values into their purchase preferences for local food (Bond, Thilmany, and Bond, 2008). The measures explored here—fair treatment of employees, producer care for the environment, and supporting fair returns for small farmers—are representative of a wider list of normative values that core and mid-level consumers bring to their purchase decisions. Normative factors of legitimacy are important across each of the values explored here. Frequent consumers of local food strongly embrace these related values. Retailers entering this space would do well to pay particular attention to clearly and credibly communicating how retailer–farmer partnerships achieve these outcomes. Retailers could develop ways to highlight the stories of farms, their families, and their workers for specific seasonal products. Storytelling and quotes may be an effective way of engaging the normative values of the core local consumer.

Local food shoppers hold strong beliefs about the qualities inherent in local food, seeking a cognitive legitimacy in market partnerships, particularly associated with quality and health. The association of local with higher quality is one of the strongest measures distinguishing core from other types of consumer. These quality measures seem to go beyond safety. “Artisanal,” “small batch,” and “fresh” are quality signals that work in the farm market setting that could be translated into the grocery merchandising of local products. Processed local products can present added challenges. There appears to be some evidence that labels connected with local food production in the grocery setting are actually not strongly trusted by core consumers. Effective engagement of core shoppers throughout the grocery store will require more than generic logos indicating “local.” The comparatively lower trust in grocery labels for processed local products underscores the potential for local-washing; savvy food consumers recognize this. Core consumers do not blindly embrace the relative safety of local products. While food safety may have some association with quality and health, these consumers appear to look to other mechanisms (besides simply local) to signal safety attributes. Communicating more details about production practices, safety standards, and nutritional attributes of local offerings can be ways to engage skeptical core local consumers.

Industry legitimacy, in the eyes of the local food consumer, relies on certain measures inherent in DTC interactions. Core local food consumers place a high value on direct producer relationships, as evidenced earlier by high farm market purchase frequency. This can translate to the retail setting, where these consumers still value this relationship. To provide a strong value proposition to these consumers, retailers must engage in efforts to share the stories, values, and human/environment interest details that drive these shoppers in the first place. These relationship- and information-intensive consumer interactions stand in contrast to simply offering convenience and low prices. While core and mid-level local consumers will consider and appreciate low-cost convenience, they require different types of signaling to grant trust and legitimacy to a product or industry.

Grocers and other retailers have an opportunity to pair the cost/convenience advantages of aggregation and distribution efficiencies with sincere messaging around local production to better engage with core and mid-level local food consumers. The careful attention to the messaging around local sourcing demanded by these shoppers can overcome a certain degree of concern about grocer performance around promoting local food and overcome the liability of newness—at least compared to traditional direct market sources. Strategic local messaging can also help outflank other grocers that are less attentive to core local values. These legitimacy strategies again are a representative, not exhaustive, list of strategies considered in local food marketing across the four legitimacy types. The goal here is to provide a framework that can hopefully lead to improved strategic positioning by all participants in the local foods marketing system.

Akerlof, G. 1970. “The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism.” Quarterly Journal of Economics 84(3):488–500.

Asgari, A. 2016. “Legitimacy of Local Food in the U.S. Market: Comparative Consumer Perspectives.” PhD Dissertation, University of Kentucky. Available online: http://uknowledge.uky.edu/agecon_etds/47

Bond, C., D. Thilmany, and J. Bond. 2008. “Understanding Consumer Interest in Product and Process-Based Attributes for Fresh Produce.” Agribusiness 24(2):231–252

Brunori, G., F. Galli, D. Barjolle, R. van Broekhuizen, L. Colombo, M. Giampietro, J. Kirwan, T. Lang, E. Mathijs, D. Maye, K. de Roest, C. Rougoor, J. Schwarz, E. Schmitt, J. Smith, Z. Stojanovic, T. Tisenkopfs, and J. Touzard. 2016. “Are Local Food Chains More Sustainable than Global Food Chains? Considerations for Assessment.” Sustainability 8(5):449.

Downs, J. 2016, March 17. “Coca-Cola a Local Food?” Louisville [KY] Courier Journal.

Drake, D., R. W. Buell, M. Barton, T. Jones, K. Keverian, and J. Stock. 2016. “Whole Foods: The Path to 1,000 Stores.” Harvard Business School Case Study 9-615-019, September 2014 (Revised June 2016).

Hartman Group. 2008. “Consumer Understanding of Buying Local”. Available online: http://www.hartman-group.com/hartbeat/2008-02-27

Katchova, A.L., and T.A. Woods. 2013. “Local Foods and Food Cooperatives: Ethics, Economics, and Competition Issues.” In Harvey S. James, ed. The Ethics and Economics of Agrifood Competition. Dordrecht: Springer, pp. 227–242.

Low, S.A., and S. Vogel. 2011. Direct and Intermediated Marketing of Local Foods in the United States. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Economic Research Report ERR-128, November.

Low, S.A., A. Adalja, E. Beaulieu, N. Key, S. Martinez, A. Melton, A. Perez, K. Ralston, H. Stewart, S. Suttles, and B.B.R. Jablonski. 2015. Trends in U.S. Local and Regional Food Systems. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Administrative Publication AP-068.

National Grocers Association. 2015. “Consumer Survey Report.” Data from various annual issues 2010–2015. Available online: https://www.nationalgrocers.org/docs/default-source/Surveys-Reports-(2015-2016)/consumersurveyreport2015.pdf

National Marketing Institute. 2017. 16th Annual LOHAS Sustainability in America. Available online: http://www.nmisolutions.com/downloads/StudyCopy/2017_NMI_USA_Sustainability_Database_Participation.pdf

Reily, L. 2016, April 15. “Farm-to-Fable: A Times Investigation into Tampa Bay’s Local Food Scene.” Tampa Bay [FL] Times. Available online: http://www.tampabay.com/news/farm-to-fable-a-times-investigation-into-tampa-bays-local-food-scene/2273052

Rossi, J., A.L. Meyer, and J. Knappage. 2018. Beyond Farmers Markets: Local Foods Opportunities in Southeaster Kentucky’s Retail and Institutional Industry. Lexington, KY: CEDIK. Available online: https://cedik.ca.uky.edu/files/beyond_farmers_markets_final.pdf

Stewart, H., and D. Dong. 2018. “How Strong Is the Demand for Food through Direct-to-Consumer Outlets?” Food Policy 79:35–43.

Stinchcombe, A.L. 1965. “Social Structure and Organizations.” Advances in Strategic Management 17:229–259.

Suchman, M.C. 1995. “Managing Legitimacy – Strategic and Institutional Approaches.” Academy of Management Review 20(3):571–610.

U.S. Department of Agriculture. 2016. Direct Farm Sales of Food: Results from the 2015 Local Food Marketing Practices Survey. Washington, DC: U.S. Department of Agriculture, Ag Census Highlights ACH12-35, December.

Wells, J.R., and T. Haglock. 2008. “Whole Foods Market, Inc.” Cambridge, MA: Harvard Business School Case Study 9-705-476, June 2005 (Revised April 2008).

Woods, T., and D. Tropp. 2015. “CSAs and the Battle for the Local Food Dollar.” Journal of Food Distribution Research 46(2):17–29.

Zanasi, C., C. Rota, S. Trerè, and S. Falciatori. 2017. “An Assessment of the Food Companies Sustainability Policies through a Greenwashing Indicator.” Proceedings in System Dynamics and Innovation in Food Networks 2017:61–81.

Zare, M., and T. Woods. 2018. “Local Food Purchasing Frequency by Locavores across Market Channels – Implications for Local Food System Development.” Paper and poster presented at Southern Agricultural Economics Association annual meeting, Jacksonville, FL, 2–6 February. Available online: https://ageconsearch.umn.edu/record/266769

Zimmerman, M., and G. Zeitz. 2002. “Beyond Survival: Achieving New Venture Growth by Building Legitimacy.” Academy of Management Review 27(3):414–431.