Since 2000, Russia has become increasingly important for world agriculture. The country, along with Ukraine, has emerged as a major grain exporter, while Russia has also become a large agricultural and food importer, especially of meat and other livestock products. However, the geopolitical events of 2014 involving the country’s relationship with Ukraine and the West, and even more so the economic crisis that hit late in the year, are disrupting its agricultural and food economy.

Largely in response to economic sanctions imposed by the United States, European Union (EU), and other Western countries, Russia in August 2014 banned many agricultural and food imports from those countries. By December 2014, Russia was entering a major economic crisis. The Western economic sanctions cut the country off from foreign credit and investment, and also motivated huge capital flight. The bulk of Russia’s export earnings come from energy exports, which have been greatly reduced in value terms by the large drop in the world price of oil in late 2014. This has led to severe depreciation of the ruble vis-à-vis the U.S. dollar (USD) and other major world currencies, which by increasing the prices of imported goods, is generating substantial price inflation. By the beginning of 2015, the Russian economy was facing both high inflation and a deep recession.

These developments will create major challenges for the agricultural and food economy in the short to medium term, covering production, distribution, and consumption. Not all of the recent events will have negative consequences. For example, the depreciation of the ruble will make Russian agricultural exports—such as grain—more price-competitive on the world market. However, like most of the economy, the agricultural sector on balance will most likely be adversely affected by these affairs.

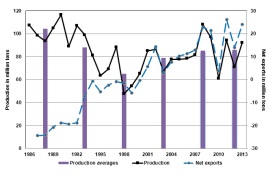

Note: The bars give average annual grain

production over the periods 1986-1990,

1991-95, 1996-2000, 2001-05, 2006-10,

and 2011-13. Negative net grain exports

are net imports.

Source: Russian Federal Service of State

Statistics; USDA PS&D.

Like the Union of Soviet Socialist Republics (USSR) in general, Russia during the Soviet period was a large grain importer. However, since 2000 Russia, along with Ukraine, has become a major grain exporter, and Kazakhstan a nontrivial one. During 2011-2013, Russia exported on average 23 million metric tons (mmt) of grain a year (figure 1), and Russia, Ukraine, and Kazakhstan collectively sold 57 mmt abroad (average annual, excluding any sales to each other). These three countries as a region supplied 19% of total world grain exports over the period, and 21% of wheat exports, supplanting the United States as the world’s biggest wheat exporter.

One reason Russia, Ukraine, and Kazakhstan have become a large grain exporting region is that their livestock sectors contracted substantially during the 1990s. With the help of generous state subsidies, the livestock sectors had expanded quickly during the last two decades of the Soviet regime. The growing demand for feed grain generated large imports of grain, soybeans, and soybean meal. With the transition from planned to market economies that began with independence in 1991, the countries’ new governments could no longer afford the hefty subsidies to livestock producers. During the 1990s, both animal herds and livestock product output in all three countries fell by more than half. Because of the reduced need for animal feed, the large Soviet-era imports of grain, soybeans, and soybean meal disappeared (Liefert and Liefert, 2012).

The other main reason why these countries have emerged as big grain exporters since 2000 is growth in grain production, which created surpluses for export. Over 1996-2000, Russia’s annual grain production averaged 65 mmt, but by 2011-2013 average yearly output had risen to 86 mmt. Grain production increased because of growth in yields, from 1.30 tons per hectare over 1996-2000—annual average—to 1.93 tons over 2011-2013 (USDA, 2015). Although many Russian farms remain virtually unchanged in operational practice from Soviet times, since 2000 a superior class of farms has arisen called “new operators” (Rylko et al., 2008). These new producers have brought investment, advanced technology, and better managerial practices into the agricultural sector, and appear to be the driving force behind overall growth in Russian agricultural productivity, as well as the rise in grain yields, production, and exports.

Despite Russia’s large grain exports, the country is a much larger agricultural importer than exporter (figure 2). In 2013, Russia’s agricultural and food imports totaled $39 billion, versus exports of $14 billion. Russia has such a large negative trade balance in agriculture and food because it exports bulks crops, such as grain and sunflower seed, while it imports high value products, like meat, fruits, vegetables, and processed foods.

Since 2000, Russia’s agricultural imports have risen substantially. One reason is high income growth, as Russian gross domestic produce (GDP) rose over 2000-2008 at an average annual rate of about 7% in real terms. The income growth increased consumer demand for food, foreign as well as domestic (Liefert, Liefert, and Shane, 2009). Agricultural imports dropped in 2009 because the world economic crisis hit Russia severely, with GDP declining by 8%. However, when the country came out of the crisis in 2010, import growth resumed.

Another reason for the increase in agricultural imports is that since 2000, Russia has had higher inflation than its main trading partners. Rising domestic prices made foreign imports more price competitive vis-à-vis domestic output, which in turn increased Russian demand for imported goods. More technically, the disadvantageous increase in Russian prices relative to prices in the country’s trading partners was not sufficiently offset by nominal depreciation of the ruble vis-à-vis the USD and other major foreign currencies. This resulted in real, as opposed to nominal, appreciation of the ruble.

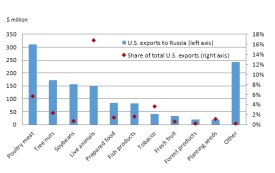

Source: USDA, Economic Research

Service using USDA, Foreign Agricultural

Service, Global Agricultural Trade System

data.

Taken as a bloc, the EU countries are the largest foreign supplier of agricultural and food products to Russia, providing almost 40% of the country’s imports in 2013, valued at $15-16 billion (European Commission, 2013). The U.S. agricultural and food sales to Russia in 2013 equaled only $1.31 billion (see figure 3 for the commodity breakdown), less than 1% of total U.S. agricultural and food exports of $162 billion. The main U.S. export to Russia was poultry ($312 million), followed by tree nuts (mainly almonds), soybeans, and live animals.

Russia in 2013 was the second largest foreign market for U.S. poultry meat—virtually all broilers—purchasing 276,000 metric tons. Yet, this is a major drop from peak U.S. broiler exports to Russia in 2001 of 1.05 mmt, when the country was the largest foreign market for U.S. poultry. Russia’s poultry imports, not only from the United States but overall, have fallen substantially in recent years, mainly because of a surge in domestic production. However, the output growth has been significantly aided by government subsidies and a restrictive regime of tariff rate quotas for meat imports, as well as extensive use of sanitary measures, often involving complete import bans, against inflows from the United States—especially of poultry—and other foreign suppliers.

Russia’s relationship with Ukraine in 2014, in particular the seizure of the Crimea, has led to a geopolitical crisis with the United States, EU, and other Western countries. In the summer of 2014, the latter imposed various economic sanctions on Russia, targeting the energy, banking, and defense sectors. In August, Russia retaliated by banning imports of many agricultural and food products from the United States, EU, Canada, Australia, and Norway. The banned goods include meat (that is, beef, pork, and poultry), milk, cheese, and other dairy products, fish and other seafood, fruit, vegetables, nuts, and many processed foods. The Russian government announced that the ban would last one year.

The ban should not strongly affect U.S. agriculture, with the possible exception of the poultry and almond industries, given how small Russia is as a market for the sector’s exports. However, given that the EU’s agricultural exports to Russia in 2013 totaled $15-16 billion, the import embargo is harming many EU agricultural producers, especially of dairy, fruit, and vegetables. During August-November 2014, total EU exports of cheese, fruit, and vegetables were down in value terms by 19%, 10%, and 13%, respectively, compared to the same period in 2013 (Agra Europe, 2015).

The ban is also hurting Russian consumers. Imports apparently supply about 40% of the country’s food domestically consumed. In 2012, imports provided about a quarter of all Russia’s meat consumption, and almost 70 percent of its consumption of fruit (FAO, 2014). Of Russia’s $39 billion of total agricultural and food imports in 2013, $23.5 billion were in the product categories affected by the ban, with the value of the banned products from the embargoed countries equaling $8.3 billion (FAO, 2014).

Some substitute supply for the banned imports will most likely arise from increased imports from non-embargoed countries, such as meat from Brazil, as well as from more domestic production. Some of the banned EU products might also be smuggled into Russia, especially through Belarus, which borders Russia and three EU member states: Poland, Lithuania, and Latvia. Russia allows imports of Belarusian processed foods that use EU agricultural goods as their base material, as long as the processing adds substantial value-added. This has led to disputes between the two countries as to what constitutes acceptable processing, with Russia blocking the import of some suspect Belarusian meat and dairy products.

The above points notwithstanding, the import ban will reduce overall food availability, which will increase food prices and overall inflation. However, given that Russia imports mainly high value products, the import ban will not reduce availability of staple foods such as wheat and rice, nor threaten the country’s overall food security.

The Russian government is arguing strongly that the ban will promote domestic agricultural production and the sector’s long run development, thereby weaning the country off of dependence on foreign food suppliers. The government said it would assist this process with increased subsidies to the sector.

Russia began 2014 with an already weak economy, forecast to grow in the year by only about half a percent. The Western economic sanctions imposed against the country in the summer of 2014 and subsequently strengthened have had had two main effects. The first is that international investment and lending to Russia has virtually dried up, and the second is large-scale capital flight, of about $150 billion of net outflows for the year (Business Insider, 2015), compared to 2013 GDP of $2.1 trillion.

Compounding the trouble is the huge drop in world oil prices that started in November 2014. The price of a barrel of Brent Crude oil began 2014 at $110, but by early March 2015 had fallen to about $60. Around 70% of Russia’s exports in value terms are oil, oil products, and natural gas, such that the oil price drop severely reduced demand for the ruble. Given that most of Russia’s energy exports are traded in USD rather than rubles, the oil price decline did not directly reduce demand for rubles. Rather, the decrease in Russian dollar export earnings to be repatriated/converted from dollars to rubles has lowered ruble demand.

This development, combined with the capital flight, has led to a major depreciation of the ruble vis-à-vis the USD and other major foreign currencies. In January 2014, one dollar exchanged for 34 rubles on average, and by mid-December the exchange rate had plunged—from the ruble’s point of view—to 80 rubles per dollar. The exchange rate then rebounded somewhat, to 62 rubles to the dollar by early March 2015, but still a drop in the ruble’s value since early 2014 of 45%. In order to stem the ruble’s decline, the Russian Central Bank in December 2014 raised its lending rate from 10.5 to 17%, though the rate was then reduced to 15% in late January. The higher Russian interest rates are intended to attract funds to the Russian banking/financial system, the hope being that this will increase demand for the ruble and thereby halt depreciation of the currency.

This mix of adverse developments is likely to generate both high inflation and recession for the Russian economy in 2015. The severe ruble depreciation will cause substantial inflation. Russia is a large importer not just of food but of many types of products, and depreciation will raise all import prices. As demand shifts from imports to domestically produced goods, their prices will also increase. Already there are reports of frantic consumer buying of goods, especially durables such as refrigerators and televisions, as consumers try to spend rubles before prices rise further. The agricultural and food import ban will also continue to put particular price pressure on foodstuffs. In January 2015, overall prices were up 15% compared to January 2014, while food prices were up 23% (Trading Economics, 2015).

However, recession could be an even bigger problem. Capital flight and the drying-up of foreign lending and capital inflows will hurt investment. The large drop in the oil price will heavily reduce the country’s export earnings, and thereby negatively impact wealth, aggregate demand, and GDP. The interest rate hike by the Central Bank to defend the ruble will further lower investment, demand, and GDP. The deputy governor of Russia’s Central Bank described the interest rate increase as “a choice between the very bad and the very, very bad” (Guardian, 2014). Consumers’ desire to convert ruble savings into either foreign currency or goods is leading to massive withdrawals from the banking system, which could threaten a banking/financial meltdown.

The Russian Central Bank has stated that GDP in 2015 could fall by 4.5% if the oil price remains at $60 a barrel (Bloomberg Business. 2014), and by early March 2015 the oil price was at that threshold. The International Monetary Fund is forecasting a drop in Russian GDP in 2015 of 3%, while the European Bank for Reconstruction and Development is projecting a 4.8% decline. The government faces the unappealing choice of defending the ruble and fighting inflation on the one hand, or fighting recession and rising unemployment on the other, with policies that combat one problem often exacerbating the other.

Russia’s main asset in the crisis is its large reserves of foreign currency holdings, about $365 billion as of early March 2015 (Bloomberg Business, 2015). This figure is down from $510 at the start of 2014, with tens of billions already spent on trying to prop up the ruble’s value by buying the currency in the foreign exchange market. Even with still substantial international reserves, the Russian economy will be hard-pressed in 2015 and beyond to meet its foreign debt obligations. Russian entities, including the government, collectively owe about $600 billion to external creditors (Financial Times, 2014). Because of the Western sanctions and inability to borrow from foreign lenders, the only sources of foreign exchange to meet debt and interest obligations are Russia’s trade surplus and international reserves.

During the past two decades, Russia in most years has run a substantial trade surplus. In 2013, its export earnings of $523 billion versus import expenditure of $344 netted a surplus of $179 billion. However, the oil price drop could severely reduce the trade surplus in 2015. Of Russia’s $365 of international reserves, only about half are “liquid” such that they can be used without special cost. From December 2014 through 2015, Russia in total will have to meet about $130 billion in foreign debt obligations, and large payments will also be necessary in 2016 (Moody’s Investors Service, 2014).

Some of the crisis-related developments should be positive for Russian agriculture. The major depreciation of the ruble will improve the trade competitiveness of Russian grain and sunflower seed exports. Domestic producers will also continue to benefit from the substantial protection from foreign competition provided by the partial agricultural and food import ban.

In January 2015, the Russian government stated that although most areas of state expenditure will receive reduced funding in 2015, agriculture will get an increase of about 50 billion rubles, for a total of over 185 billion ($2.8 billion USD) rubles of support (Sputnik, 2015). Farm credit and the seed industry will apparently receive special funding attention. Yet, the government might be hard pressed to meet fully its stated financial commitment to the agricultural sector, given all the parts of the economy and social spending that will need budgetary help during the crisis. Also, high inflation will erode any increase in financial support in real (inflation-adjusted) terms.

Any positive effects notwithstanding, the developments associated with the economic and geopolitical crises on balance will probably be negative for the agricultural and food economy, impacting production and distribution and hurting consumers. One of the economic crisis’ first effects for agriculture has been to disrupt domestic grain flows. The improvement in the trade price competitiveness of Russian grain from the ruble depreciation, combined with a bountiful 2014 grain harvest of about 105 mmt, is pushing up grain exports. From July 2014 through January 2015, Russia exported a record volume of total grain—for that part of the year—of 23 mmt, and also of wheat at 18 mmt. However, although grain producers are selling to export traders, domestic inflationary concerns are motivating them to withhold selling for domestic use in expectation of higher future prices, as indicated by rapidly declining grain supplies held by domestic processers. This is creating a domestic grain shortage and further driving up prices, which in turn raises prices for bread and animal feed.

To curb these market reactions, the government is trying to keep grain within the country. In December 2014, the government raised its purchase price of wheat for the State Intervention Fund by 50%. The state also imposed restrictions on grain exports, including sanitary controls in issuing export licenses and limits on grain railway transport to ports, and in February 2015 a grain export tax, to run through June. The tax consists of an export duty of 15% plus a 7.5 euro per ton fixed charge, with the total per unit tax not less than 35 euros per ton ($40 at the current exchange rate).

In the mid-2000s, the Russian government and agricultural establishment made the technological upgrading of agriculture a priority, a major part of the program being the importation of high quality seeds, machinery, and live animals. Because of the ruble depreciation, domestic agricultural producers will be hurt by the steep rise in prices for these and other imported inputs. In the longer term, agricultural and food production will suffer from the drop in investment, resulting from economic sanctions, capital flight, and higher interest rates.

The ruble depreciation is making it difficult for Russian farms to get fertilizer from domestic suppliers. In recent years Russia has exported about 90% of its fertilizer output, and the ruble depreciation will motivate the fertilizer industry to export even more. The government is lobbying fertilizer producers to sell more domestically and at lower prices, with one report indicating that fertilizer producers had agreed to reduce the prices they charge by a third (Daily Mail Wires by Reuters, 2015).

If food prices rise too high, the Russian government might consider price controls. However, such a decision would involve the unappealing choice between open and repressed inflation. The latter could result in sold-out shops and the perception of serious food shortages, reminiscent of the Soviet period.

The crisis might also motivate the Russian government to reconsider the ban on agricultural and food imports, at least for some products and embargoed Western countries. The Russian government has already floated this idea, especially vis-à-vis certain EU member states. Reducing the ban would aid food consumers and probably earn some international good will, especially from Europe which has been much more adversely affected than the United States.

Yet, whatever reactive steps the Russian government might take to the problems facing the agricultural and food economy, if the Western economic sanctions remain in effect and the world oil price stays low, the country’s economic crisis will persist. Russian agricultural producers and consumers, as well as world agricultural markets, will continue to face the disruption and challenges generated by these events.

Agra Europe. 2015. “Russia Remains EU’s Third Largest Agri-Food Export Destination Despite Ban,” January 29. Available online: https://www.agra-net.net/agra-europe/policy-and-legislation/trade-policy/russia-remains-eus-third-largest-agri-food-export-destination-despite-ban-468072.htm

Bloomberg Business. 2014. “Russia Sees GDP Shrinking at Least 4.5% in 2015 With $60 Oil,” December 15. Available online: http://www.bloomberg.com/news/articles/2014-12-15/russia-sees economy-shrinking-at-least-4-5-in-2015-with-60-oil

Bloomberg Business. 2015. “Russia’s Foreign Exchange and Gold Reserves,” March 4. Available online: http://www.bloomberg.com/quote/RUREFEG:IND

Bokusheva, R., H. Hockmann, and S.C. Kumbhakar. 2012. “Dynamics of Productivity and Technical Efficiency in Russian Agriculture.” European Review of Agricultural Economics 39(4): 611-37.

Business Insider. 2015. “Russia Capital Flight More Than Doubled in 2014 to $151 bn,” January19. Available online: http://www.businessinsider.com/afp-russia-capital-flight-more-than-doubled-in-2014-to-151-bn-2015-1

Daily Mail Wires by Reuters. 2015. “Russia Starts Spring Sowing with Raised Hopes for Harvest,” March 4. Available online: http://www.dailymail.co.uk/wires/reuters/article-2979429/Russia-starts-spring-sowing-raised-hopes-harvest.html

European Commission. 2013. “Agricultural Trade in 2013: EU Gains in Commodity Exports,” Monitoring Agri-Trade Policy. Available online: http://ec.europa.eu/agriculture/trade-analysis/map/2014-1_en.pdf

Financial Times. 2014. “The Only Cure for What Plagues Russia,” December 17. Available online: http://www.ft.com/intl/cms/s/0/770f73c2-8541-11e4-ab4e00144feabdc0.html#axzz3UIgBALOY

Food and Agriculture Organization (FAO). 2014. “Russia’s Restrictions on Imports of Agricultural and Food Products: An Initial Assessment.” Available online: http://www.fao.org/3/a-i4055e.pdf

Guardian. 2014. “Russia Has Just Lost the Economic War with the West,” December 16. Available online: http://www.theguardian.com/business/2014/dec/16/russia-has-lost-economic-war-with-west-rouble-currency

Liefert, W., O. Liefert, and M. Shane. 2009. Russia’s Growing Agricultural Imports: Causes and Outlook. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Outlook Report WRS-09-04, May. Available online: http://www.ers.usda.gov/media/157740/

wrs0904_1_.pdf

Liefert, W., and O. Liefert. 2012. “Russian Agriculture During Transition: Performance, Global Impact, and Outlook.” Applied Economic Perspectives and Policy 34(1): 37-75.

Liefert, O., W. Liefert, and E. Luebehusen. 2013. Rising Grain Exports by the Former Soviet Union Region: Causes and Outlook. Washington, DC: U.S. Department of Agriculture, Economic Research Service, Outlook Report WHS-13A-01, February. Available online: http://www.ers.usda.gov/media/996699/whs13a01.pdf

Moody’s Investors Service. 2014. “Russian Foreign Exchange Reserves Decreasing But Sufficient to Cover 2015 External Debt Needs,” December 5. Available online: https://www.moodys.com/research/Moodys-Russian-foreign-exchange-reserves-decreasing-but-sufficient-to-cover--PR_314405

Russian Federal Service of State Statistics. Rossiiskii Statisticheskii Ezhegodnik (Russian Statistical Yearbook). Moscow, annual.

Rylko, D., I. Khramova, V. Uzun, and R. Jolly. 2008. “Agroholdings: Russia’s New Agricultural Operators.” In Z. Lerman, Edition Russia’s Agriculture in Transition: Factor Markets and Constraints on Growth. Lanham, MD: Lexington Books, pp. 95-133.

Sputnik. 2015. “Russian Agriculture Development Program to Receive Nearly $3bln in 2015,” January 17. Available online: http://sputniknews.com/russia/20150117/1017016150.html

Swinnen, J.F.M., K. Van Herck, and L. Vranken. 2012. “Agricultural Productivity Paths in Central and Eastern European Countries and the Former Soviet Union: The Role of Reforms, Initial Conditions and Induced Technological Change.” In K. Fuglie, S.L. Wang, and V.E. Ball, eds. Productivity Growth in Agriculture: An International Perspective. Oxfordshire, UK: CAB International, pp. 127–144.

Trading Economics. 2015. “Russia Food Inflation,” March 4. Available online: http://www.tradingeconomics.com/russia/food-inflation

U.S. Department of Agriculture (USDA). 2015. Washington, DC: Foreign Agricultural Service, FAS Production, Supply and Distribution Online (USDA PS&D). Available online: http://www.fas.usda.gov/psdonline/

World Trade Atlas, Global Trade Information Services. Accessed February 27, 2015.