Russian soldiers marching on Kyiv, Ukraine, in early 2022 pushed already-rising agricultural commodity prices higher. Whereas much of the discussion has focused on the immediate effects as the two crop-producing countries experienced reductions in area and exports, there are also uncertainties about what will happen if these circumstances persist, stocks are drawn down, and crop area in other crop-producing regions is reallocated or even expanded.

In fact, the war in Ukraine has brought to the forefront, and to a certain degree accentuated, significant uncertainties that have characterized agricultural markets since the previous price boom and bust in the aftermath of the financial crisis of the late 2000s, namely the transformation of food systems, the transition to more sustainable forms of energy, and the international ruling of trade relationships. While these uncertainties cover known areas and topics, and had already been identified as a result of asymmetry in post-COVID recovery, the Russian invasion added a dramatic new twist to every one of these issues.

Commodity prices have been increasing since the second quarter of 2020 and are now at a level close to previous peaks in the 2008/09 and 2011/12 marketing years. Food commodity prices, represented by the FAO Food Price Index, reached an all-time high in February 2022. After Ukraine and Russia agricultural potential was partly removed from the market, cereal, meat, and sugar prices surged, with vegetable oils rising even faster.

Sustained general food price increase (also referred to as “food inflation”) can be explained by market fundamentals. Global demand was supported by the rapid post-COVID recovery, and supply-chain bottlenecks persisted in many sectors, especially shipping. The global economic rebound also pushed up the price of energy and raw materials, which was passed on to the costs of the agricultural and food sector. A negative shock to Ukrainian and Russian commodity exports added to the inflationary supply-side pressures in global markets.

International energy prices in general, represented by the IMF Energy Index, were rising from their pandemic lows to mid-2022 yet still not as high as they had been in 2008. The Brent crude oil price increased from around USD 40 per barrel (b) in 2020 to approximately USD 100/b in February–March 2022. The price of coal and gas, which are used to produce nitrogen fertilizer and electricity, also spiked; the World Bank’s Natural Gas Index for February 2022 was more than four times higher than the 2020 average.

Ukraine is a global agricultural powerhouse, accounting for a significant share of the world’s exports of wheat (10%), maize (16%), other coarse grains (10%), oilseeds (3%), and vegetable oils (7%) (OECD/FAO, 2022b, using 2018–2020 averages). As long as military combat persists, at least some farmers will be prevented from planting, growing, harvesting, or exporting crops due to population and labor-force displacement, damage to infrastructure (e.g., ports, farmland, storage facilities), and missed fertilizer and pesticide applications.

To assess the potential impact on global agricultural markets if the war persists, a simulation scenario was undertaken based on two blocks of assumptions:

• Crude oil and fertilizer prices: The world petroleum price average stays at $100/b and fertilizer prices are pressured higher still, to average about 65% higher than in the baseline.

• Agricultural supply: Ukrainian exports are reduced for wheat (-50%), coarse grains (-40%), and soybeans (-30%). Assuming sanctions persist, Russian exports are off for wheat (-15%). The sizes of the scenario shocks are based on the difference between the 2021 and 2022 OECD/FAO agricultural outlook baselines. Exports of all other crops from these two countries are assumed to be at their 2021 baseline level. Harvested areas in Ukraine are reduced in proportion to exports.

These shocks clearly have a negative impact on agricultural supply levels. In the discussion, we therefore also consider the potential of certain land use policies in the European Union and United States, intended to increase the agricultural area temporarily, to mitigate the market impacts of the negative supply shocks.

The model we use is a large-scale, dynamic partial-equilibrium model called Aglink-Cosimo (OECD/FAO, 2022a; Pieralli et al., 2022), which has been used to study other market and policy shocks (Araujo-Enciso and Fellmann, 2020; Elleby et al. 2020; Chatzopoulos et al., 2021). Below, in the discussion of the scenario results, we focus on 2025/26 marketing year results for crops and 2025 calendar year outcomes for livestock product markets, assuming the same supply and input price shocks in each of the years 2022–2025. Our focus is on the outcomes if the shock persists; the long-lasting price pressure depletes stocks but also induces supply response elsewhere.

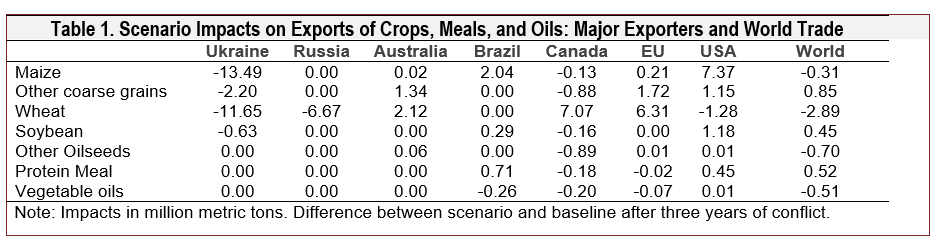

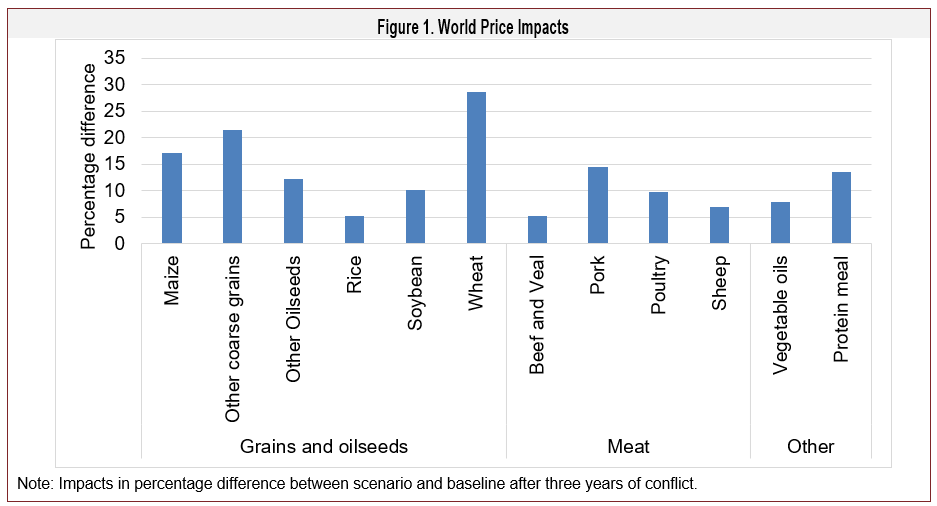

World market impacts are summarized in terms of their impacts on global export supply (Table 1) and indicator prices (Figure 1). World trade falls, but other producing regions increase their export supply in response to the sustained high crop prices. Wheat trade falls the most, and it is also the crop that experiences the largest price increase (29% compared to the baseline). Canada, Australia, and the European Union increase their wheat exports considerably in response to the higher prices. The reallocation of area in some countries to wheat, lowerUkrainian exports of coarse grains, and higher fertilizer prices cause coarse grains prices to increase by 17%, enough to cause increased exports from other suppliers to offset the loss of supply from Ukraine. Oilseeds, protein meal, and vegetable oil prices increase by 8%–14%, with the sign of the total export impact depending on the commodity. The exact trade response varies among exporting and importing countries according to local price impacts, their comparative advantages, the role fertilizers play in production of different crops, and demand the domestic response.

Livestock product supplies respond, too, if the conflict is sustained, but more time also allows time for livestock herds to contract. The higher crop prices put pressure on livestock supplies, resulting in mostly lower output and higher prices of meats, poultry, and dairy products (Figure 1). Pork, in particular, experiences the largest price increase on the world markets (14%), followed by butter (11%) and poultry (10%). Skim milk powder experiences the smallest price increases (2%) in the scenario.

The higher price of crude oil in the scenario also has an important effect on the biofuel market. Higher crude prices, on the one hand, translates directly into higher fuel prices, which lowers the demand for fuel in general but increases the demand for biofuel as a substitute for fossil fuels. On the other hand, higher energy and fertilizer prices increase the production costs of the main biofuel feedstocks (maize, sugar cane, and oilseeds), which leads to lower supply and, in turn, higher prices. Finally, the loss of biofuel feedstock supply (especially maize) from Ukraine adds to price pressure. Together, these effects cause the biodiesel and ethanol prices to increase by 21% and 15%, respectively, on the world market, relative to the baseline.

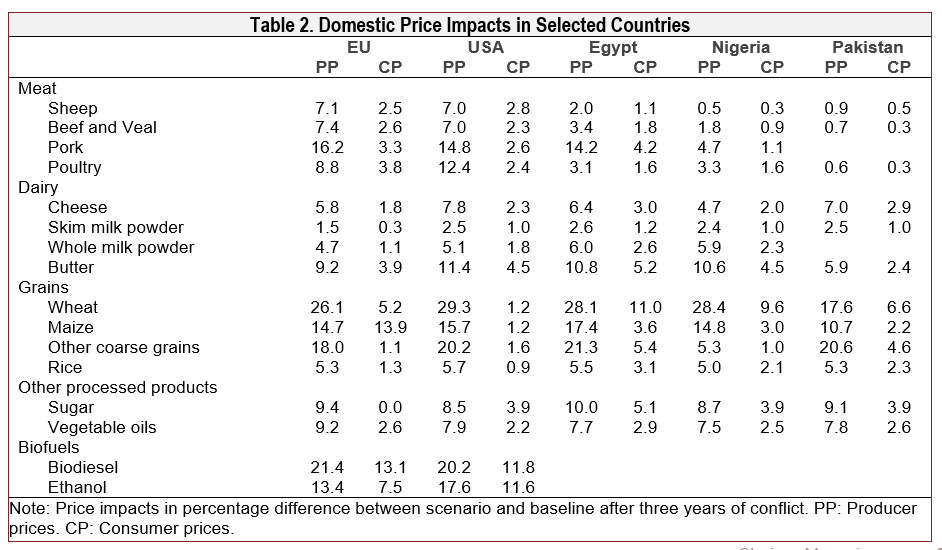

The sharply lower crop supplies caused by the conflict raised concerns about food prices throughout the world. It seems mistaken to attribute strong consumer food price inflation to this one factor alone, but the impact of a persistent conflict on food prices warrants consideration given that it does affect food security at least to some extent. Consumer price impacts vary widely (Table 2), even though producer price impacts are often more similar among countries. EU and U.S. producer and consumer prices rise, but consumer price changes are often a third of the producer price changes or less in relative terms reflecting the role that large marketing margins play in dampening the impacts on final goods’ prices. In other countries—such as Egypt, Nigeria, and Pakistan—the producer price impacts are sometimes muted by policy or other barriers to trade, yet the consumer price impact can be closer to half as large as the producer price change in relative terms.

Wheat prices relate to a food staple and are sensitive to disruptions caused by events in Ukraine. An enduring conflict raises producer prices of wheat by 26%–29% in the European Union and United States, but EU and U.S. wheat product consumer prices rise by 1%–5%. In Egypt and Nigeria, the wheat producer price rises by a similar amount,yet the consumer price impacts are 10%–11%. Less of the world market impact is transmitted to the commodity price in Pakistan, but the wheat product consumer price nevertheless rises more than the prices of such goods in the European Union and United States.

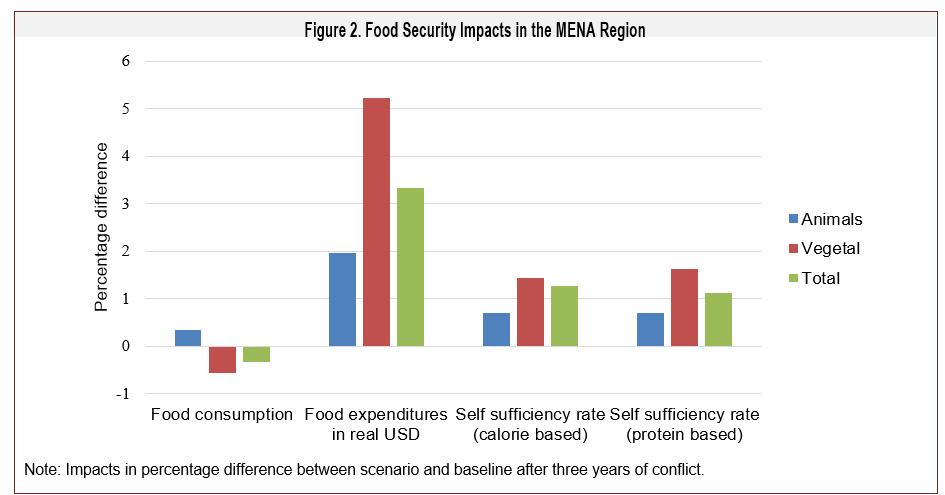

Food security indicators outline the implications of a sustained conflict on people in the Middle East and North Africa (Figure 2). Food consumption falls with losses of crop products, including staples, induced by rising world prices more than offsetting modest cross-effects on livestock products. But food consumption must be maintained despite rising prices; food expenditures rise by over 3% in this region, with crop product costs rising over 5%. Self-sufficiency rises as global market disruption reduces these countries’ import opportunities. The higher share of domestic production in food consumption among these countries could offer some protection against further international market shocks yet at the same time increase vulnerability to domestic shocks. Extrapolating from this case, the global food security impacts of sustained conflict are negative if measured by food consumption quantities or costs.

The scenario represents the case of a sustained conflict. This perspective seems necessary for setting the context of any policy response that goes beyond alleviating short-term stress, including policies relating to crop area, research, or new mechanisms that will take time to implement. Impacts are based on observed events, but there is uncertainty about measured planting and exports during such a conflict, and extrapolating into the future is fraught with uncertainty. Moreover, future pressures on natural gas markets and fertilizer prices, which have varied widely among regions in the short run, are unknown. Fertilizer supply response might curtail price impacts over time and fertilizer trade might equalize price shocks spatially. Nevertheless, the experiment is intended to help policy makers and market agents consider the possible context for their decisions if the conflict is sustained.

Persistent disruption in crop and crop product supplies from Ukraine and Russia could lead to more discussion about changing the balance between environmental and other policy goals. In particular, some proposed in the early weeks of the crisis that U.S. and EU crop areas set-aside for conservation purposes be reduced to support greater production. Moreover, an increase in consumer prices might lead to unrestricted grain exports from Russia even if the crisis continues. We undertake some admittedly speculative scenarios to explore possible outcomes.

We simulate the evolution of markets and prices during an extended crisis in the case that U.S. Conservation Reserve Program (CRP) and EU set-aside (as ecological focus areas) are reduced below levels implied by existing targets or baseline levels. Just over 1.5 million acres (0.6 million ha) are expected to exit CRP (AgWeb, 2022); we reduce EU set-aside by 1.7 million ha. We assume the yield on this area is the same as the average yield on land already in crop production, whereas the actual yield from the converted land could be quite different.

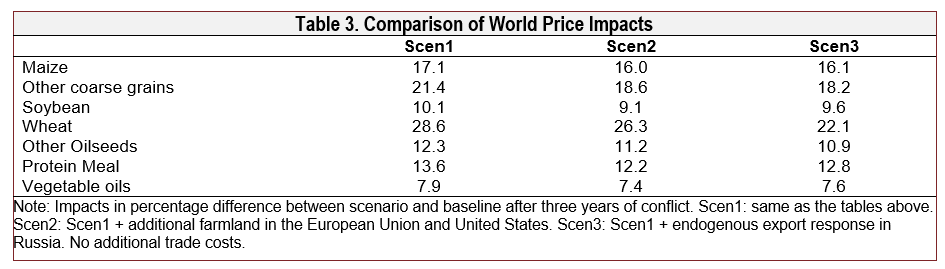

The price impacts of EU and U.S. policy changes that shift land set aside for environmental objectives into agricultural commodity production offset a portion of the price impacts of a sustained Ukraine crisis (Table 3). In this case, the world wheat price is 26% higher than it would have been without the Ukraine crisis, compared to a 29% increase without the reduction in set-aside area. The world corn price change is 16%,

compared to 17% without the set-aside change. Other changes in price outcomes are of a similar magnitude. We do not estimate the environmental impacts of the set-aside reduction, which would presumably be negative by design. We also do not test the implications of this policy after the Ukraine crisis is concluded, but we recognize that this analysis would be sensitive to assumptions about whether the policy change would be reversed and total set-aside area restored at some point.

There is also the possibility that the world price impacts brought about by sustained conflict lead to greater exports from Russia. In the initial scenarios, we implicitly constrained Russia export supply response; we assumed that Russian crop exporters and producers could not take advantage of rising world prices. If the higher prices do lead to greater Russian production and exports, then this response mitigates some of the price impact (Table 3). The wheat price impact of sustained conflict is 22%,compared to 29% without Russian export expansion, and other crop price impacts are also moderated in this case.We do not trace the export response of Russia to anyspecific factor, allowing that it might be explained by policy responses or disruptions associated with the conflict.

Stories of mined crop land, blocked ports, and lost grain stocks seized the attention of everyone involved in global commodity trade at the start of 2022. Prices jumped and people looked to satellite images and food price indicators to assess the impacts. Yet the focus on immediate impacts betrays the potential that the risks might change if the conflict endures and does not inform policy makers about the context for those options that have delayed impacts, such as those relating to area, research, or slowly developing food support.

We apply a widely used structural economic model to estimate the impacts of a three-year conflict on key world market and food security indicators. Even taking into account supply response in other crop producing regions, there is potential for food grain price impacts of nearly 30%. Moreover, the effects spill over into livestock markets over time. The implications for consumers in developing countries could be sustained pressure on food security.

AgWeb, 2022. “CRP Contract Termination to Offset Global Food Crisis Gains USDA's Approval.” Available online: www.agweb.com/news/policy/politics/crp-contract-termination-offset-global-food-crisis-gains-usdas-approval

Araujo-Enciso, S.R., and T. Fellmann. 2020. “Yield Variability and Harvest Failures in Russia, Ukraine and Kazakhstan and Their Possible Impact on Food Security in the Middle East and North Africa.” Journal of Agricultural Economics 71(2):493–516.

Chatzopoulos, T., I. Pérez Domínguez, A. Toreti, M. Adenäuer, and M. Zampieri. 2021. “Potential Impacts of Concurrent and Recurrent Climate Extremes on the Global Food System by 2030.” Environmental Research Letters 16(12):124021.

Elleby, C., I. Pérez Domínguez, M. Adenauer, and G. Genovese. 2020. “Impacts of the Covid-19 Pandemic on the Global Agricultural Markets.” Environmental and Resource Economics 76(4):1067–1079.

OECD/FAO. 2022a. “Aglink-Cosimo Model Documentation.” Organisation for Economic Co-operation and Development and Food and Agriculture Organization of the United Nations Agricultural Outlook. Available online: http://www.agri-outlook.org/about/

———. 2022b. OECD-FAO Agricultural Outlook 2022-2031. Paris: OECD Publishing.

Pieralli, S., T. Chatzopoulos, C. Elleby, and I. Pérez Dominguez. 2022. Documentation of the European Commission’s EU Module of the Aglink-Cosimo Model: 2021 Version. Luxembourg: Publications Office of the European Union, EUR 31246 EN.