The Russian invasion of Ukraine on February 24, 2022, had drastic impacts on agriculture, trade, and food grain prices. As a result of the invasion, an estimated 22 million metric tons (MMT, including about 6.8 MMT of corn, 5.6 MMT of wheat, 4.6 MMT of sunflower, and others) of grains and oilseeds were jammed in Ukrainian silos due to port closures and logistical challenges (Nichols, 2022). Since the Russian invasion of Ukraine, alternative brokered agreements were negotiated to reopen Ukraine ports and relax the logistical constraints. The initial and renewed agreement were each for 120 days. Resolution of the logistic problems could take months to resolve, and ramping up shipments to normal (5–6 MMT monthly average) would take a long time.The purpose of this paper is to determine the price impacts if these additional grain flows into the international market with the reopening of Ukraine ports. Specifically, we illustrate the price changes that occurred using two different methods. Our price analysis is restricted to corn and wheat. First, the equilibrium displacement model (EDM) is used, combining supply and demand elasticities with the change in export flows due to reopening of Ukraine ports. Second, we use distributions derived from the futures and option markets to place upper and lower bounds on future price scenarios.

BackgroundGlobal food grain markets have faced dramatic developments in recent years. In the case of corn, Ukraine has emerged as one of the dominant exporters to China and other key markets previously dominated by the United States. Ukraine is a major exporter of wheat to the Middle East and Africa and is the dominant exporter of sunflower oil. Indeed, Ukraine is referred as the “Breadbasket of the World.” Since the early 2000s, Ukraine has expanded its grain production and exports, particularly for corn, wheat, and sunflower oil. Concurrently, the Ukraine agriculture (Lyddon, 2021; Pleasant, 2021) and its grain marketingsystem have evolved (Salin, 2020; Sizov, 2020; Wilson, 2020). Ukraine has had some of the lowest interior rail shipping costs in the world and a historically important river system (most prominent is the Dnieper River). In recent years, the Dnieper River has been underdeveloped, underutilized, and in need of upgrades (Center for Transport Strategies, 2014; Wilson, Lakkakula, and Bullock, 2022).

In addition to the logistical differences between the United States and Ukraine, there are substantial trade interventions affecting competition in the global markets. As examples, in the case of corn, these trade interventions include the European Union’s retaliatory tariffs on U.S. corn imports, tariff rate quotas for imports into China, tariff rate quotas for Ukraine exports to the European Union, and varying forms of quality restrictions related to phytosanitary and genetically engineered corn. Recently, China has become increasingly more dominant in the global corn import market. Finally, Ukraine is continuing to evolve and has been confronting land reform that is expected to increase productivity and competitiveness (Day, 2021; Polityuk and Hogan, 2021; VanTrump 2021; Verbyany and DeSousa, 2021). A combination of changes in logistical systems and trade interventions has resulted in intense rivalry between the United States and Ukraine, particularly when serving common importers.

Recently, many factors have strained global grain and oilseed markets. These include the 2021 drought in the U.S. northern plains, the emergence of renewable diesel and sustainable aviation fuels, an increase in oil prices to $120/barrel, Chinese restrictions on fertilizer and other agricultural chemicals, the post-COVID economic expansion, and supply chain issues. These factors have had drastic impacts on prices, increasing their volatility even before the Russian invasion of Ukraine.

Though the Russian invasion was promoted as a “special operation” focusing on eastern Ukraine, its scope has broadened and, over time, agriculture has become an integral element in the war. Now, the war includes the bombing of farms and equipment and other agricultural facilities—including elevators and railroads—and stealing grain from farms and silos. Additionally, sea/naval mines in the Black Sea and other waterborne logistical channels had a significant impact in closing the Black Sea ports and Odessa, a critical port in Ukraine. In part, this is due to the geography of the war but also because ocean carriers were reluctant to allow ships to enter those waters; as a result, insurance costs escalated.

Compounding problems resulting from these developments include 1) a shortage of storage space for the 2022 crop (Yale School of Public Health, 2022); 2) landmines causing problems for field work; 3) cash flow problems, which will constrain seeding the 2023 crop; and 4) the need to develop alternative logistical channels. All export trading companies are exploring alternative logistical channels. However, such efforts confront export capacity, noncompatibility of multiple rail gauge tracks, higher export costs, and other border crossing constraints. For perspective, prior to the Russian invasion, Ukraine had one of the lowest logistical costs in the world. As a result of the invasion, logistical costs are estimated to increase by between $55/mt and $125/mt (or more). In addition, it is believed that Ukraine, which normally exports 5 MMT-6 MMT per month, has a reduced capacity restricted to about 2.0 MMT per month (Angel, 2022). The combined effects of these developments has led to reduced exports and higher export costs, resulting in adverse implications for much of the world, including concerns of starvation and food price inflation (Steinhauser, 2022). On May 16, 2022, the European Union began promoting the need to develop “solidarity lanes,” an effort to either reopen the Black Sea and Odessa ports for shipments (either after mines were removed or byusing some type of convoy) or to facilitate and improve the efficiency of cross-border movements through eastern European countries—including Romania, Poland, and others—to effectively utilize the Danube River, Europe’s second-longest river (European Commission, 2022).

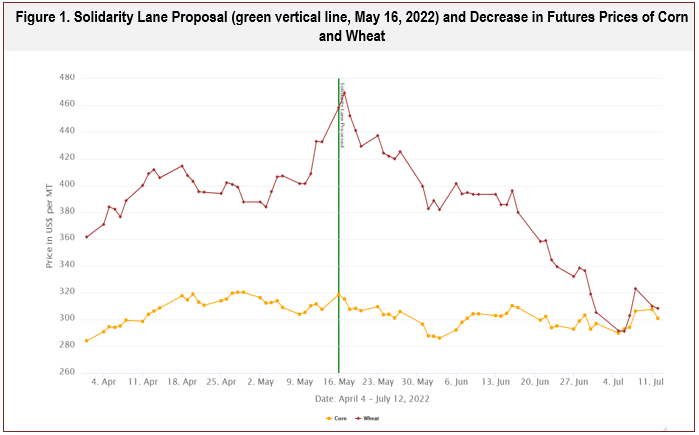

This approach is less useful in the case of vegetable oil. The most direct observation of the change in prices due to the Russian invasion can be interpreted from behavior of the futures prices. It is important that commodity prices had been increasing before the Russian invasion of Ukraine. On May 16, 2022, the EU announced a strategy to develop “solidarity lanes.” Prior to that date, there were strong expectations of a permanent closure of the Black Sea for exports. Commencing on this date, both futures and basisvalues (for export) began declining. As shown in Figure 1, wheat futures price decreased from $469/MT on May 17, 2022, to $291/MT on July 6, 2022. U.S. basis values decreased similarly. Corn futures prices also declined from $319/MT on May 17, 2022, to $290 on July 5, 2022. Similarly, U.S. basis values for wheat also decreased. Of course, numerous other factors impacted and/or accelerated the price decline during this period, including favorable corn planting, fund liquidation, seasonal selling, wheat harvest, favorable conditions for Brazil corn. Nevertheless, notable changes in grain price dynamics were evident fol lowing the announcement of solidarity lanes.

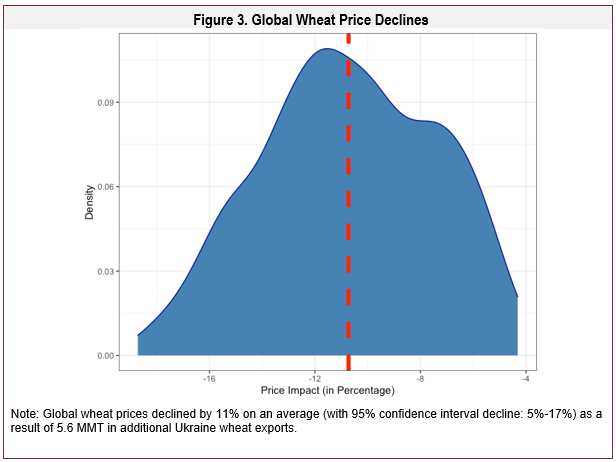

One of the problems with simply looking at price changes is that other factors (as described above) are changing concurrently, making it difficult to isolate the impacts. In order to better depict the impacts of the constrained exports from Ukraine on global market prices, we used an equilibrium displacement method (EDM) (Wohlgenant, 2012). Specifically, we analyze the price impact if Ukraine ports were to reopen and to add about 6.8 MMT of corn and 5.6 MMT of wheat into the global market. In the following section, we then use futures and options markets to derive market distributions for predicting future price scenarios with both lower and upper bounds.

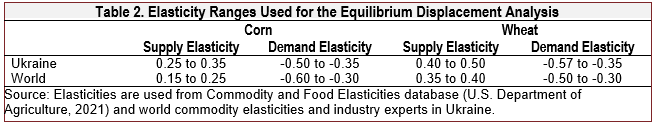

The EDM was applied to this problem as It captures the status of export sensitivities given the supply and demand in both the world and Ukraine. Specifically, we solve a six-equation system (demand system and supply system, each with two equations for Ukraine and the world, a market clearing condition, and a price equation). We use a range of inelastic supply and demand elasticities (instead of point elasticities) to analyze the effect (to make the model simple, the cross-price elasticities are set to zero). We use a uniform distribution (with 500 iterations) of the elasticities to analyze the effect of increased Ukraine exports available in the global market due to the reopening of Ukrainian export ports.

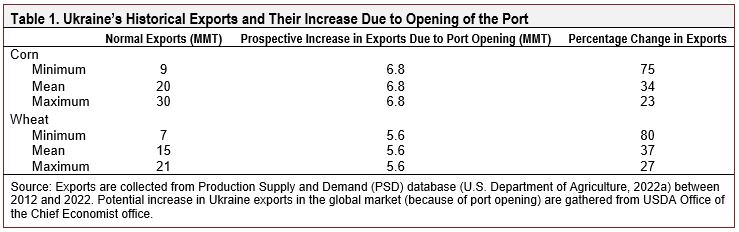

Ukraine’s traditional wheat and corn export levels arecompared with the additional levels that flow into the global market from reopening Ukraine’s export ports to analyze the impact on the global prices. Baseline scenarios that indicate minimum, maximum, and mean levels of Ukraine exports between 2012 and 2022 are used for the analysis (Table 1).

We collected historical supply, demand, and exports for both Ukraine and world from the Production, Supply, and Demand database of the USDA’s Foreign Agricultural Service (U.S. Department of Agriculture, 2022). Table 2 shows the range of supply and demand elasticities used, taken from the Commodities and Food Elasticities database of the U.S. Department of Agriculture (2021) and industry experts.

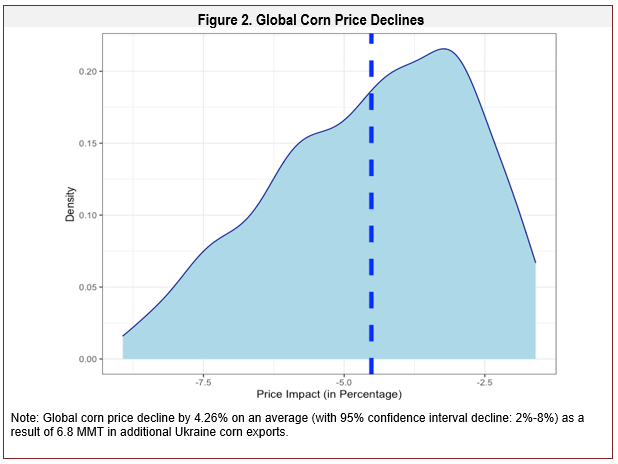

The results of price decline are shown in Figures 2 and 3. Overall, the results show that the reopening of Ukraine’s export ports would have a greater impact on wheat price compared with the corn price. In the case of wheat, the results show that global wheat price would decline on average by 11%, with the 95% confidence intervals showing the decline would be between 5% and 17%. Similarly, in case of corn, the results show that the global price decline by 4.26% on an average, but the price decrease would be between 2% and 8% based on the 95% confidence interval. Generalizing the results, on average, each million metric tons of Ukrainian corn and wheat entering the global market would reduce the global price of corn by 0.62% and of wheat by 1.96%.

The preceding equilibrium displacement model analyzes price impacts using a fundamental modeling approach. To complement these model results, we utilized the market’sown distributional price projections in this section to validate that our fundamental results are in line with the information currently contained in the forward markets. The futures and options markets reflect substantial information and can be used to infer the prospective distribution of prices in response to these events. While a futures price represents the collective wisdom of market participants regarding the mean of the distribution, the option premium contains the collective estimate of the standard deviation of the distribution (Bullock and Hayes, 1992, 1993). Unlike futures, options are an actuarial market since they contain insurance-like features. Put options generate indemnity payments (intrinsic value) when prices fall below a coverage level (strike price), and call options generate payments when prices go above the coverage level.

Actuarial formulae, such as Black’s (1976) Option Pricing Model (BOPM), can be inverted to derive the market estimate of future price volatility called implied volatility, which represents the price standard deviation as an annualized percentage of the futures price. The BOPM model provides a risk-neutral market valuation for options on futures by utilizing risk-adjusted probabilities to calculate the expected, fair terminal value of the option contract. These probabilities are calculated based on the absence of risk-free arbitrage in a portfolio containing commodity options.

Annualization of the implied volatility allows the forecast to be time-scaled to any forward time horizon via the simple formula σ(t)=√t∙iv∙f, where σ(t) is the forecasted standard deviation for the period t years into the future, iv is the market-derived implied volatility percentage, and f is the current futures price. Black (1976) implicitly assumes a lognormal distribution of prices, therefore the complete forecast distribution can be derived by substituting f for the mean and σ(t) for the standard deviation into a normalized lognormal distribution.

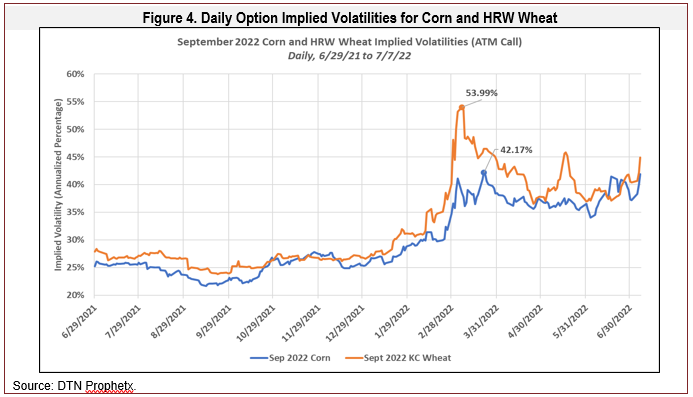

It is important to note that since the invasion, the volatility of futures prices has escalated substantially. Figure 4 shows a plot for the daily option implied volatilities for the September 2022 contracts using the at-the-money (ATM) call values for the past year. For the last half of 2021, the implied volatility for corn and hard red winter (HRW) wheat averaged 24.8% and 26.3%, respectively. Beginning around mid-January 2022, as rumors of an impending Russian invasion of Ukraine started to heat up, the implied volatilities for both commodities began to slowly rise. In early March, volatilities spiked to their maximum values of 42.2% and 54.0% for corn and HRW wheat, respectively, following the February 24 commencement of the Russian “special operation” in Ukraine.

Following their peaks, the implied volatilities for both corn and wheat fell into the upper 30s range as the initial Russian attack on Kyiv was repelled. The wheat implied volatility rose to a temporary peak in early to mid-May as the Russian offensive was renewed in the Donbas region: however, the volatility collapsed lower after negotiations of the “solidarity lanes” proposal announced on May 16, even though negotiations were not consummated until July 14, 2022. However, both events had no noticeable effect on the implied volatility of corn.

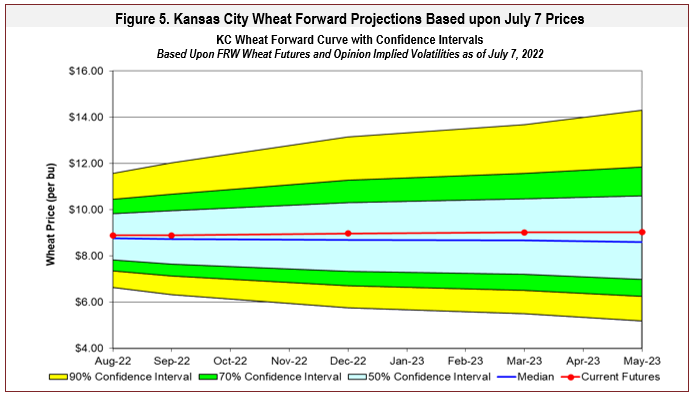

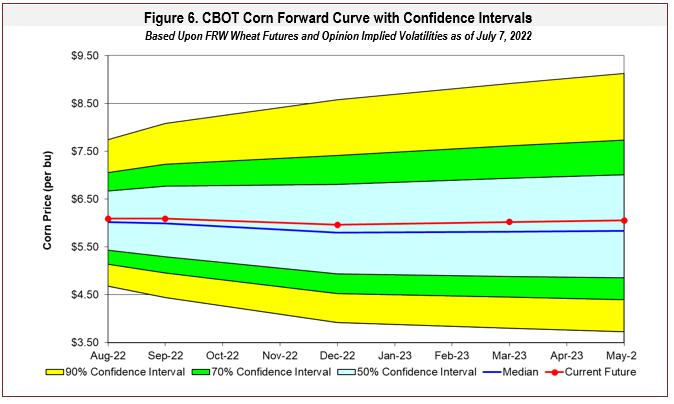

For this analysis, we applied the Black (1976) model to the July 7, 2022, futures and option market price quotes for corn and soybean futures to derive the likely upside and downside pricing scenarios and their probabilities of occurrence. While no specific fundamental scenario, such as the resolution of the Ukrainian grain export situation, can be directly attributed to these price scenarios, it is reasonable to assume that all current Ukraine possibilities have been incorporated into the current market prices. Therefore, these estimates can be used to place both upside and downside bounds on any fundamental projections based upon current information.

The futures/option implied volatility forward market price forecasts from July 7, 2022, are summarized in Figures 4 (for wheat) and 5 (for corn). The 50%, 70%, and 90% confidence intervals are shaded around the futures forward curve (mean). Due to the skewed nature of the lognormal distribution, the median (blue line) lies slightly below the futures price indicating a slight upward skew in the projections. There is a 5% chance of realized prices occurring above the 90% confidence upper limit and same chance for below the lower limit.

For wheat, the results indicate that, given the current (July 7) spot price of $9.12/bushel, there is a 5% chance that prices could fall below $5.75/bushel (decline of $3.37) by mid-December 2022 (Dec 22 futures). By mid-May 2023 (May 23 futures), there is the same chance that prices could fall below $5.18/bushel (decline of $3.94). For corn, the results indicate that, given the current spot price of $7.35/bushel, there is a 5% chance that prices could fall below $3.92/bushel (decline of $3.43) by mid-December 2022. By mid-May 2023, there is the same chance that prices could fall below $3.73/bushel (decline of $3.62). These values place lower bounds on potential price scenarios (forecasts) through those periods resulting from the Russian invasion of Ukraine.

The Russian invasion of Ukraine has had and continues to have a significant impact on global food grain prices threatening food security and food inflation globally, especially in poor countries. The invasion blocked about 22 MMT of food grain exports from Ukraine due to closure of export ports in the Black Sea region. This study analyzes the global price impact of 6.8 MMT tons of Ukraine corn and 5.6 MMT of Ukraine wheat exports flowing into the global market with reopening of Odessaport in Ukraine. We used two methods to analyze the price impacts. The equilibrium displacement model for wheat shows a higher price decline ranging between 5% and 17%, while global corn prices decline by about 2%–8%. That is, for each MMT of Ukrainian corn and wheat entering the global market, the global price would decline by 0.62% for corn and 1.96% for wheat. These results are consistent with the market outlook scenarios embedded in the July 7, 2022, futures and option markets, with all our projections well within the 90% confidence interval of the implied market forecast distribution.

The results of this study have many implications. First, given the importance of Ukraine’s production and exports of these crops, any restrictions can have potentially dramatic impacts on commodity prices. The constrained logistics had the impact of elevating overall price levels, changing the international price spreads, and increasing basis values for suppliers competing with Ukraine’s exports. As a result, the quest for alternative routes come at greater costs. Ultimately, grain flows have changed radically because of the changes in relative logistics costs and constraints. Second, the escalation in volatility in both futures and basis has resulted in many opportunities for trading firms with increased profits, albeit prospectively lower volumes. Third, with rising global inflation in agricultural and food products in 2022, the opening of Ukraine ports and the resulting decline in prices would be welcome, especially for North African countries and others that are highly dependent on agricultural/grain imports for their food consumption. Finally, the decline in prices would also have implications for marketing margins of the agribusinesses involved in processing food grains (corn and wheat as inputs) to finished products.

Angel, M. 2022, June 7. “Ukraine Grain Exports Capped at 2 Million Tonnes/Month If Ports Remain Blocked.” Reuters. Available online: https://www.reuters.com/article/uk-igc-grains-conference/ukraine-grain-exports-capped-at-2-million-tonnes-month-if-ports-remain-blocked-idUKKBN2NO17H

Black, F. 1976. “The Pricing of Commodity Contracts.” Journal of Financial Economics 3(1):167–179.

Bullock, D.W., and D.J. Hayes. 1992. “Speculation and Hedging in Commodity Options: A Modification of Wolf’s Portfolio Model.” Journal of Economics and Business 44(3):201–221.

———. 1993. “The Private Value of Having Access to Derivative Securities: An Example Using Commodity Options.” International Review of Economics & Finance 2(3):233–249.

Center for Transport Strategies. 2014. “Ukraine—Agricultural Trade, Transport, and Logistic Advisory Services Activity.

Center for Transport Strategies.” Available online: https://mtu.gov.ua/files/for_investors/Ukraine Agricultural Trade Transport and Logistic.pdf

Day, C. 2021. “Historic Land Reform Implemented in Ukraine, U.S. Ukraine Foundation.” U.S. Ukraine Foundation. Available online: https://usukraine.org/content/historic-land-reform-implemented-in-ukraine/

European Commission. 2022. An Action Plan for EU-Ukraine Solidarity Lanes to Facilitate Ukraine’s Agricultural Export and Bilateral Trade with the EU. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions.

Lyddon, C. 2021, July 9. “Focus on Ukraine.” World Grain. Available online: https://www.world-grain.com/articles/15532-focus-on-ukraine

Nichols, M. 2022, May 18. “U.N. Chief in Talks on Restoring Ukraine Grain Exports amid Global Food Crisis.” Reuters. Available at https://www.reuters.com/world/un-chief-expected-disclose-talks-ukraine-grain-exports-un-officials-2022-05-18/

Pleasant, K. 2021, June 20. “Global Food Supply and Ukraine: The Soviet Union’s Breadbasket Plan to Feed the World.”

Pavlovsk. Available online: https://www.pavlovsk.org/global-food-supply-and-ukraine-the-soviet-unions-breadbasket-plan-to- feed-the-world/

Polityuk, P., and M. Hogan. 2021, November 15. “Chinese Buyers Bought Ukrainian Corn Last Week – Traders.” Nasdaq.com. Available online: https://www.nasdaq.com/articles/chinese-buyers-bought-ukrainian-corn-last-week- traders-2021-11-15

Salin, D. 2020. “Ukraine Grain Transportation.” USDA 2020 Outlook Conference: Trade and Global Market Place. Black Sea Grain Export Market Session.

Sizov, A. 2020. “The Black Sea: From the Largest Grain Importer to the Top World Exporter.” USDA 2020 Outlook Conference: Trade and Global Market Place. Black Sea Grain Export Market Session.

Steinhauser, G. 2022, July 10. “Ukraine War Pushes Millions of the World’s Poorest Toward Starvation.” Wall Street Journal.

U.S. Department of Agriculture. 2021. Commodities and Food Elasticities. Washington, DC: USDA Economic Research Service. Available online: https://www.ers.usda.gov/data-products/commodity-and-food-elasticities/

———. 2022. Production, Supply, and Distribution. Washington, DC: USDA Foreign Agricultural Service. Available online: https://apps.fas.usda.gov/psdonline/app/index.html#/app/home

VanTrump. 2021. More U.S. Competition… Land Market Reforms Giving Ukraine More Agricultural Potential. Available online: https://www.vantrumpreport.com/2021/07/13/more-u-s-competition-land-market-reforms-giving-ukraine-more-agricultural-potential/

Verbyany, V., and A. DeSousa. 2021, June 20. “One of the Most Fertile Nations Wants to Feed the World: Ukraine Will Introduce Long-Awaited Land Reforms Next Month Just as Food Prices Rise to the Highest in Almost a Decade.” Bloomberg.

Wilson, W. 2020. “What Does It Take to Farm in Russia and Ukraine?” USDA 2020 Outlook Conference: Trade and Global

Market Place. Black Sea Grain Export Market Session.

Wilson, W.W., P. Lakkakula, and D.W. Bullock. 2022. Logistical Competition for Corn Shipments from the United States and Ukraine to Targeted International Market. Fargo, ND: North Dakota State University, Agribusiness and Applied Economics Report 811.

Wohlgenant, M.K. 2012. “Consumer Demand and Welfare in Equilibrium Displacement Models”. In J.L. Lusk, J. Roosen, and J.F. Shogren, eds. Oxford Handbook of the Economics of Food Consumption and Policy. Oxford, UK: Oxford University Press, pp. 292-318.

Yale School of Public Health. 2022. Ukraine’s Crop Storage Infrastructure: Post Invasion Impact Assessment. Available online: https://hub.conflictobservatory.org/portal/sharing/rest/content/items/67cc4b8ff2124d3bbd5b8ec2bdaece4f/data